Market Data

April 17, 2025

SMU Survey: Sheet lead times ease further, plate hits one-year high

Written by Brett Linton

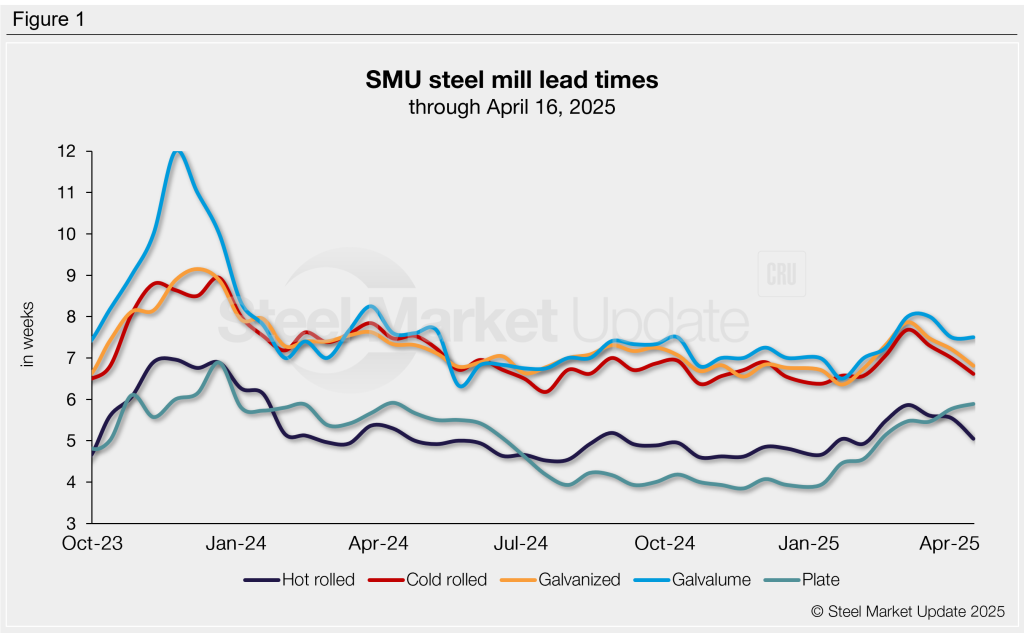

Steel buyers responding to this week’s SMU market survey report a continued softening in sheet lead times. Meanwhile, plate lead times have moderately extended and are at a one-year high.

Steel mill production times had extended back in early February, when a tariff-driven buying surge prompted many buyers to pull forward future orders. That surge proved to be short-lived on sheet products, with lead times peaking in early March and gradually declining since. As of this week, most sheet lead times are about half a week longer than the lowest levels recorded in the past year, while plate lead times are approximately two weeks longer.

The average lead time for hot-rolled steel has fallen to five weeks. Tandem products range from six-and-a-half to seven-and-a-half weeks, while plate remains just under six weeks.

Table 1 summarizes current lead times and recent changes by product (click to expand).

Compared to our April 2 market check, all five of our lead time ranges shifted this week:

- Hot rolled: The longest lead time in our range declined from seven weeks to six.

- Cold rolled: Our range shifted one week lower, now between five and eight weeks.

- Galvanized: The shortest lead time declined from six weeks to four. The longest lead time decreased from nine weeks to eight.

- Galvalume: The shortest lead time increased from six weeks to seven, while the longest lead time decreased from 10 weeks to nine.

- Plate: The longest lead time declined from eight weeks to seven.

Buyers predict stability

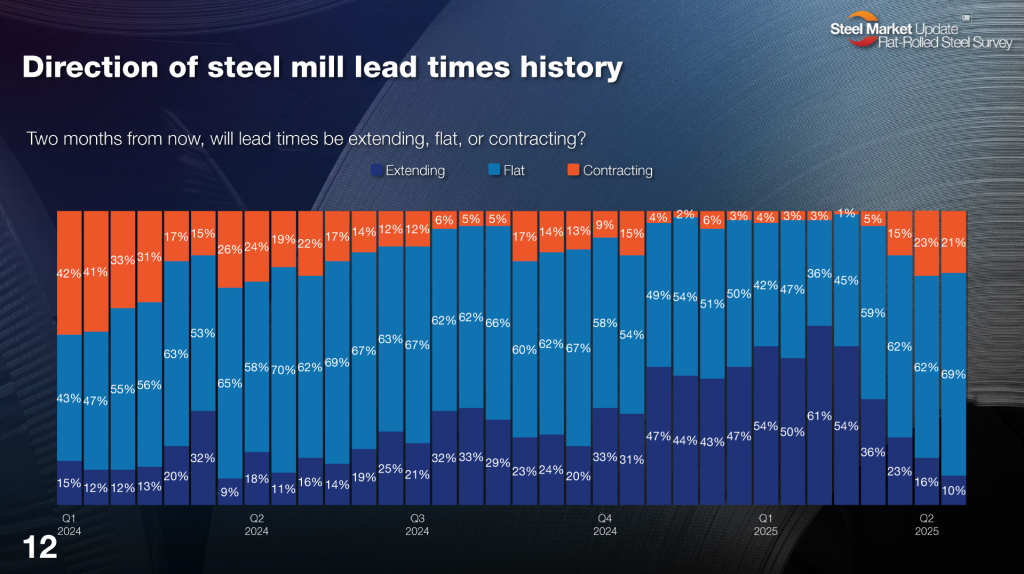

The majority of buyers (69%) continue to predict lead times will hold steady across the next two months, a rate we have seen grow in each of our last five surveys. Of the remainder, 21% expect production times will contract further (this figure has been growing since mid-March). Just 10% anticipate lead times will extend from here, a rate we have seen gradually decline since February. Below is a historical slide from our survey results deck for this question (click to expand):

Here are some of the comments we collected:

“The rally is fading and summer will be the finishing blow.”

“I think the panic buying is behind us and decreased buying will cause lead times to fall.”

“Demand remains soft due to market uncertainty.”

“We see already fairly short lead times from most mills.”

“Even with the tariffs, imports will look OK. Add into that more domestic capacity and we’re in for a mess.”

“Contracting, summer slowdowns.”

“Extending, summer shutdowns for maintenance.”

“Contracting due to July OEM outages.”

Trends

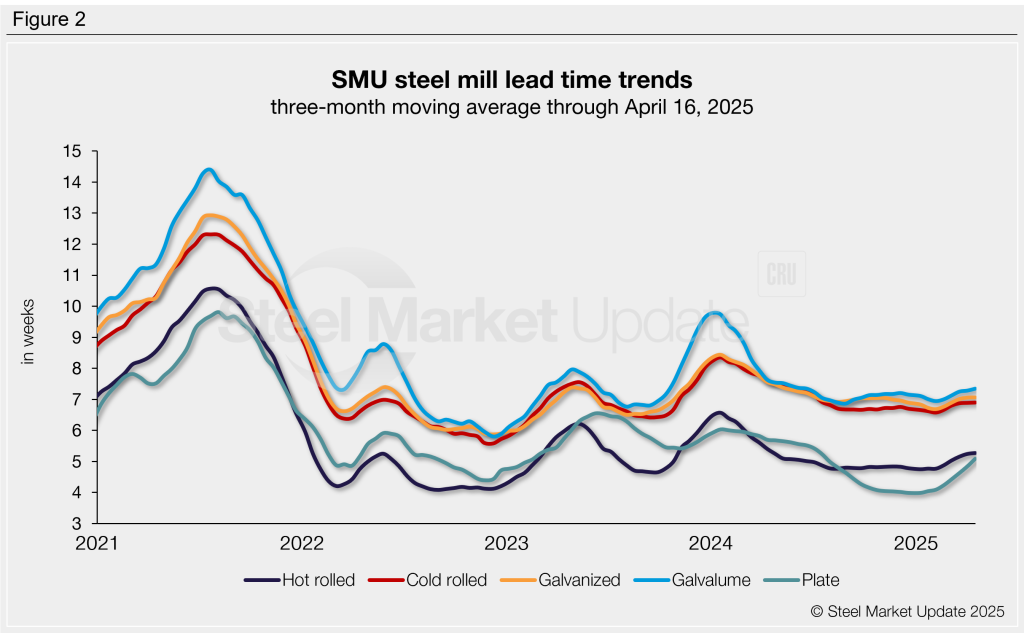

To smooth out biweekly fluctuations, we calculate lead times on a three-month moving average (3MMA) to better highlight trends. This week marks the fifth consecutive survey where 3MMA lead times have increased across the board. This follows a yearlong decline, during which production times touched multi-year lows (Figure 2).

Over the past three months, the average lead times by product are as follows: hot rolled at 5.27 weeks, cold rolled at 6.90 weeks, galvanized at 7.06 weeks, Galvalume at 7.34 weeks, and plate at 5.08 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Consult your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.