Analysis

April 9, 2024

Steel exports gain momentum through February

Written by Brett Linton

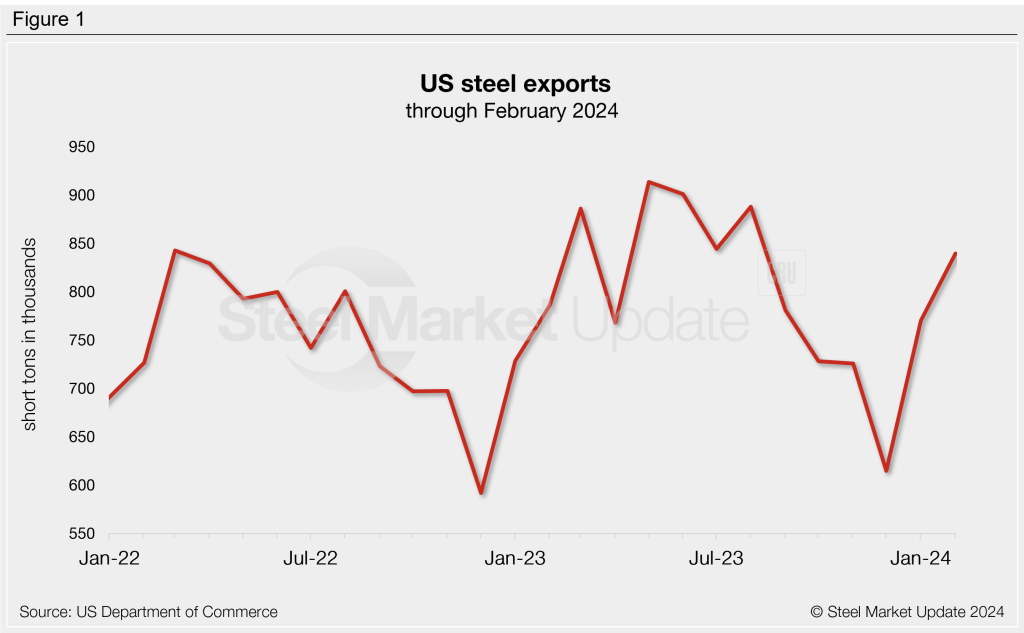

Following their 25% jump from December to January, US steel exports rose another 9% in February. The latest US Department of Commerce data shows 840,000 short tons (st) of steel left the country in February. This is the highest monthly export rate since August 2023.

Monthly averages

Looking at exports on a 3-month moving average (3MMA) basis can smooth out the monthly fluctuations. Shipments had trended downward throughout the second half of 2023, falling to an 11-month low in December. The 3MMA changed course as it entered the new year, now up 5% month-on-month (m/m) to a three-month high of 742,000 st through February.

Exports can be annualized on a 12-month moving average (12MMA) basis to further dampen month-to-month variations and highlight historical trends. From this perspective, steel exports have steadily trended upwards since bottoming out in mid-2020. The 12MMA figure surpassed 800,000 st in January, now at 805,000 st through February figures and up to the highest 12MMA level since October 2018.

Exports by product

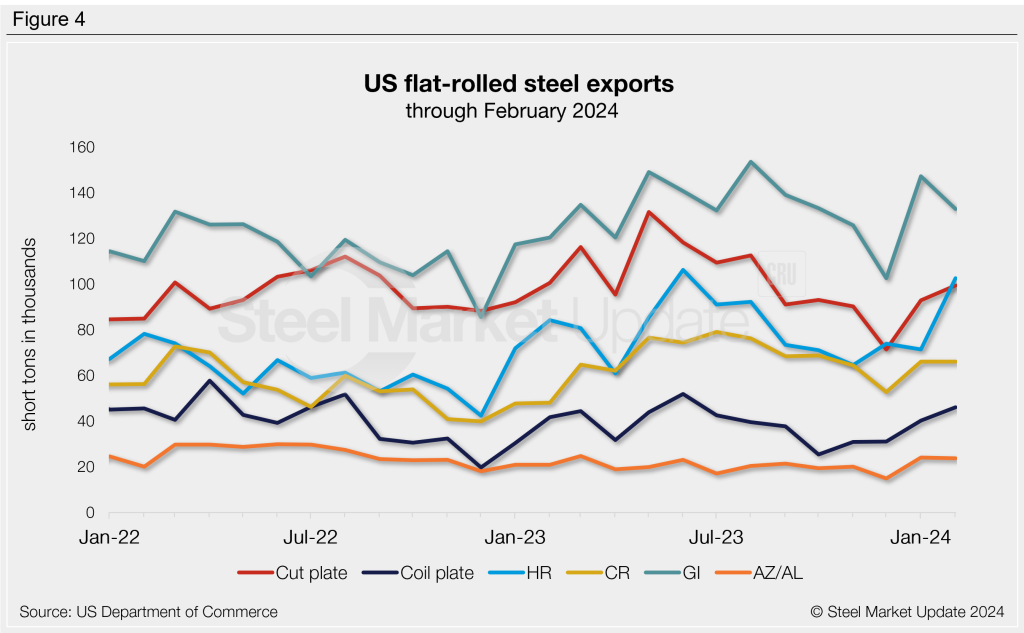

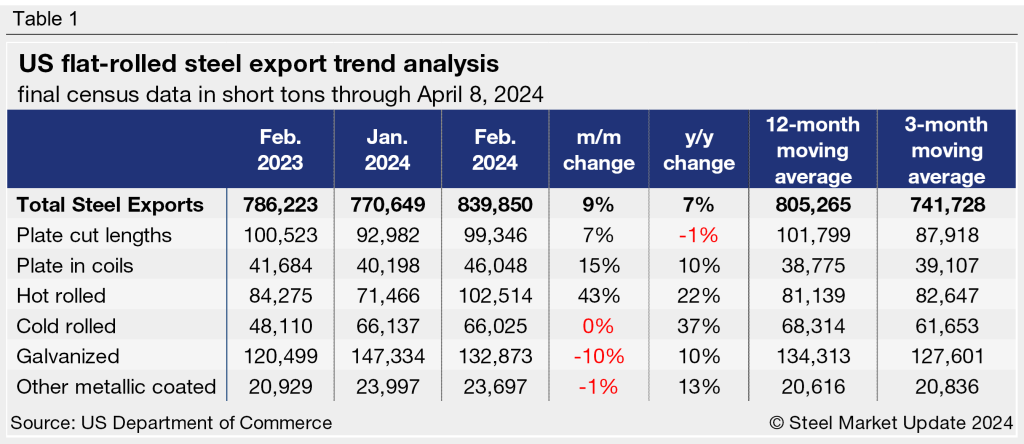

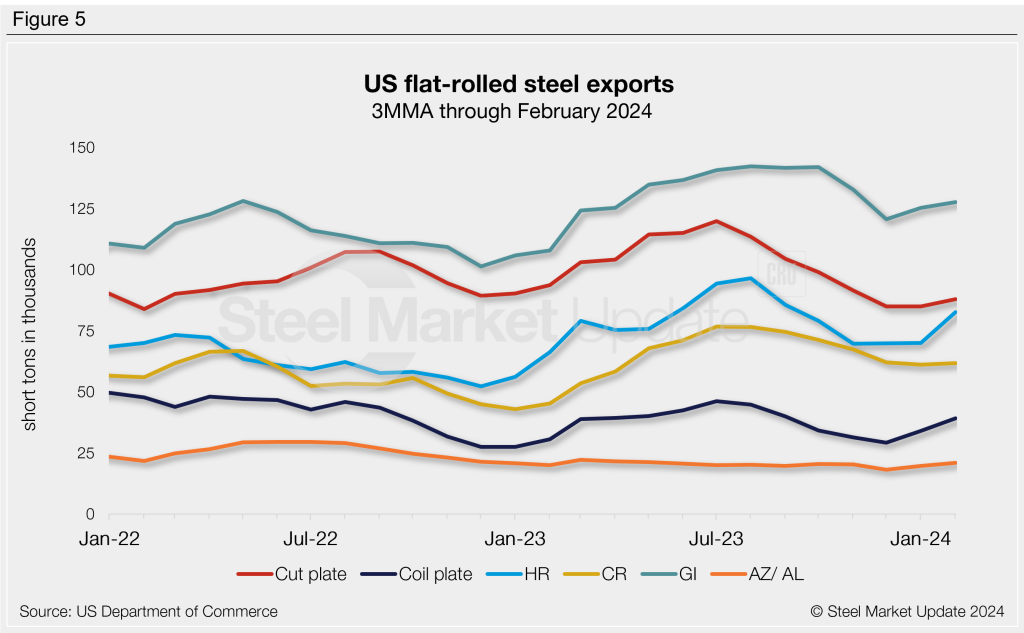

Exports of all major flat-rolled steel products showed significant increases from December to January, except for hot-rolled sheet, which declined 3%. Movement was mixed in February, with plate and hot-rolled products increasing, cold rolled flat and coated products declining. The most impressive mover in February was in hot rolled products, surging 43% m/m. Coiled plate saw a 15% increase in that span, while galvanized exports shrunk 10%.

Notable year-on-year (y/y) increases were seen in exports of cold-rolled sheet (+37%), hot-rolled sheet (+22%) and other-metallic-coated products (+13%).

On a 3MMA basis, each of the steel product exports we track saw increases from January to February. The largest m/m movers were hot-rolled sheet (+18%) and coiled plate (+15%).

Note that most steel exported from the US is destined for USMCA trading partners Canada and Mexico.