Analysis

June 9, 2025

April steel exports fall to lowest level since 2020

Written by Brett Linton

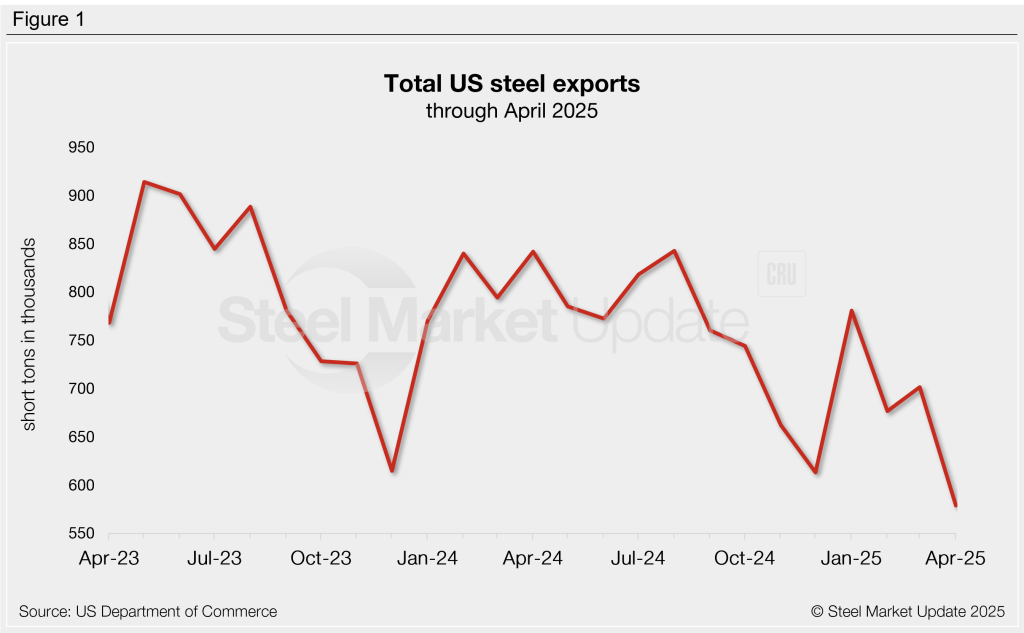

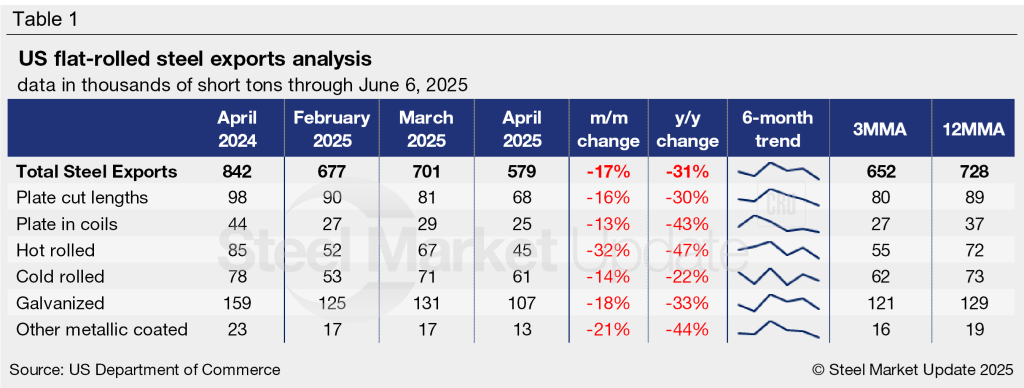

US steel exports totaled 579,000 short tons (st) in April, according to US Department of Commerce data. That’s the lowest monthly volume recorded since July 2020.

The volume of steel shipped out of the country declined 17% month over month (m/m) and is 31% lower than shipments recorded one year prior.

Steel exports fell 123,000 st from March to April, the largest month-over-month decline witnessed since April 2020 (Figure 1). April exports were also 25% below the 2024 monthly average of 770,000 st and 31% below the same month last year.

The majority of US exports (>90%) go to U.S.-Mexico-Canada Agreement (USMCA) trading partners: 62% of April exports were sent to Mexico and 31% to Canada. Other notable destinations included Brazil, the United Kingdom, China, Colombia, Germany, and the Bahamas, each accounting for 1% or less of April exports. Visit the International Trade Administration’s Steel Mill Export Monitor for detailed export data on specific products or countries.

Monthly averages

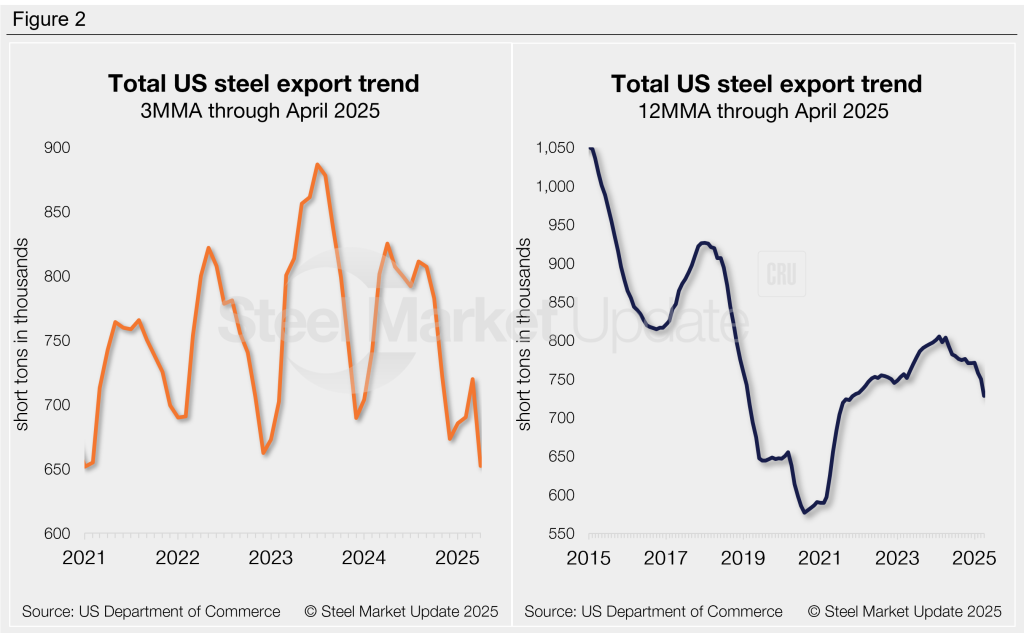

Analyzing steel exports on a three-month moving average (3MMA) basis helps smooth monthly fluctuations and highlight underlying trends (Figure 2, left). On this basis, exports peaked at a five-year high in July 2023 (887,000 st) and have trended lower since. The April 3MMA has fallen to a four-year low of 652,000 st.

Exports can be annualized on a 12-month moving average (12MMA) basis to eliminate seasonal variation (Figure 2, right). From this perspective, annualized exports have also weakened since 2023 but remain above 2019-2022 levels. The 12MMA fell for the third-straight month in April to 728,000 st, the lowest rate seen since November 2021. For comparison, the 12MMA reached a five-and-a-half-year high of 805,000 st in February 2024.

Exports by product

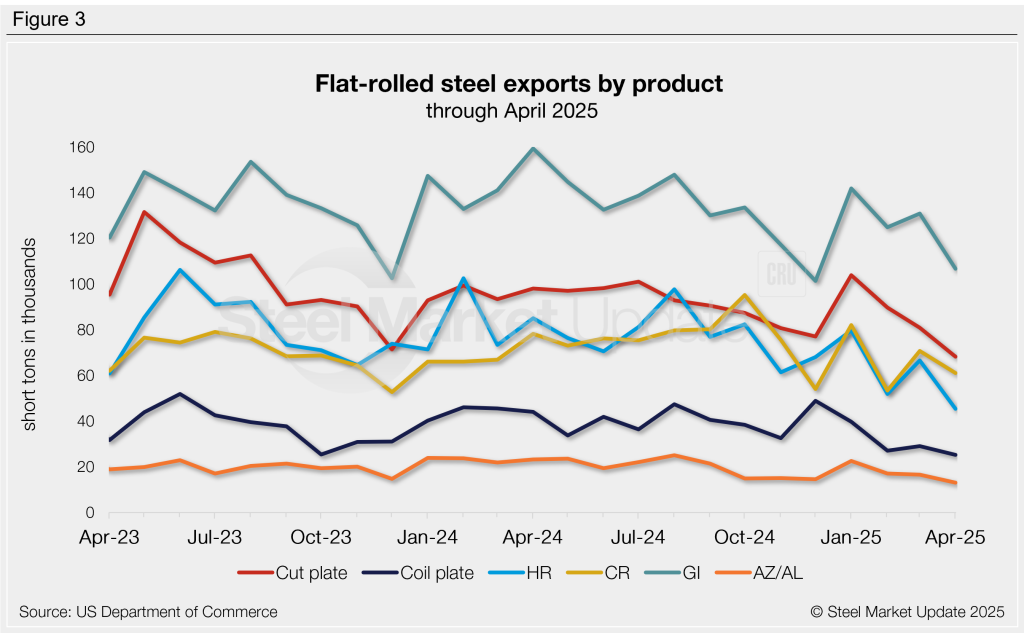

All six of the flat-rolled steel products we monitor saw reduced exports from March to April. Some were down as much as 47% from levels seen one year ago, and all were beneath their respective 3MMA and 12MMA rates. Significant movements from March to April include:

- Plate-cut-length exports fell 16% m/m to a near five-year low.

- Coiled plate exports declined 13% to a two-year low.

- Hot-rolled sheet exports slipped 32% to a two-year low.

- Cold-rolled exports fell 14%, the third-lowest monthly rate seen over the last year.

- Galvanized sheet exports fell 18%, one of the lowest levels of the past three years.

- Other-metallic coated exports dropped 21%, the lowest since May 2020.

SMU members can view historical steel trade data on the Steel Exports page of our website.