Market Data

November 26, 2024

SMU price ranges: Steady market ahead of Thanksgiving

Written by Brett Linton

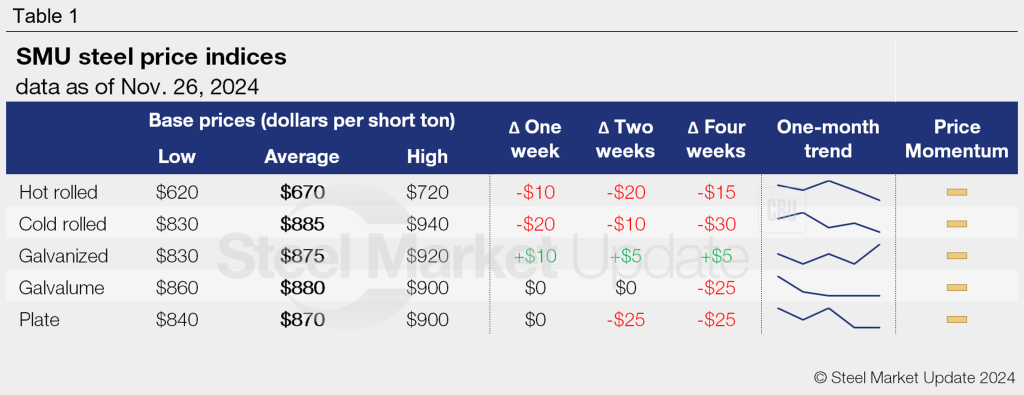

SMU’s price indices saw minor fluctuations on sheet products this week, while our plate and Galvalume indices held steady.

The majority of our indices have trended lower throughout November, falling between $15-30 per short ton (st) across the month. Galvanized was the only product to buck the trend, rising $5/st in that time.

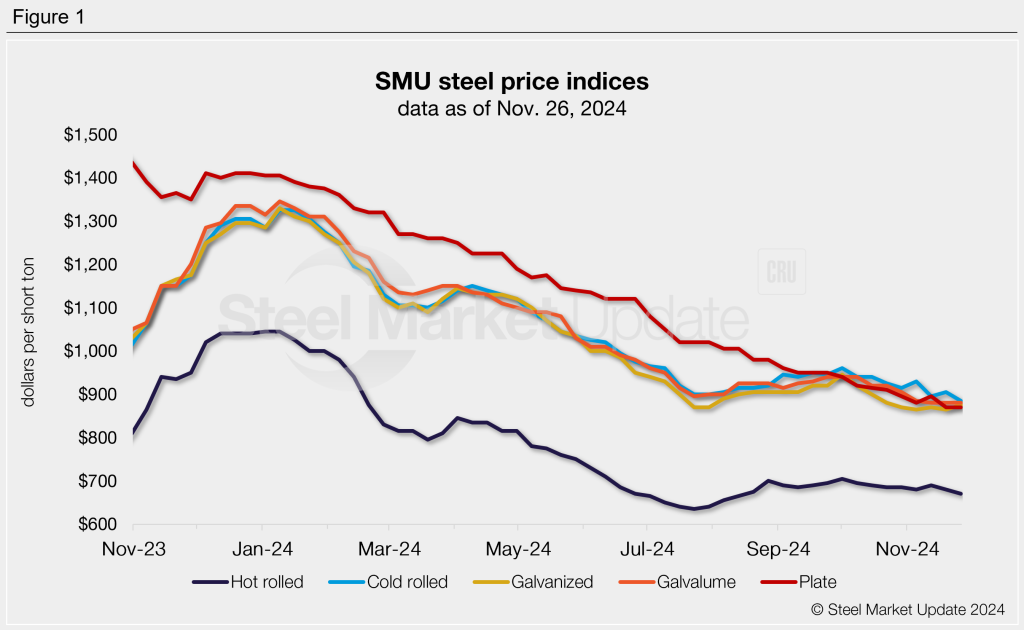

Sheet prices remain at or near multi-month lows, similar to levels seen around late July/early August. Plate prices continue to edge lower from their mid-2022 peak.

SMU’s hot-rolled steel index fell to a 15-week low of $670/st this week. Cold rolled prices eased to $885/st, surpassing the July low, and now at the lowest level seen since September 2023. Our galvanized index ticked up $10/st week on week (w/w) to $870/st, previously at a 13-month low last week. Galvalume held at $880/st for the third week in a row, the lowest price seen since September of last year. Plate prices were steady w/w at $870/st, remaining at low levels last seen in December 2020.

Our price momentum indicators remain at neutral for both sheet and plate products. We will keep our eyes out in the weeks ahead for any signs of the market shifting.

Refer to Table 1 for the latest SMU steel price indices and how prices have moved in recent weeks.

Hot-rolled coil

The SMU price range is $620-720/st, averaging $670/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $20/st w/w. Our overall average is down $10/st w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.6 weeks as of our Nov. 20 market survey.

Cold-rolled coil

The SMU price range is $830–940/st, averaging $885/st FOB mill, east of the Rockies. Our range has shifted $20/st lower w/w. Our price momentum indicator for cold-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 5-9 weeks, averaging 6.7 weeks through our latest survey.

Galvanized coil

The SMU price range is $830–920/st, averaging $875/st FOB mill, east of the Rockies. Our range has shifted $10/st higher w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $927–1,017/st, averaging $972/st FOB mill, east of the Rockies.

Galvanized lead times range from 5-8 weeks, averaging 6.6 weeks through our latest survey.

Galvalume coil

The SMU price range is $860–900/st, averaging $880/st FOB mill, east of the Rockies. Our range is unchanged w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,154–1,194/st, averaging $1,174/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 7.0 weeks through our latest survey.

Plate

The SMU price range is $840–900/st, averaging $870/st FOB mill. The lower end of our range is up $10/st w/w, while the top end is down $10/st w/w. Our overall average is unchanged w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 2-6 weeks, averaging 3.8 weeks through our latest survey.

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.