Prices

October 31, 2024

HRC vs. galvanized prices: Lowest spread of 2024

Written by Brett Linton

The premium galvanized coil prices carry over hot-rolled (HR) coil continues to decline following the uptick seen earlier this year. Through Oct. 29, the spread between these two products has eased to the lowest level recorded in over 15 months.

Recent prices

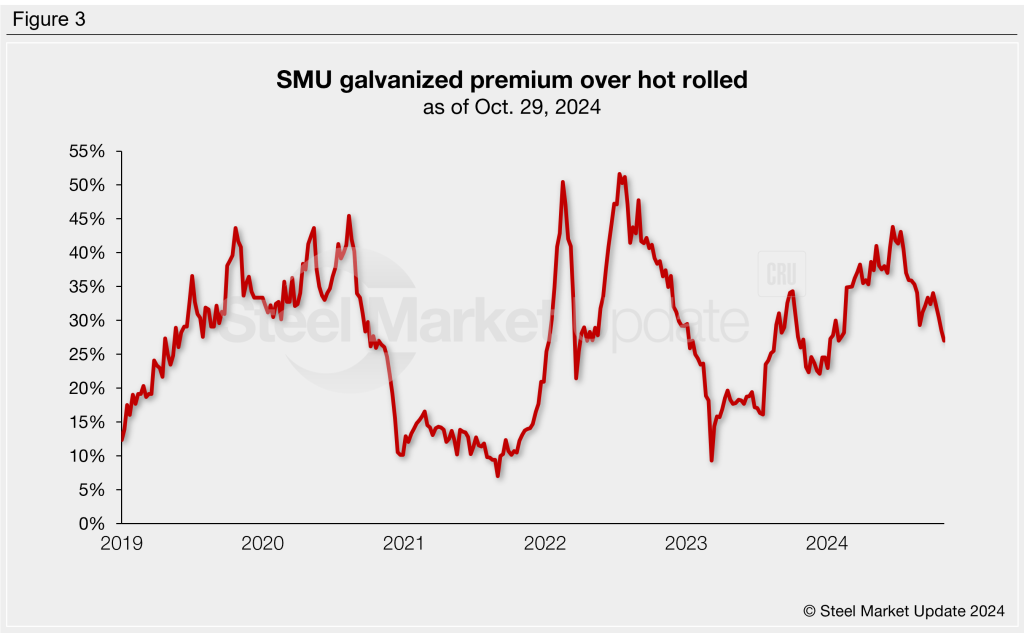

SMU’s HR coil price held steady week over week (w/w) at $685 per short ton (st) in our price check on Oct. 29. HR prices have fluctuated within a relatively narrow range of $635-705/st over the last four months. Prices touched a 16-week high in early October but have since trended lower, currently sitting at one of the lowest levels recorded in the last 10 weeks.

Our galvanized index fell $10/st w/w to a 13-week low of $870/st this week (base price with no extras). This is tied with late July for the lowest galvanized price recorded in over a year. Prices had risen as high as $950/st over the last four months.

Figure 1 graphs the pricing relationship between these two products over the last five years.

Galvanized premium

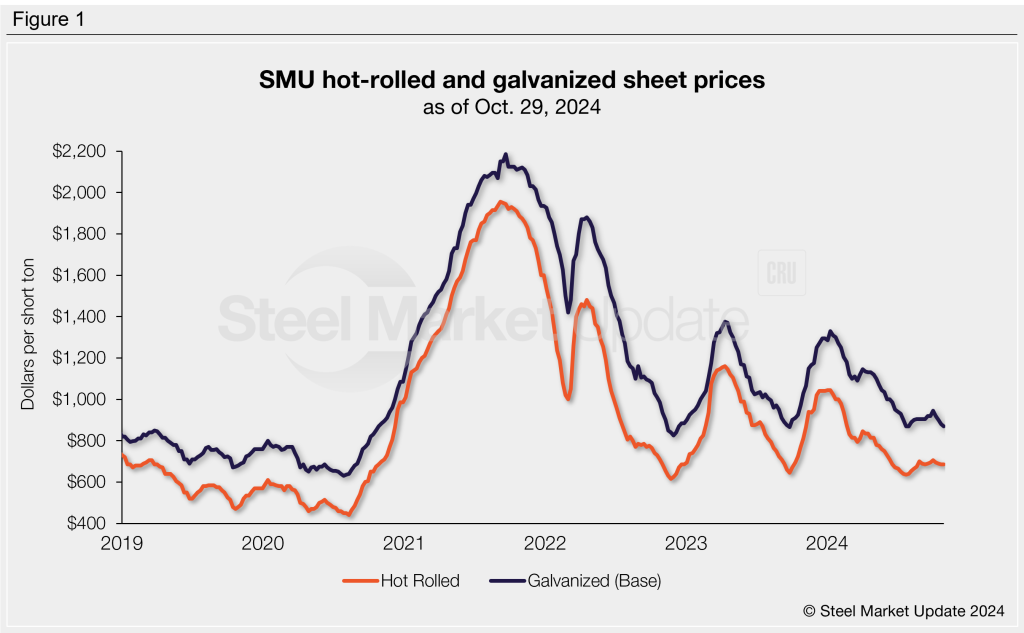

As seen in Figure 2, the relationship between hot rolled and galvanized prices has experienced increased volatility since late 2021.

As of last week, galvanized currently holds a $185/st price premium over hot-rolled steel. This is the lowest spread measured since July 2023. The spreads we have experienced over the past month are similar to those seen from August through November of last year. Looking back across the past year, the spread quickly widened in November 2023. It peaked in May of this year at a seven-month high of $320/st, then gradually declined over the last five months. The spread has averaged $260/st over the last 12 months. For historical reference, we saw pre-pandemic spreads mostly between $85-220/st for over a decade.

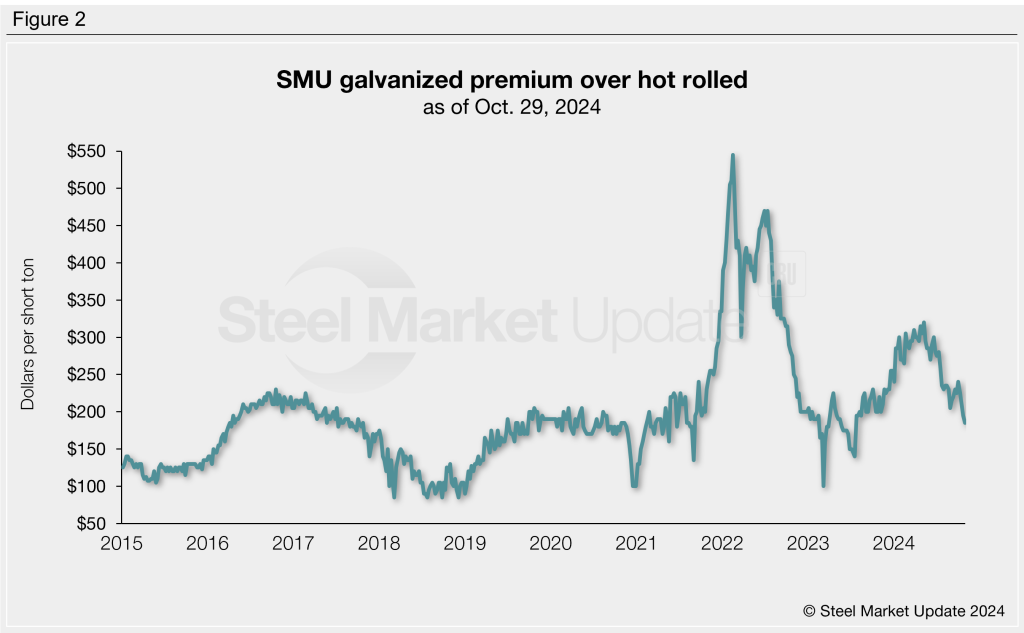

An alternative way to compare these two product prices is to look at the galvanized premium as a percentage rather than a dollar value. Figure 3 graphs the hot-rolled/galvanized price spread as a percentage of the hot rolled price.

The percentage premium paints a slightly different picture from Figure 2. The latest premium is down to a nine-month low of 27%. The premium climbed to a near-two-year high of 44% back in June, an upward trend generally since March 2023 (when the premium had fallen to 9%). This time last year the premium was also 27%.

Prior to the pandemic volatility, galvanized prices held an average premium of 24% above hot rolled prices from 2017 through the end of 2021. The premium reached a record high of 52% in July 2022.