Prices

February 24, 2025

Buyers optimistic for strong scrap market in March

Written by Brett Linton

Buyers are optimistic for a strong scrap market in March, driven by limited scrap inflows from severe weather disruptions and increasing mill demand. Combine this with a strengthening steel market, and it sets the stage for rising scrap prices.

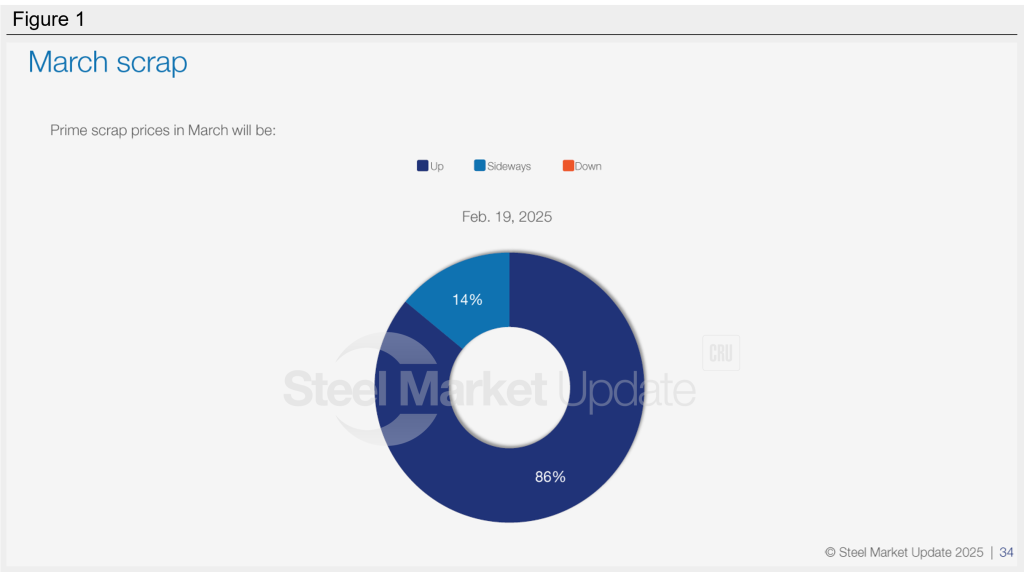

According to last week’s survey, the majority of our respondents believe scrap prices will continue to climb into March, while a small portion expect a sideways market (Figure 1). Not a single buyer expected prices to decline.

At the beginning of February, buyers had also anticipated an increase in scrap prices. Over three quarters of those we polled expected prices to rise from January to February, while 23% predicted a stable market. Buyers felt the same way at the start of the year regarding January prices.

Here are some of the comments we collected last week:

“Increasing scrap prices are the current trend and I see a current bump in demand/buying.”

“Cold weather continues to crimp flows, and mill demand will be steady to up.”

“Higher demand and low supply concerns.”

“Utilization is up, demand is up, and scrap is up, especially with severe weather in Q1.”

“Scrap is outpacing iron ore in a big way. Outside of normal balance between the two products.”

“Expect up $60 -100/gt following steel increases.”

“Trend is up.”

“Scrap will follow increased price of steel.”

“February was pretty strong and we’re being told to expect another bump in March.”

“Harsh winter continues to disrupt flows… plus demand is increasing in US.”

“Seasonal uptick and demand improvement for finished products.”

“Larger than expected February print will create sideways for March. Weather could impact it enough to drive up though.”

“Everybody feeds off of everybody else in the value chain.”