Prices

December 13, 2024

HRC vs. busheling spread down a tick in December

Written by Ethan Bernard & Stephen Miller

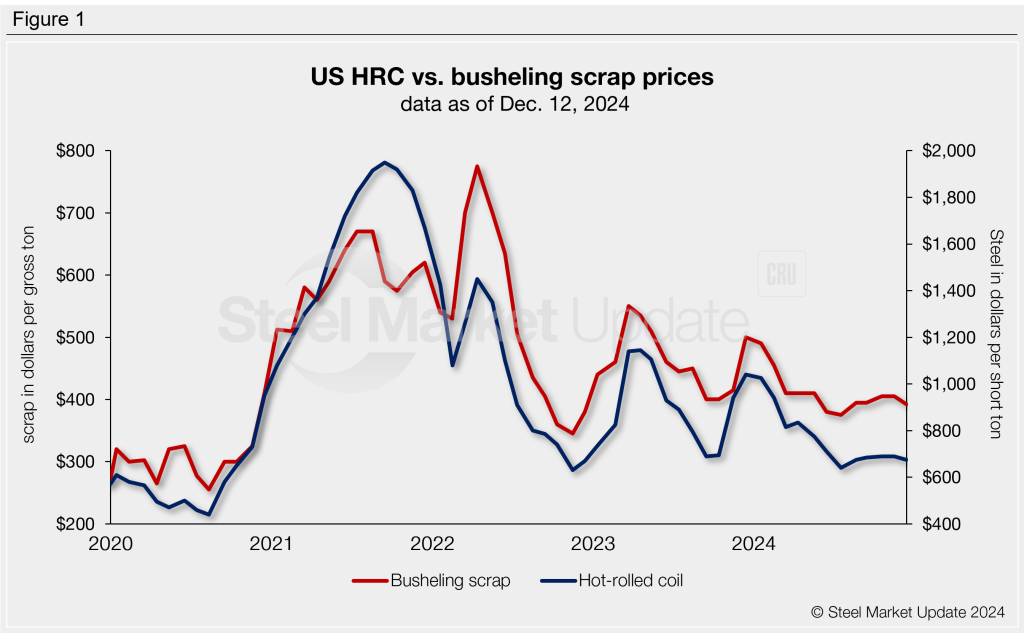

The price spread between hot-rolled coil (HRC) and prime scrap narrowed slightly in December, according to SMU’s most recent pricing data.

SMU’s average HRC price slipped week over week (w/w), and the December price for busheling fell from November.

Our average HRC price as of Dec. 10 was $675 per short ton (st) FOB mill, east of the Rockies, down $5 per short on (st) w/w.

At the same time, busheling tags fell in December. They are down $12.50 per gross ton (gt) month over month to an average of $392.50/gt. Figure 1 shows price histories for each product.

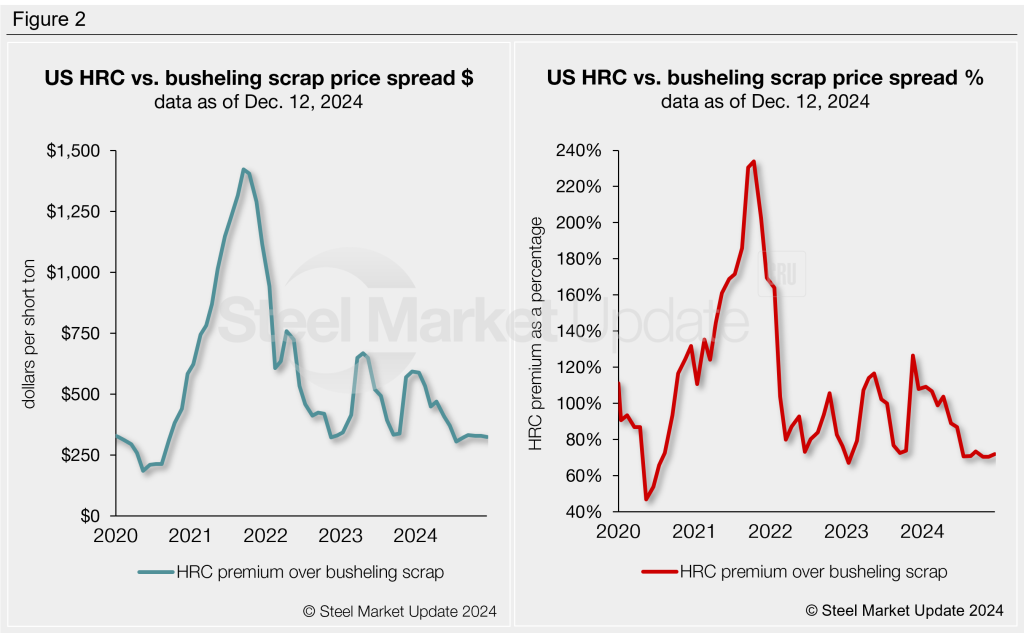

After converting scrap prices to dollars per short ton for an equal comparison, the differential between HRC and busheling scrap prices was $325/st as of Nov. 14. That’s down a mere $3/st from a month earlier (Figure 2). The spread hasn’t topped the $400/st mark since it was at $409/st in May.

What’s going on?

Unless HRC prices rise in January, the spread between #1 Busheling and HRC will continue to narrow. In fact, it already has begun.

When the scrap market initially started to form earlier this month, mills posted bids $20/gt lower than November. But, some major buyers subsequently had to adjust their prices upward to cover their requirements.

We will see this effect when the January spread is calculated since price tags for busheling are likely to increase.

HRC premium as a percentage

The chart on the right-hand side below shows the spread relationship differently: We have graphed HRC’s premium over busheling scrap as a percentage. HRC prices carry a 72% premium over prime scrap. That’s up from 70% a month earlier.

Ethan Bernard

Read more from Ethan Bernard