Prices

March 7, 2024

HR futures 'hot,' busheling futures 'not'

Written by Andre Marshall

Hot rolled (HR) futures have been on a bit of a hot streak recently, while busheling futures have been more in the “not” category.

Hot:

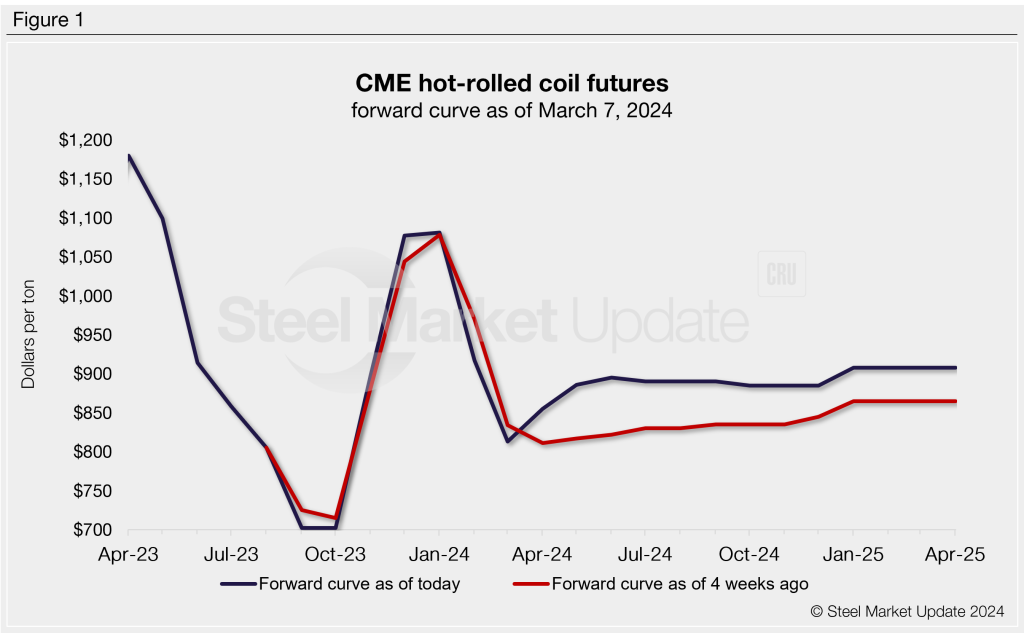

HR futures popped up in the afternoon of Tuesday, March 5, with the futures rising some $30-40 on the nearby months of April and May, and $20-25 in the June-through-August months. As well as on Thursday, markets drove higher again with some surprising moves.

There are rumors that a mill or mills have been selling some spot tons, and therefore will be in the market with a price increase in the near future. This may have spooked some shorts. There was also an announcement Tuesday by the Chinese government about their stimulus plans, which included both monetary and fiscal measures, the latter which surprised some. Crude oil popped up 2% on that day, likely on the back of it.

Maybe HR and all commodities got swept up in the move to start off this little rally? What started the move is maybe less important than that the move was started. It will now need to find out where the sellers appear? $875? $885? To put it in perspective, settles today vs. a week ago have resulted in an increase of $68 for April and $66 for May, respectively, $55 for June, $45 for Q3, and $30 for Q4. Q3 and Q4 were last $875 offered. Volumes have been a little below average.

Not:

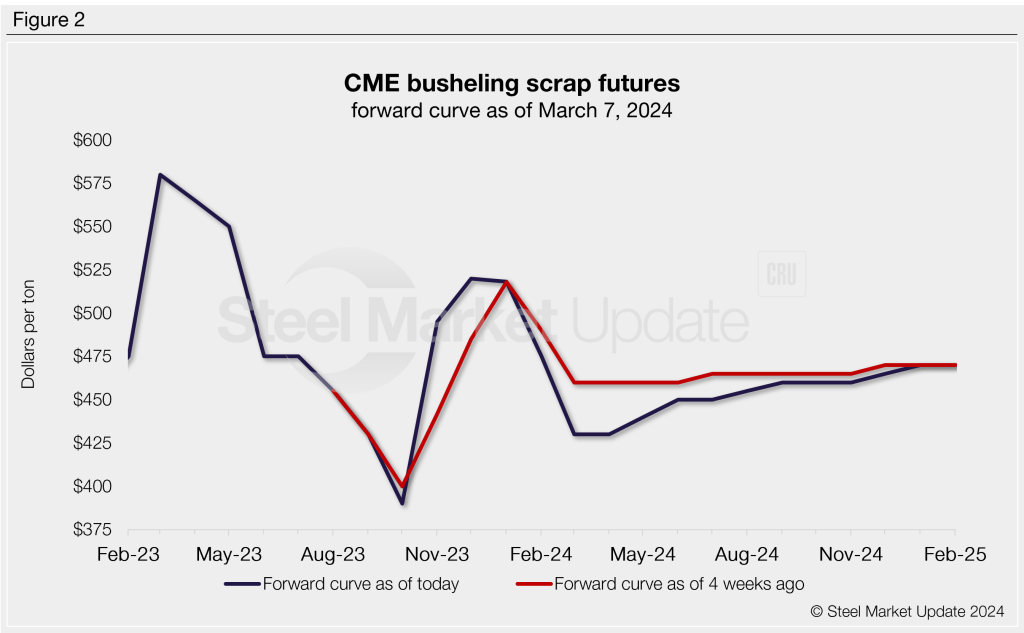

Busheling (BUS) futures have actually been quite active, particularly on the second-half months. This is attributed to forward scrap buying meeting bearish hedge selling. There has also been some HR/BUS differential that has traded in the $380-390 per short ton/gross ton metal margin zone. Meanwhile, market intel has it that early mill buying is coming in as low as down $70. Some expect, regardless, that the market will end up more than down $50.

Late added maintenance outages in March and April by a number of mini-mills suggest the order books may be struggling in the immediate period. If steel shorts are concerned about whether mills may impose a price increase, it’s hard to see that if the scrap floor is shifting downward. Unlike HR futures above, BUS futures have moved maybe $5-10 in the back half of 2024, with trades today coming in at $462 per gross ton.

Disclaimer: The content of this article is for informational purposes only. The views in this article do not represent financial services or advice. Any opinion expressed by Andre Marshall should not be treated as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of his opinion. Views and forecasts expressed are as of date indicated, are subject to change without notice, may not come to be and do not represent a recommendation or offer of any particular security, strategy or investment. Strategies mentioned may not be suitable for you. You must make an independent decision regarding investments or strategies mentioned in this article. It is recommended you consider your own particular circumstances and seek the advice from a financial professional before taking action in financial markets.