Analysis

February 17, 2025

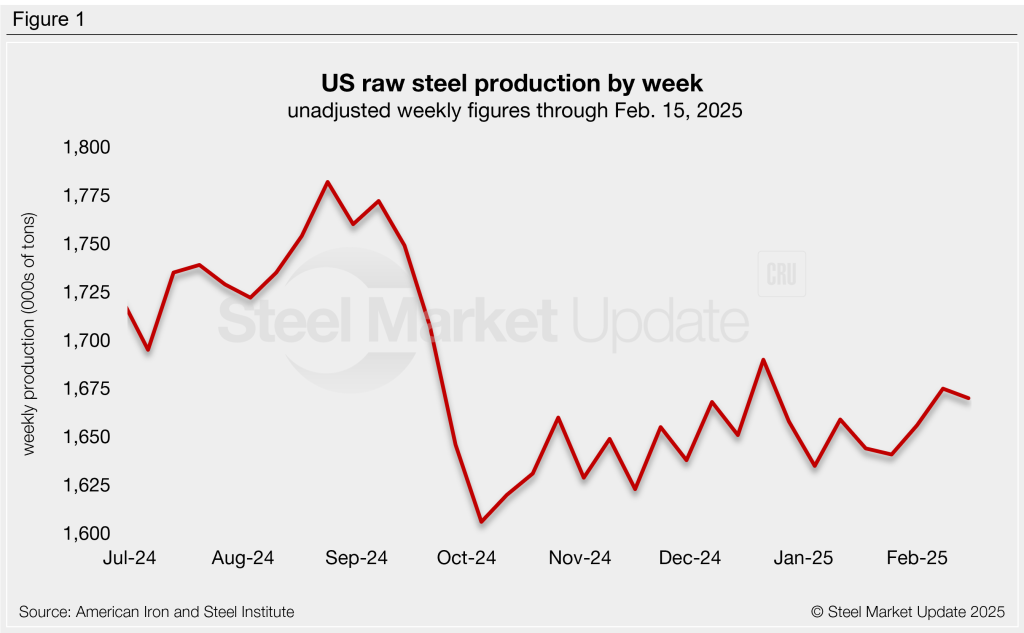

AISI: Raw steel output and capacity utilization slip

Written by Brett Linton

US steel mills produced an estimated 1,670,000 short tons (st) of raw steel last week, according to recently released American Iron and Steel Institute (AISI) figures.

In the week ending Feb. 15, domestic steel output declined by 5,000 st, or 0.3%, compared to the prior week (Figure 1). While down, this marks the third-highest rate recorded across the past four months.

US production was 0.9% higher than the year-to-date weekly average of 1,654,000 st per week, but 3.2% lower than the same week last year.

Last week’s mill capability utilization rate was 75.0%, down from 75.2% one week prior. This time last year it was significantly higher at 77.7%.

Year-to-date mill output now totals 10,879,000 st at a capability utilization rate of 74.3%. This is 0.3% lower than the same period of 2024 when 10,912,000 st were produced at a capability utilization rate of 75.4%.

Weekly regional production data and week-over-week (w/w) changes are as follows:

- Northeast – 122,000 st (up 2,000 st)

- Great Lakes – 487,000 st (down 9,000 st)

- Midwest – 247,000 st (down 3,000 st)

- South – 750,000 st (up 3,000 st)

- West – 64,000 st (up 2,000 st)

Editor’s note: The raw steel production tonnage provided in this report is estimated and should be used primarily to assess production trends. The graphic included in this report shows unadjusted weekly data. The monthly AISI “AIS 7” report is available by subscription and provides a more detailed summary of domestic steel production.