Market Data

January 30, 2024

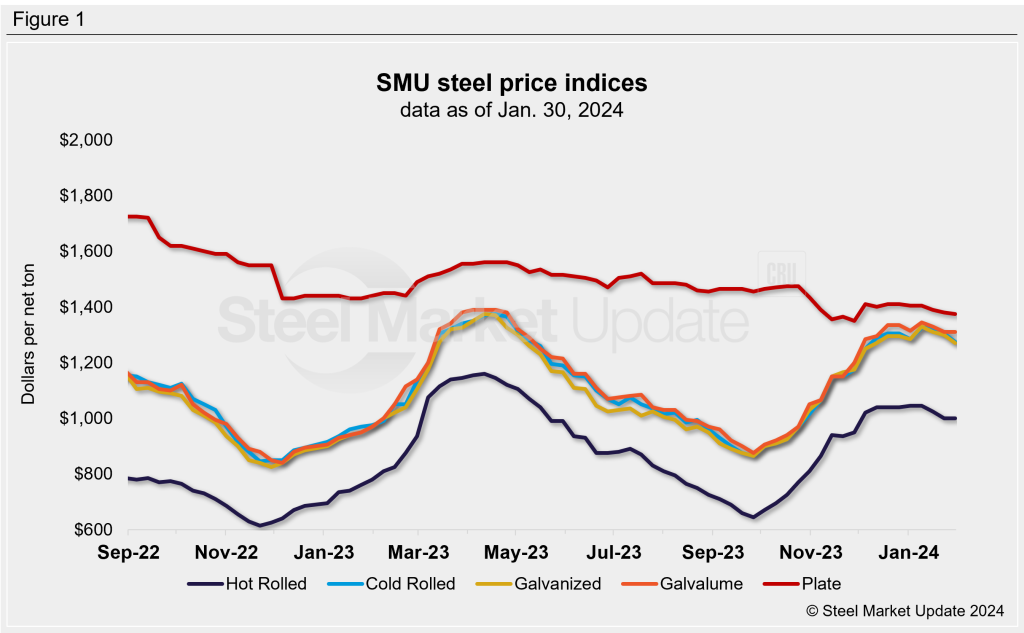

SMU price ranges: Sheet prices mixed as HR holds, CR/galv dip

Written by David Schollaert & Michael Cowden

Movements in sheet prices were mixed this week, with hot-rolled coil (HRC) unchanged but cold rolled (CR) and coated prices down.

SMU’s HRC prices remain at $1,000 per short on (st) on average. Galvalume prices were also unchanged at $1,310/st.

But CR coil prices slipped to $1,275/st on average, down $30/st from last week. Galvanized base prices now stand at $1,270/st on average – also down $30/st from a week ago.

Our plate price is flat at $1,375/st, down a modest $5/st week over week (w/w).

SMU’s price momentum indicator continues to point downward because we don’t see a catalyst that might lead prices higher over the near term.

Hot-rolled coil

The SMU price range is $940–1,060/st, with an average of $1,000/st FOB mill, east of the Rockies. The bottom end of our range was down $10/st vs. one week ago, while the top end of our range was up $10/st w/w. Our overall average, as a result, was unchanged w/w. Our price momentum indicator for HRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Hot rolled lead times: 6–8 weeks

Cold-rolled coil

The SMU price range is $1,240–1,310/st, with an average of $1,275/st FOB mill, east of the Rockies. The lower end of our range was $30/st lower vs. the prior week, while the top end of our range was also down $30/st. Our overall average is down $30/st from last week. Our price momentum indicator for CRC remains lower, meaning SMU expects prices will move lower over the next 30 days.

Cold rolled lead times: 6–12 weeks

Galvanized coil

The SMU price range is $1,240–1,300/st, with an average of $1,270/st FOB mill, east of the Rockies. The lower end of our range was down $20/st vs. the prior week, while the top end of our range was $40/st lower. Our overall average is $30/st lower than the week prior. Our price momentum indicator for galvanized remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,337–1,397/st with an average of $1,367/st FOB mill, east of the Rockies.

Galvanized lead times: 6-11 weeks

Galvalume coil

The SMU price range is $1,260–1,360/st, with an average of $1,310/st FOB mill, east of the Rockies. The lower end and the top end of our range was unchanged from the prior week. Our overall average, as a result, was also unchanged when compared to the previous week. Our price momentum indicator for Galvalume remains lower, meaning SMU expects prices will move lower over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,554–1,654/st with an average of $1,604/st FOB mill, east of the Rockies.

Galvalume lead times: 6-15 weeks

Plate

The SMU price range is $1,320–1,430/st, with an average of $1,375/st FOB mill. The lower end of our range was $10/st lower vs. the week prior, while the top end of our range was unchanged. Our overall average is down $5/st vs. one week ago. Our price momentum indicator for plate remains lower, meaning SMU expects prices will move lower over the next 30 days.

Plate lead times: 4-7 weeks

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

David Schollaert

Read more from David Schollaert