Analysis

January 10, 2025

Steel exports decline further to 11-month low in November

Written by Brett Linton

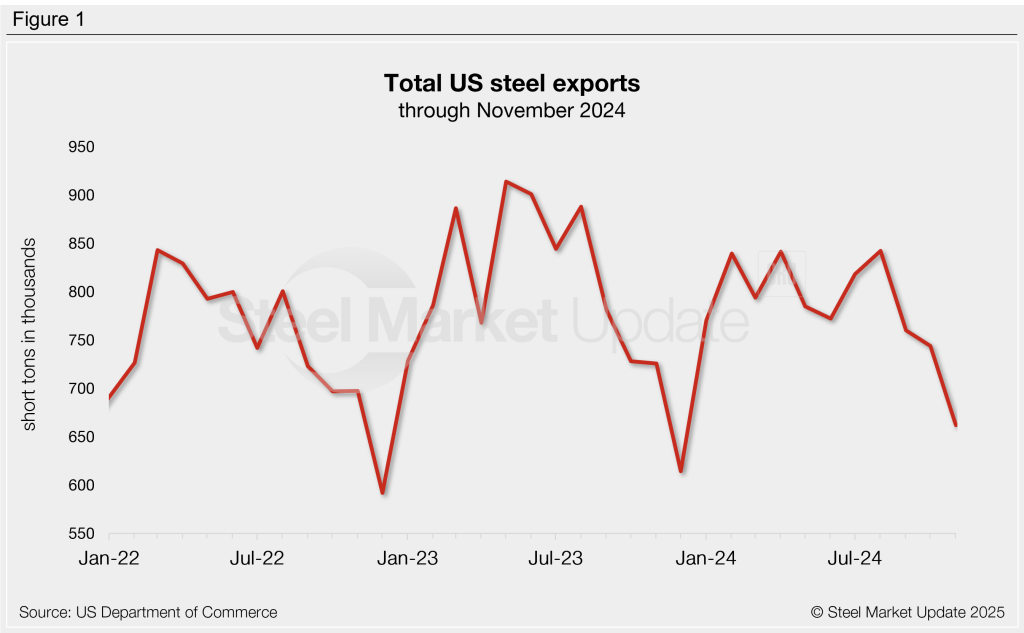

The amount of steel exiting the country continued to decline through November, falling to an 11-month low, according to the latest US Department of Commerce data. This is the third month in a row that steel exports have eased and the second-lowest monthly rate recorded in almost two years.

Steel exports fell 11% month on month (m/m) to 662,000 short tons (st) in November, 21% lower than the one-year high seen last August. November exports were 16% below the average monthly rate of 2024 to date (785,000 st), and 9% less than the same month one year prior.

The majority of steel exported from the US is shipped to US-Mexico-Canada Agreement (USMCA) trading partners. Over half of November exports went to Mexico, while 40% went to Canada.

Other notable recipients included China, Sweden, the Dominican Republic, India, Saudi Arabia, the United Kingdom, Brazil, Italy, and Chile, each receiving 1% or less of the November export pie.

Visit the International Trade Administration’s Steel Mill Export Monitor for more detailed export data by product and country.

Monthly averages

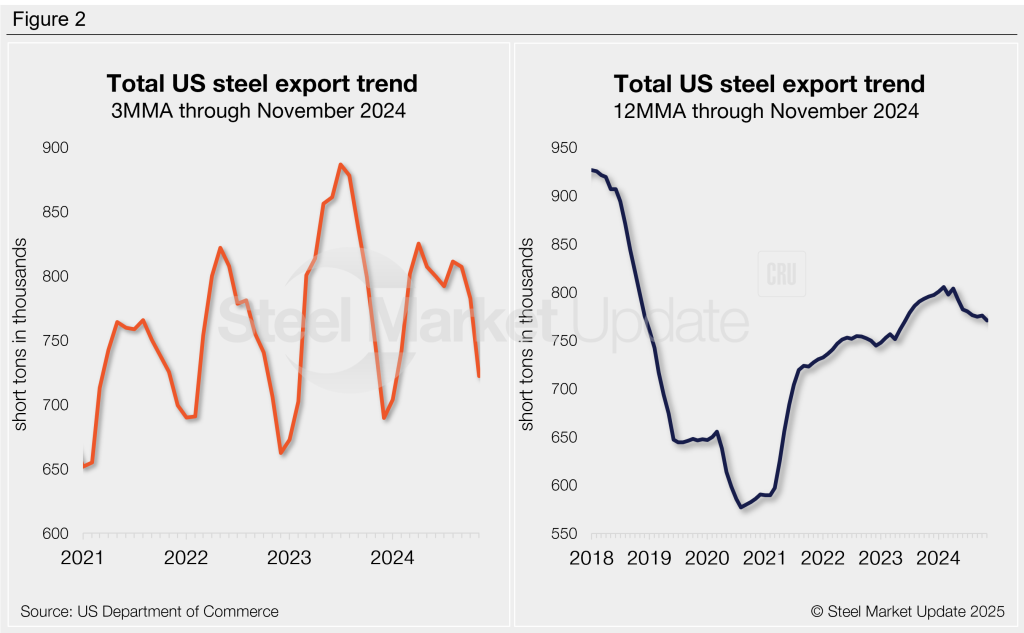

Looking at steel exports on a three-month moving average (3MMA) basis can smooth out monthly variations (Figure 2, left). After reaching a five-year high of 887,000 st in July 2023, 3MMA export volumes sharply declined in the second half of 2023, then partially recovered through mid-2024. The 3MMA has trended downward each month since August.

Exports can be annualized on a 12-month moving average (12MMA) basis to further highlight long-term trends (Figure 2, right). On this annualized basis, steel exports have edged lower since early 2024 but remain strong relative to 2019-22 volumes. The 12MMA through November is down to a 17-month low of 771,000 st. Compare this to the February 2024 five-and-a-half-year high 12MMA of 805,000 st.

Exports by product

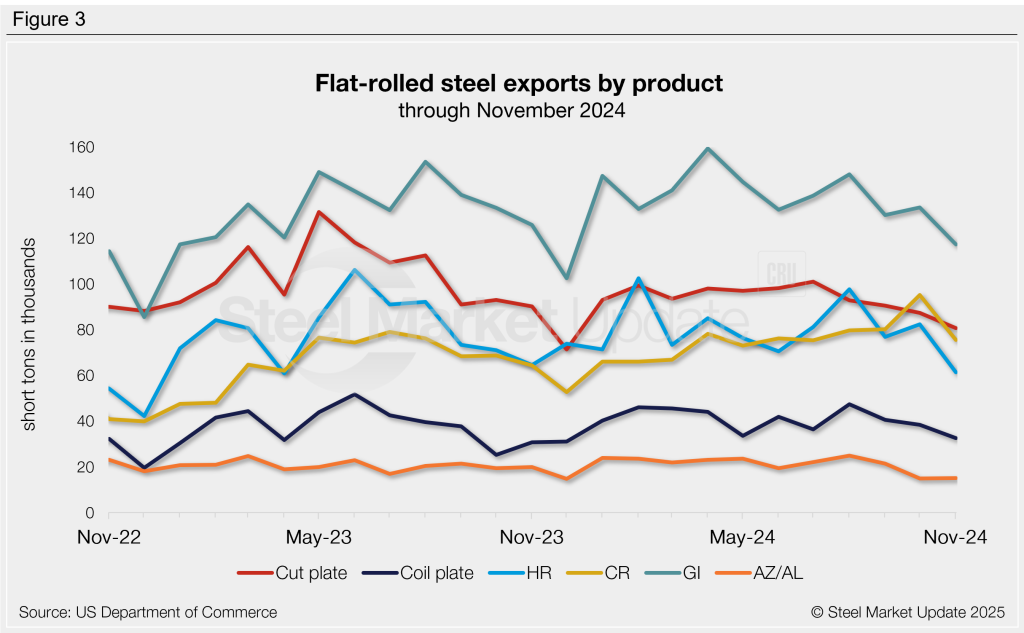

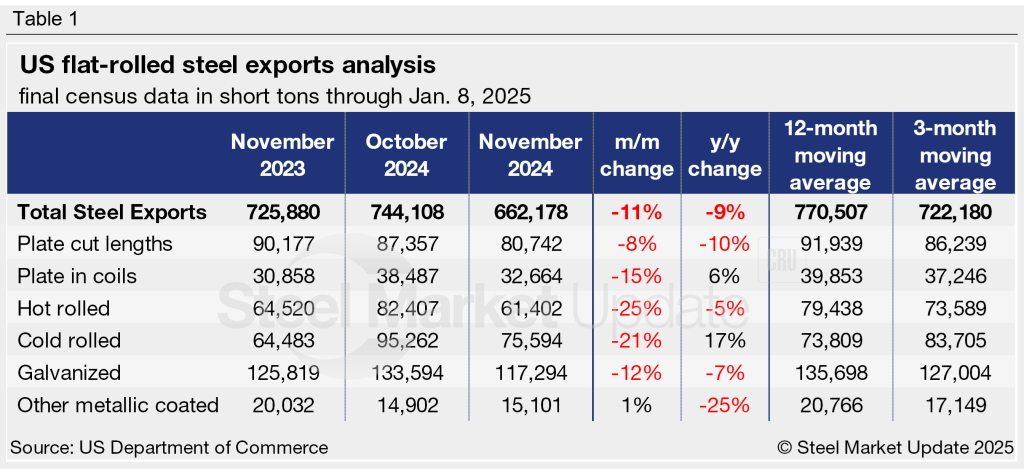

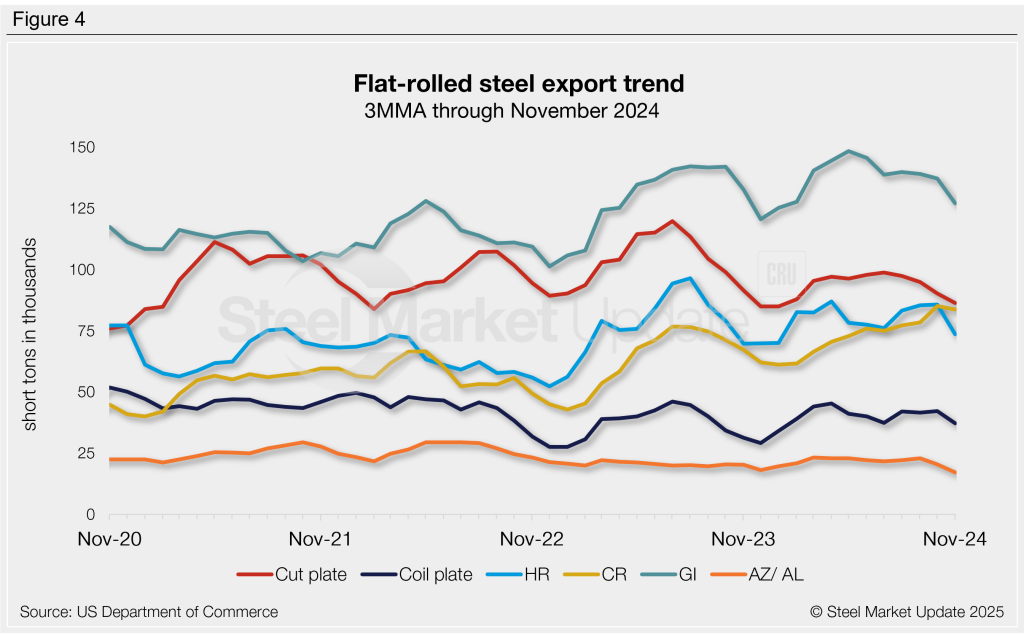

Looking specifically at flat-rolled exports, we saw monthly declines in most of the sheet and plate products we track, with many products falling to multi-month lows. A few notable trends through November data:

- Hot-rolled exports fell 25% from October to a 19-month low.

- Exports of galvanized, plate cut lengths, and plates in coils all declined in November to the lowest monthly rates of 2024.

- The only product to rise from October to November was other-metallic coated, up 1%.

Compared to the same month one year prior, November exports were mixed by product, with four products lower and two higher. Significant year-on-year (y/y) changes were witnessed in other-metallic coated exports (-25%), cold rolled (+17%), and plate cut lengths (-10%).

November exports for all six products were lower than their respective 3MMA and 12MMA, with the exception of cold rolled, which was slightly higher than the 12MMA through this month.

Figure 4 shows a history of exports by product on a 3MMA basis.

SMU members can view historical steel trade data on the Steel Exports page of our website.