Market Data

December 15, 2023

Service Center Shipments and Inventories Report for November

Written by Estelle Tran

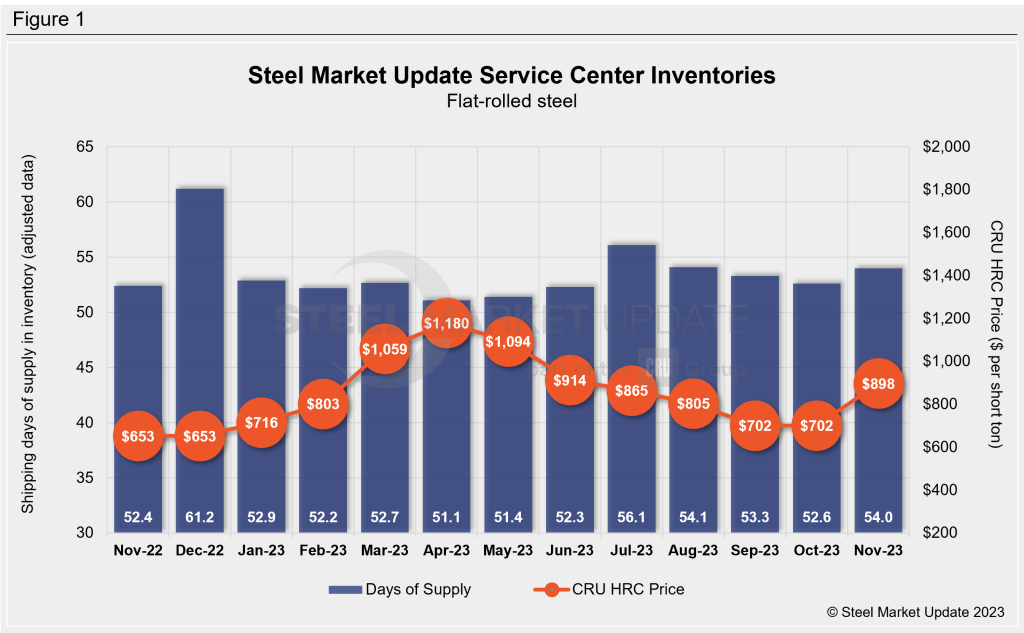

Flat Rolled = 54.0 Shipping Days of Supply

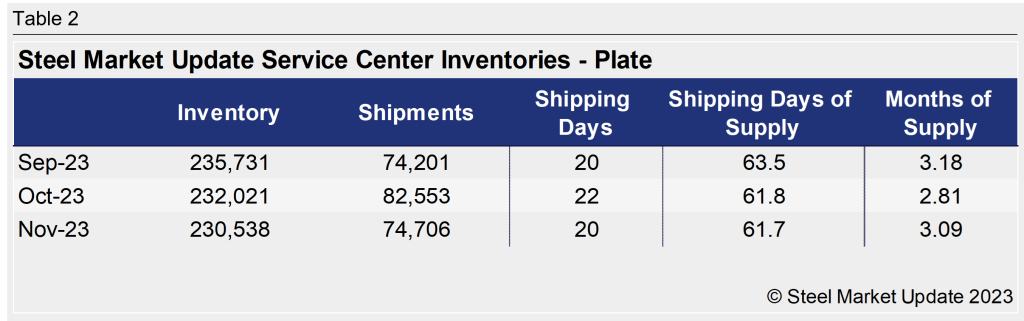

Plate = 61.7 Shipping Days of Supply

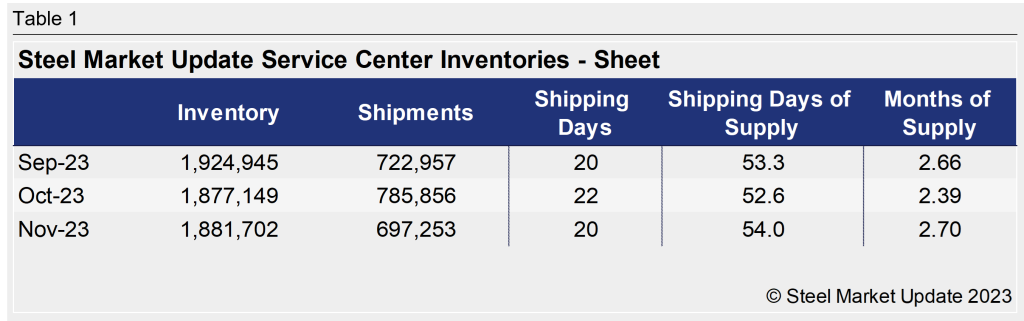

Flat Rolled

After three months of inventory cuts, US service center flat-rolled steel inventories grew in November as shipments slowed. At the end of November, service centers carried 54 shipping days of flat-rolled steel supply on an adjusted basis, up from 52.6 shipping days of supply at the end of October. Flat roll supply at service centers represented 2.7 months of supply in November, up from 2.39 months in October. November had 20 shipping days, compared to 22 in October.

The daily shipping rate in November was the lowest level since December 2022, and intake in November outpaced shipments. According to the latest SMU survey published December 8th, 73% of service centers said they were maintaining inventories and 9% said they were building inventory. A month prior, 71% of service centers were maintaining inventories and 19% said they were building inventory.

The amount of flat-rolled steel on order hit a high point in October and eased slightly in November. At the end of November, shipping days of supply on order were up vs. October and November 2022. The amount of flat roll on order represented in inventories in November was down vs. October.

Service centers said that the high level of material on order includes opportunistic deals done before this current upcycle as well as imports arriving in the first half of 2024. The massive amount of material on order indicates that new orders may remain low, even after seasonal holiday slowdown. This could be exacerbated by a lackluster demand outlook.

Meanwhile, lead times retreated for the first time since late September. The latest SMU survey published mill HRC lead times at 6.76 weeks, down from 6.9 weeks one month ago. With the seasonal slowdown in demand and sizeable amount of material on order that flat-rolled steel inventories will spike in December.

Plate

US service center plate inventories held steady in November. Service center plate inventories at the end of November stood at 61.7 shipping days of supply, compared to 61.8 shipping days of supply in October. In terms of months on hand, plate stocks represented 3.09 months of supply in November, up from 2.81 months in October. Inventories remain higher than they were in November 2022, when plate stocks represented 50.3 shipping days or 2.52 months of supply on hand.

Plate mills announced price increases at the end of November. While service centers have been avoiding placing new orders, the price increases have convinced some buyers to get off the sidelines. Mill lead times for plate reached 6.14 weeks in the latest SMU survey, up from 5.57 weeks the month before.

While demand typically slows down at this time of year, market contacts have been underwhelmed by demand for months. Looking ahead to Q1 and with prices trending up, service centers have been booking more material recently. Inventories should rise in December with the seasonal slowdown in orders.