Market Data

November 19, 2024

SMU price ranges: Sheet slide over amid mill price increase rumors?

Written by Brett Linton & Michael Cowden

SMU’s flat-rolled steel prices were mixed this week with slight declines across most products, and a modest increase in prices for cold-rolled coil.

The spreads between our high and low prices also remained wide. That sometimes happens when prices are about to inflect higher or lower.

This week, for example, we recorded deals for larger orders of HR (thousands of tons) for as low as $620 per short ton (st). Meanwhile, truckload quantities were closer to the $750/st price posted by Nucor, Cliffs, and followed by other major mills.

What appears to be out of the market are numbers below $600/st for the very largest buyers (tens of thousand of tons). Some who had placed orders at those figures in late October or earlier this month reported being rebuffed by mills more recently. That has sparked rumors that mills might be weighing another round of price hikes.

Some sources said price hikes wouldn’t be justified given flat scrap prices, increased supply, and elevated inventories. But others said lead times stretching into 2025, optimism around a second Trump administration, and a potentially aggressive move on tariffs shortly after Inauguration Day on Jan. 20 could support higher tags.

Market participants also noted that certain mills had closed 2024 and had not yet opened 2025 for spot tons. Producers are probably doing so in hopes of holding out for higher prices in the new year, they said.

It was a similar story on tandem products, where prices at or below $800/st seem to be out of the market. Another support comes from a trade petition against 10 countries that is expected to impact prices more in 2025 – even if the imports continue to weigh on the market in the meantime.

Plate prices, meanwhile, remain at low levels. But, as SMU has reported before, leaner plate inventories could mean that market is primed for a quick turnaround if there is a catalyst to move prices higher.

Our price momentum indicators remain at neutral. We will keep our eyes out in the weeks ahead for any signs of the market bottoming and rebounding.

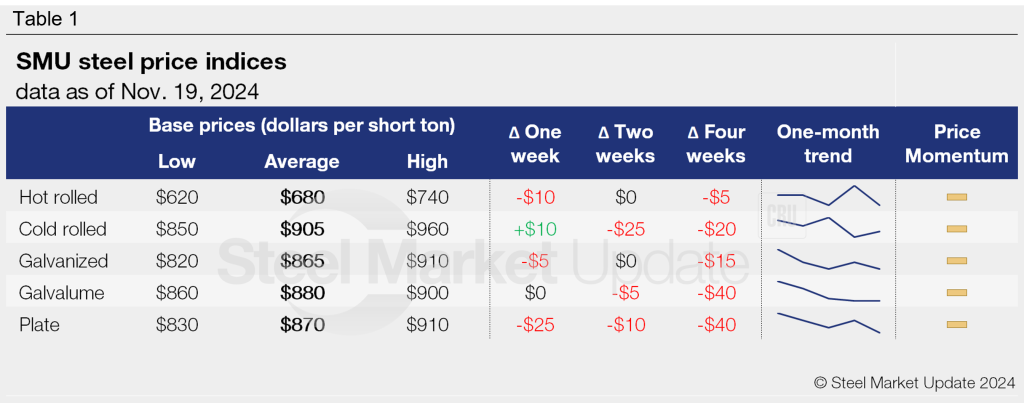

Refer to Table 1 for the latest SMU steel price indices and how prices have moved in recent weeks.

Hot-rolled coil

The SMU price range is $620-740/st, averaging $680/st FOB mill, east of the Rockies. The lower end of our range is down $20/st week over week (w/w), while the top end is unchanged w/w. Our overall average is down $10/st w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.6 weeks as of our Nov. 6 market survey. We will publish updated lead times this Thursday.

Cold-rolled coil

The SMU price range is $850–960/st, averaging $905/st FOB mill, east of the Rockies. The lower end of our range is unchanged, while the top end is up $20/st w/w. Our overall average is up $10/st w/w. Our price momentum indicator for cold-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 5-8 weeks, averaging 6.6 weeks through our latest survey.

Galvanized coil

The SMU price range is $820–910/st, averaging $865/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $10/st w/w. Our overall average is down $5/st w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $917–1,007/st, averaging $962/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.8 weeks through our latest survey.

Galvalume coil

The SMU price range is $860–900/st, averaging $880/st FOB mill, east of the Rockies. The lower end of our range is up $20/st w/w, while the top end is down $20/st w/w. Our overall average is unchanged w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,154–1,194/st, averaging $1,174/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-7 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $830–910/st, averaging $870/st FOB mill. The lower end of our range is down $10/st w/w, while the top end is down $40/st w/w. Our overall average is down $25/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 3.9 weeks through our latest survey.

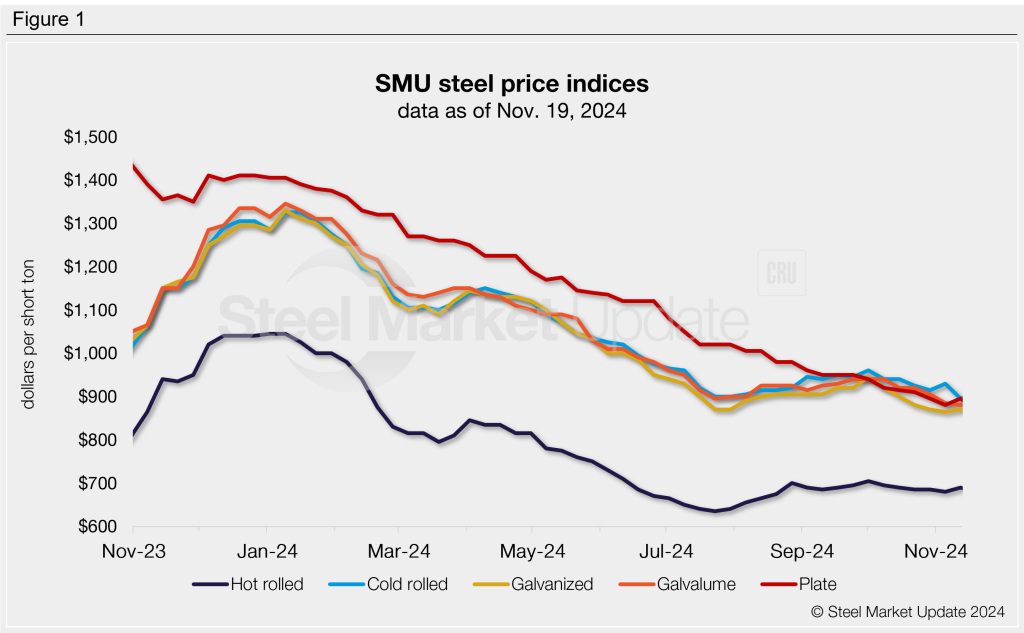

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton