Market Segment

April 24, 2024

SSAB Americas Q1 results hit by lower plate prices, demand

Written by Laura Miller

Lower demand and prices for steel plate impacted SSAB Americas’ results in the first quarter, Swedish parent company SSAB said in its Q1’24 interim report.

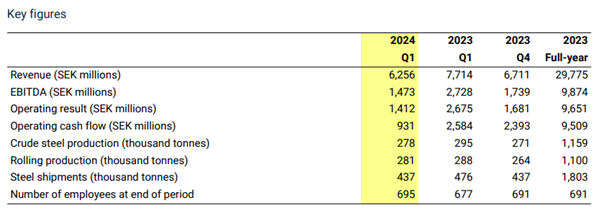

Below are the results for the SSAB Americas segment:

In the report, SSAB highlighted the cautious approach of the American market in the quarter, particularly service centers, in response to lower prices. This caution significantly impacted shipments, with SSAB Americas experiencing an 8% year-on-year (y/y) drop in steel shipments to 437,000 metric tons (mt). Shipments were flat from the prior quarter.

SMU’s interactive pricing tool shows discrete plate prices declined 9% from an average of $1,471 per short ton (st) in Q1’23 to an average of $1,334/st in Q1’24.

The lower prices and reduced shipments hurt SSAB Americas’ Q1 revenues, which dropped 19% y/y to SEK 6,256 million (US$575 million). The Americas segment also posted a 46% y/y decline in adjusted Ebitda to SEK 1,473 million (US$135 million).

SSAB noted the ramp-up of SSAB Zero production in the US continues, with 21,000 mt shipped in Q1.

In the current quarter, SSAB Americas’ total shipments are expected to be somewhat higher than Q1, while realized prices will be somewhat lower, according to the company.

SSAB said its main market in Europe continues to be weak even as the market for high-strength steel is stable.

The company recently announced a major project at its Lulea works in Sweden to convert steelmaking from the blast furnace route to electric-arc furnaces (EAF). The investment comes with a price tag of €4.5 billion (US$4.8 billion).

Additionally, SSAB is considering expanding its US operations upon receipt of a significant grant from the US government.