Market Data

June 6, 2024

SMU survey: Buyers' Sentiment Indices jump back up

Written by Ethan Bernard

SMU’s Steel Buyers’ Sentiment Indices both rebounded sharply this week, according to our most recent survey data.

Every other week, we poll steel buyers about their companies’ chances of success in the current market as well as three to six months down the road. We use this information to calculate our Current Steel Buyers’ Sentiment Index and Future Sentiment Index. (We have historical data dating to 2008. You can find that here.)

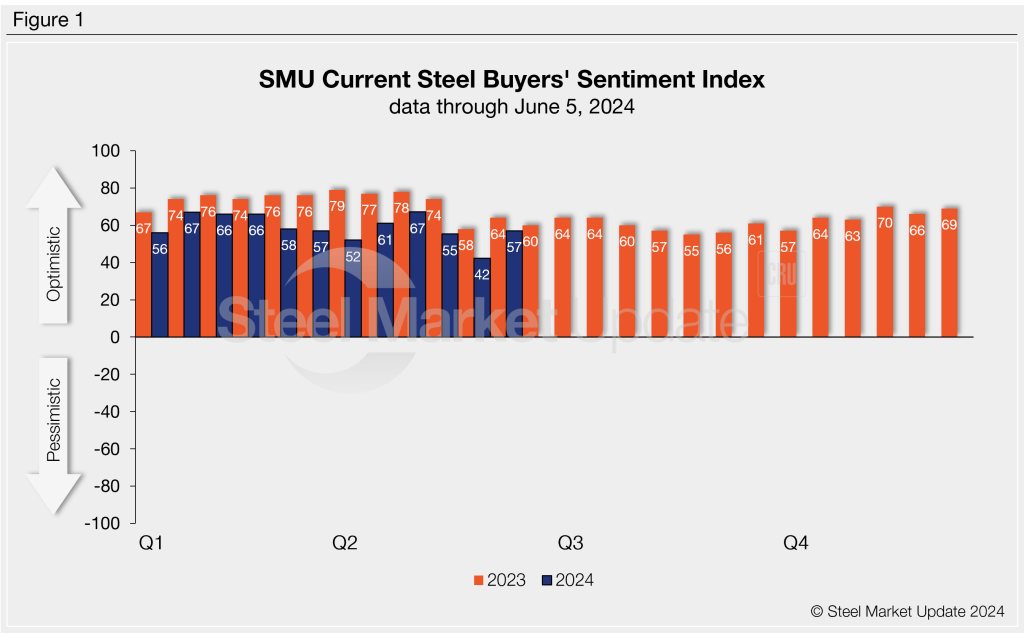

SMU’s Current Buyers’ Sentiment Index was +57 this week, rocketing up 15 points from two weeks earlier. (Figure 1). After reaching an almost four-year low at our last market check, this reading is more in line with what we’ve seen since the beginning of the year. As the summer plays out, we’ll see if the last reading was an anomaly or if it predicts rocky times ahead.

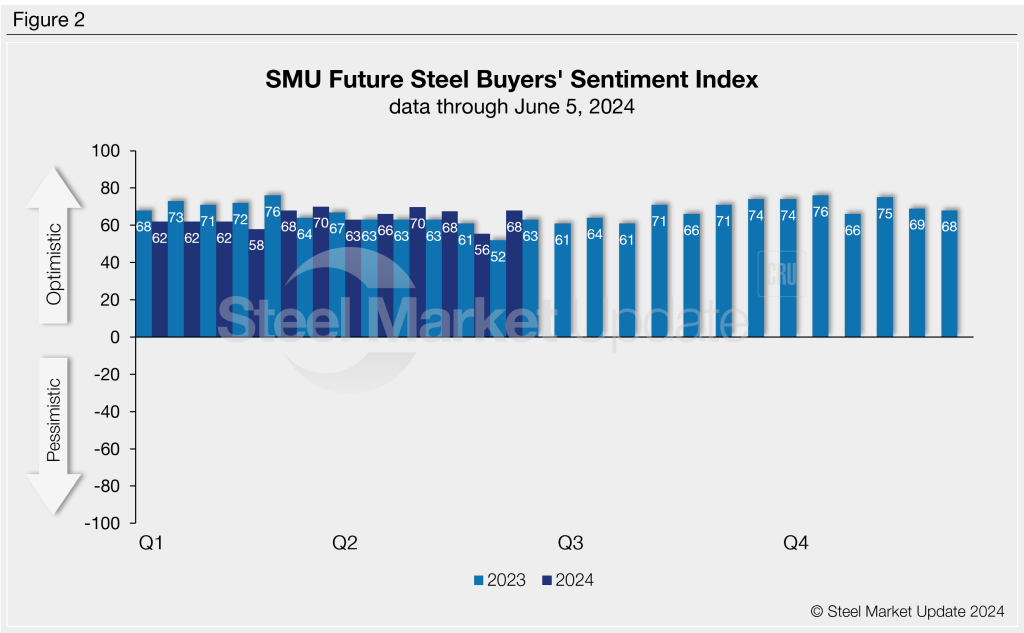

SMU’s Future Buyers’ Sentiment Index measures buyers’ feelings about business conditions three to six months in the future. This index also soared, rising 12 points this week to +68 (Figure 2). After last week’s plunge of 12 points, this takes us back to the higher side of territory we’ve seen all year.

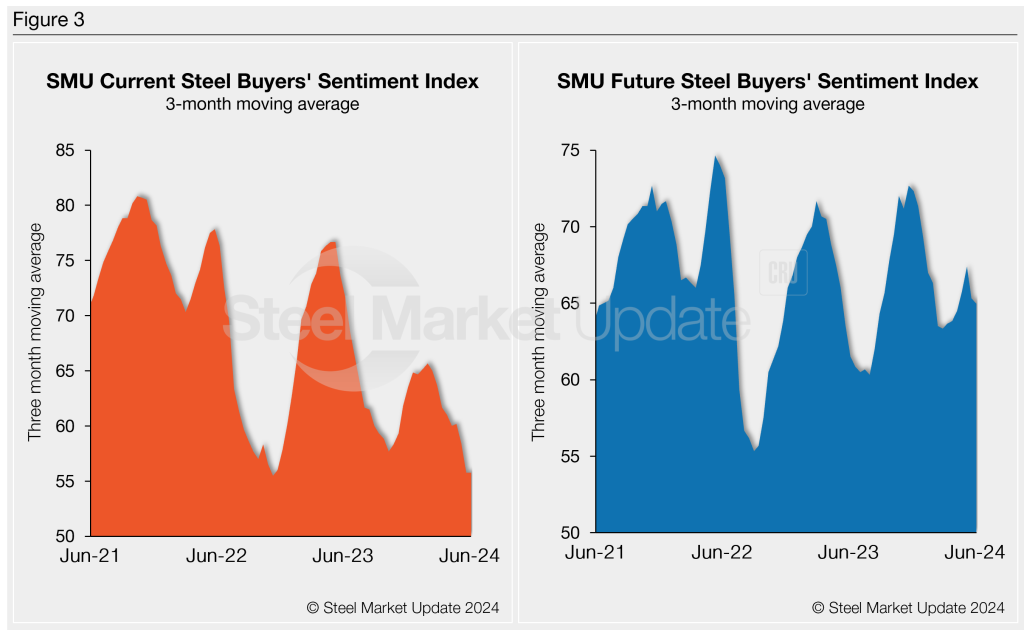

Measured as a three-month moving average, the Current Sentiment 3MMA ticked up to +55.78 from +55.77 two weeks earlier.

Meanwhile, this week’s Future Sentiment 3MMA fell to +64.96 vs. +65.31 at the last market check (Figure 3).

What SMU survey respondents had to say:

“Pricing stability does not support our growth objectives or support our financial targets for 2024.”

“Holding tight inventory – anticipating lower prices.”

“Very tough selling off higher-priced inventory in a downward market with sluggish demand.”

“We seem to be doing fine.”

“Based on new products coming online in H2, our volume and profitability will be up dramatically.”

“Working through high-cost inventory and some timely buys coming up at ‘the bottom’ should set us up for future profitability.”

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology is here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.