Market Data

May 20, 2025

SMU Price Ranges: Market stabilizes as summer slowdown begins

Written by Brett Linton

Most sheet and plate prices edged lower again this week, albeit at a slower pace compared to the movements seen over the last seven weeks. Buyers remain cautious and hesitant to hold onto much inventory, citing lingering demand concerns, ongoing tariff uncertainty, and a potentially weakening scrap market in June.

Two large service center buyers weighed in on current market conditions, citing tariff uncertainty and short-term price pressures. One exec remarked, “Prices are trending down and it seems pretty clear to me that tariff uncertainty started this lull in activity and continues to slow business.” Another anticipated a potential rebound, saying, “If prices get hit hard in the next month, it’s hard to see that they would continue to fall – I imagine they will dip and then head back up.”

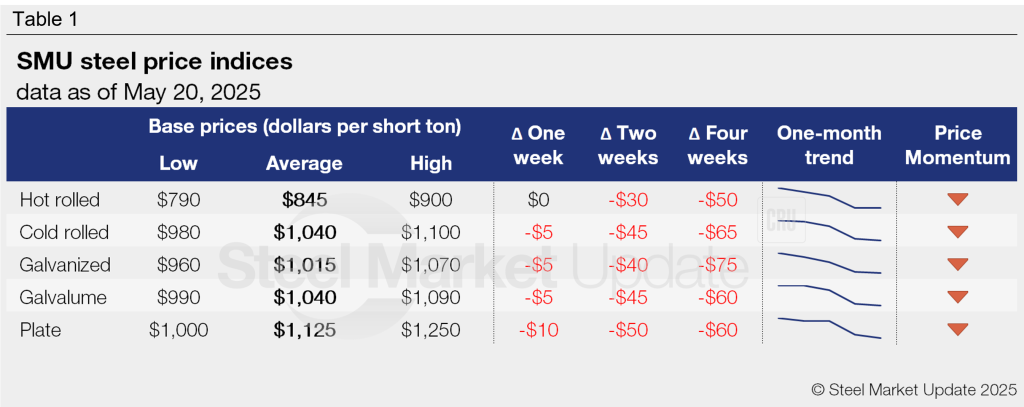

Hot-rolled coil (HRC) was the only product that did not move this week, holding at $845 per short ton (st) and breaking its three-week decline streak. HRC prices have decreased $50/st across the past month.

Tandem products all declined $5/st week over week (w/w), with cold rolled and Galvalume each at $1,040/st and galvanized at $1,015/st. These products have consistently declined since early April and are $60-75/st lower than they were four weeks prior.

Plate prices dipped for the second week in row, falling $10/st w/w to $1,125/st. Prices are down $60/st from mid-April.

SMU’s price momentum indicator remains at lower for both sheet and plate products, signaling that we expect prices to trend lower over the next 30 days.

Refer to Table 1 (click to enlarge) for our latest price indices and trends.

Hot-rolled coil

The SMU price range is $790-900/st, averaging $845/st FOB mill, east of the Rockies. Our range was unchanged w/w. Our price momentum indicator for hot-rolled steel remains at lower, meaning we expect prices to decline over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.6 weeks as of our May 15 market survey.

Cold-rolled coil

The SMU price range is $980–1,100/st, averaging $1,040/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is unchanged. Our overall average is down $5/st w/w. Our price momentum indicator for cold-rolled steel remains at lower, meaning we expect prices to decline over the next 30 days.

Cold rolled lead times range from 5-8 weeks, averaging 6.5 weeks through our latest survey.

Galvanized coil

The SMU price range is $960–1,070/st, averaging $1,015/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is unchanged. Our overall average is down $5/st w/w. Our price momentum indicator for galvanized steel remains at lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,057–1,167/st, averaging $1,112/st FOB mill, east of the Rockies.

Galvanized lead times range from 4-8 weeks, averaging 6.2 weeks through our latest survey.

Galvalume coil

The SMU price range is $990–1,090/st, averaging $1,040/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is down $10/st. Our overall average is down $5/st w/w. Our price momentum indicator for Galvalume steel remains at lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,284–1,384/st, averaging $1,334/st FOB mill, east of the Rockies.

Galvalume lead times range from 6-8 weeks, averaging 6.8 weeks through our latest survey.

Plate

The SMU price range is $1,000–1,250/st, averaging $1,125/st FOB mill. The lower end of our range is unchanged w/w, while the top end is down $20/st. Our overall average is down $10/st w/w. Our price momentum indicator for plate remains at lower, meaning we expect prices to decline over the next 30 days.

Plate lead times range from 4-7 weeks, averaging 5.2 weeks through our latest survey.

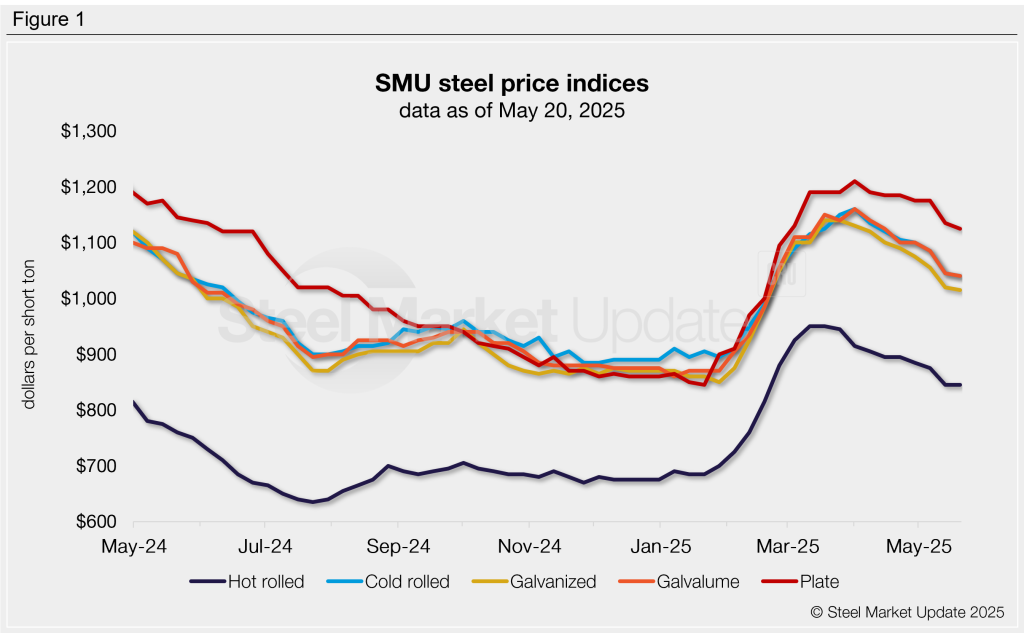

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.