Market Data

March 6, 2025

SMU Survey: Very little wiggle room on mill pricing, buyers say

Written by Brett Linton

The majority of the steel buyers responding to our latest market survey reported that domestic mills are not open to negotiating prices on new orders this week.

In response to President Trump’s tariff actions and rising mill prices, negotiation rates drastically declined in our mid-February survey and continued to decline this week. As a result, negotiation rates have reached their lowest point in nearly two years.

Every other week, SMU surveys buyers to assess if domestic mills are willing to negotiate lower spot prices on new orders. As shown in Figure 1, only 14% of participants this week reported that mills were willing to talk price on new orders. This marks an 11-percentage point decline from our previous survey. Recall that buyers previously held the bargaining power for most of 2024 and up until January of this year.

Negotiation rates by product

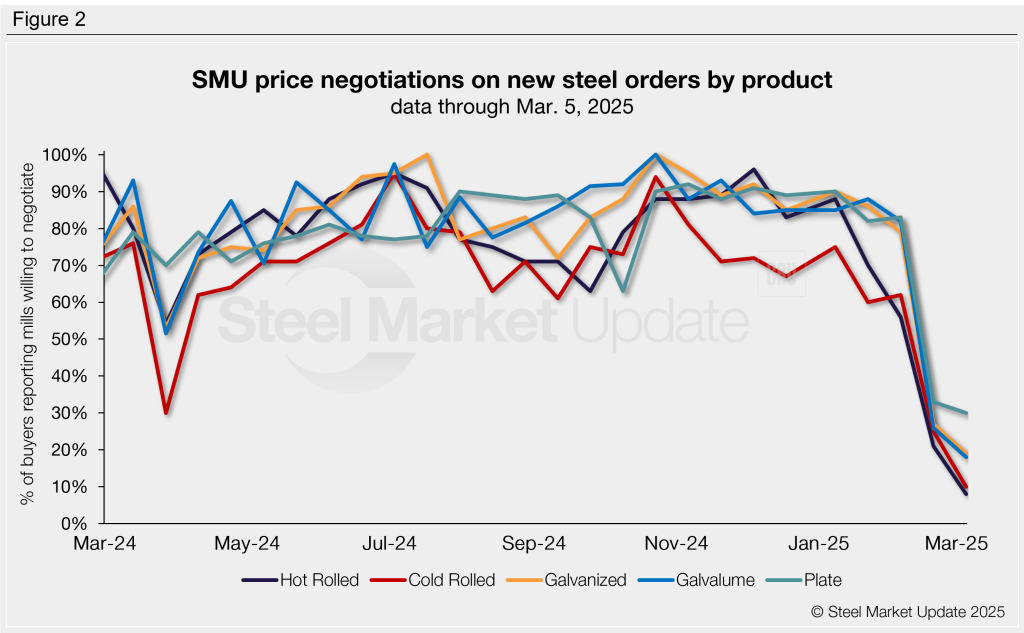

Negotiation rates were lowest on hot-rolled and cold-rolled product this week, although rates for all sheet and plate products we monitor are at lows not seen in at least a year (Figure 2). Rates this week are as follows:

- Hot rolled: 8%, down 13 percentage points from Feb. 19 to the lowest rate seen since September 2021.

- Cold rolled: 10%, down 15 percentage points to the lowest rate seen in over a year.

- Galvanized: 19%, down eight percentage points to the lowest rate seen in three years.

- Galvalume: 18%, down eight percentage points to the lowest rate seen in over a year.

- Plate: 30%, down three percentage points to the lowest rate seen in almost two years.

Steel buyer remarks:

“Not so much!”

“There may be a $20-$40 per-ton range [on galvanized] depending on mill and volume being purchased.”

“They really are not [on hot rolled] at this point in time.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.