Market Data

July 8, 2025

SMU Price Ranges: Sheet, plate slip as lift from S232 ebbs

Written by Brett Linton & Michael Cowden

Sheet and plate prices fell this week on so-so demand, sideways scrap prices, and chatter that certain mills were making unsolicited calls looking for tons.

But customers continued to buy mostly hand-to-mouth amid continued uncertainty around demand and the longer-term impact of President Trump’s tariffs.

Some sources noted lower inventories and lower import volumes, trends they said should give mills more leverage.

Others noted that lead times remained short and that new capacity continues to ramp up, trends they said more than offset lower inventories.

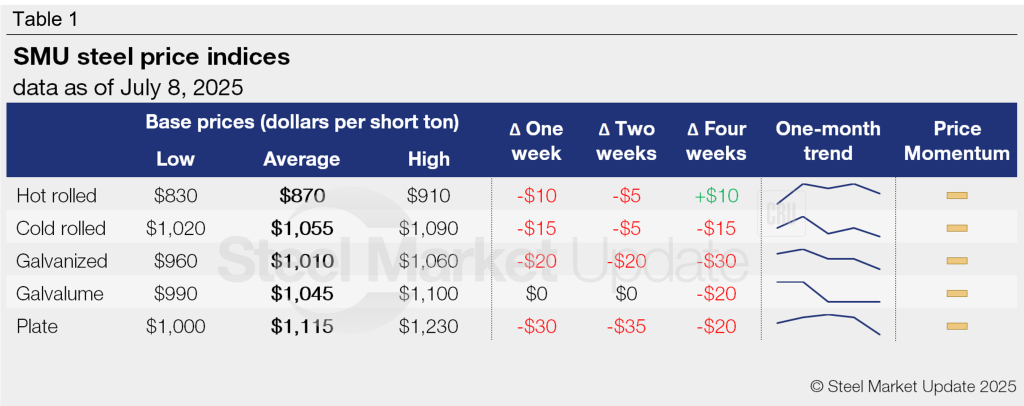

SMU’s hot-rolled (HR) coil price slipped to $870 per short ton (st) on average, down $10/st from last week. Cold-rolled prices dipped $15/st to $1,055/st. Galvanized prices lost $20/st to settle at $1,010/st on average. And Galvalume prices held steady at $1,045/st.

Plate, meanwhile, dropped $30/st amid talk that some mills were offering substantial discounts to list prices.

Broadly speaking, market participants agreed that the boost to June prices provided by Section 232 tariffs doubling to 50% had passed. SMU’s price momentum indicators remain at neutral until the market establishes a clear direction.

SMU’s price momentum indicator remains at neutral for all sheet and plate products, signaling that we see no clear direction for prices over the next 30 days.

Refer to Table 1 (click to enlarge) for our latest price indices and trends.

Hot-rolled coil

The SMU price range is $830-910/st, averaging $870/st FOB mill, east of the Rockies. Our entire range shifted $10/st lower w/w. Our price momentum indicator for hot-rolled steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Hot rolled lead times range from 3-6 weeks, averaging 4.4 weeks as of our June 26 market survey. We will publish updated lead times this Thursday.

Cold-rolled coil

The SMU price range is $1,020–1,090/st, averaging $1,055/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, while the top end is down $10/st. Our overall average is down $15/st w/w. Our price momentum indicator for cold-rolled remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 4-9 weeks, averaging 6.3 weeks through our latest survey.

Galvanized coil

The SMU price range is $960–1,060/st, averaging $1,010/st FOB mill, east of the Rockies. The lower end of our range down $40/st w/w, while the top end is unchanged. Our overall average is down $20/st w/w. Our price momentum indicator for galvanized steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $1,038–1,138/st, averaging $1,088/st FOB mill, east of the Rockies.

Galvanized lead times range from 4-8 weeks, averaging 6.0 weeks through our latest survey.

Galvalume coil

The SMU price range is $990–1,100/st, averaging $1,045/st FOB mill, east of the Rockies. The lower end of our range is down $10/st w/w, while the top end is up $10/st. Our overall average is unchanged w/w. Our price momentum indicator for Galvalume steel remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,258–1,368/st, averaging $1,313/st FOB mill, east of the Rockies.

Galvalume lead times range from 4-8 weeks, averaging 6.2 weeks through our latest survey.

Plate

The SMU price range is $1,000–1,230/st, averaging $1,115/st FOB mill. The lower end of our range is down $40/st w/w, while the top end is down $20/st. Our overall average is down $30/st w/w. Our price momentum indicator for plate remains at neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 4-8 weeks, averaging 5.6 weeks through our latest survey.

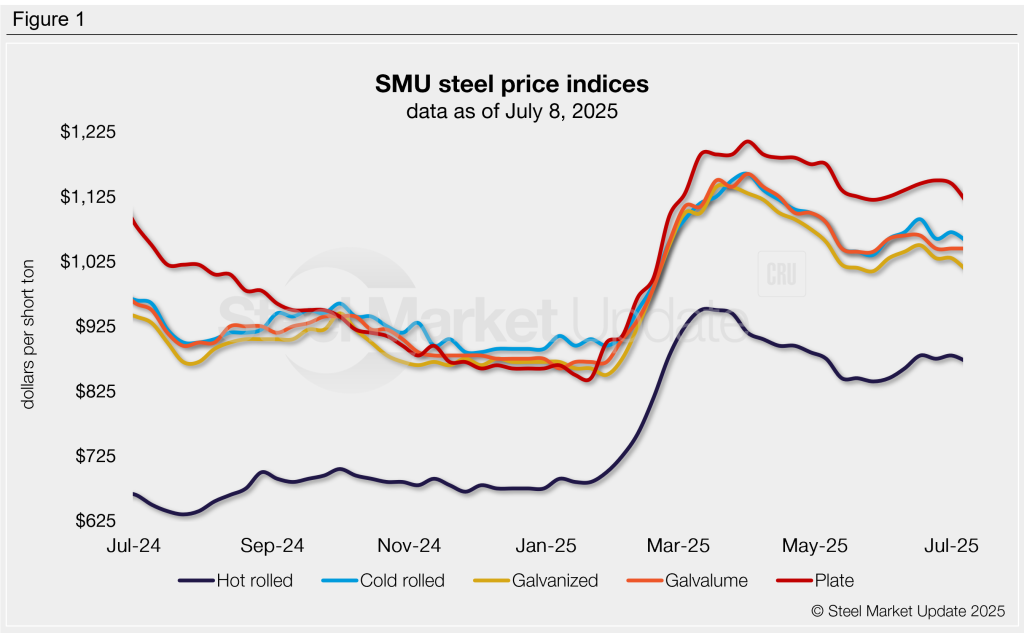

SMU note: Above is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is also available on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton