Analysis

July 11, 2025

SMU Survey: Sentiment splits, buyers have better view of future than the present

Written by Brett Linton

SMU’s Steel Buyers’ Sentiment Indices moved in opposite directions this week. After rebounding from a near five-year low in late June, Current Sentiment slipped again. At the same time, Future Sentiment climbed to a four-month high. Both indices continue to show optimism among buyers about their company’s chances for success, but suggest there is less confidence in that optimism than earlier in the year.

Every two weeks, we poll thousands of industry executives asking how they rate their company’s chances of success today, as well as three to six months down the road. This data is used to calculate our Current and Future Steel Buyers’ Sentiment Indices, metrics we have tracked since SMU’s inception.

Current Sentiment

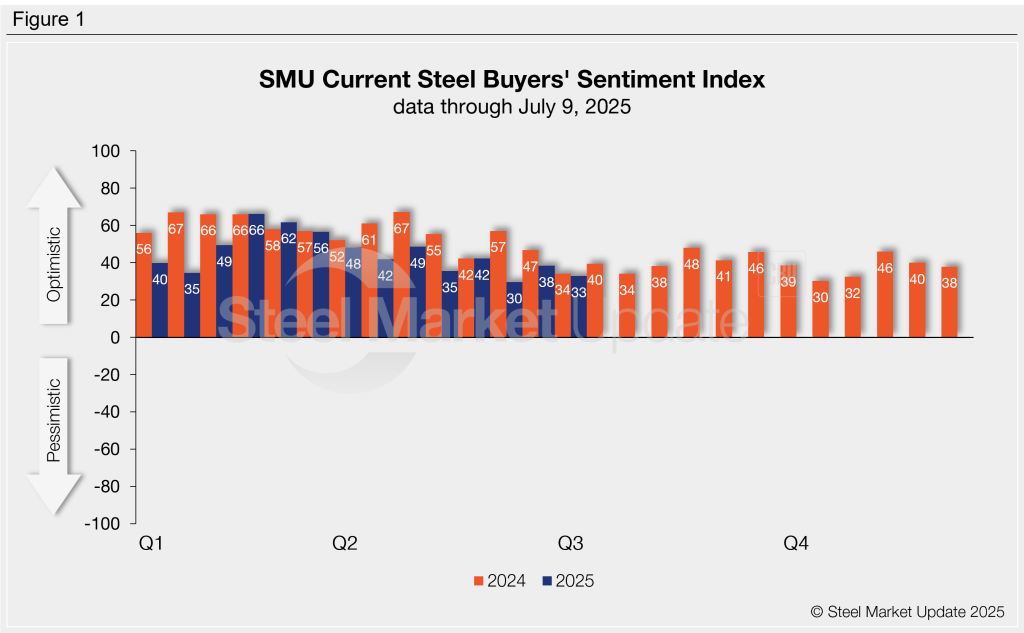

SMU’s Current Buyers’ Sentiment Index fell five points this week to +33, the second lowest reading in the past eight months (Figure 1). At this time last year, it was just one point higher at +34. Buyers’ Sentiment has been trending lower since peaking in February, and, since March, has consistently held at or below year-ago levels. Sentiment has averaged +45 across the first half of 2025.

Future Sentiment

Future Sentiment increased five points to +58, the highest level since March (Figure 2). After trending downward through the first five months of the year, this index hit a near-three-year low of +46 in May. Future Sentiment has shown modest improvement in the last two months, but has remained at or below 2024 levels since March. Future Sentiment has averaged +57 so far this year and was slightly higher one year ago at +61.

What SMU survey respondents had to say:

“We are optimistic that our business model will result in increased revenue.”

“Rough on the price side as everyone is ‘racing to the bottom’ and not passing through cost increases fully.”

“Awful, Section 232 tariffs.”

“We will miss our annual forecast for sure.”

“Our Q3/Q4 outlook is showing some signs of improvement over Q2.”

“Hard to be hopeful with trade policy by whim of one guy who thinks he knows better than everyone else.”

“We are hoping we see a rate cut in late summer, fingers crossed!”

Sentiment trends

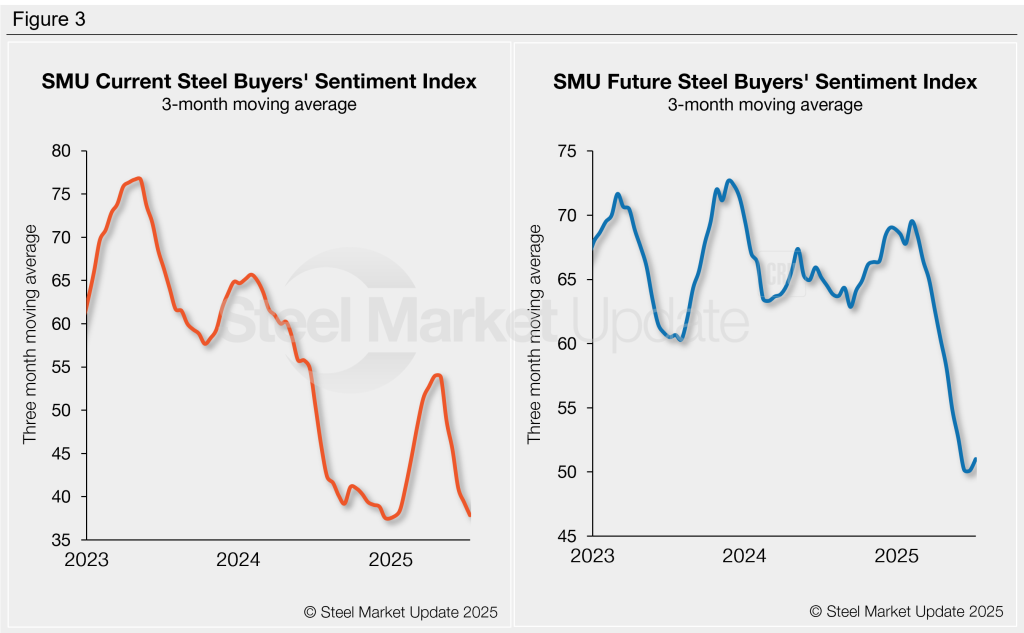

On a three-month moving average (3MMA) basis, Current Sentiment declined for the sixth consecutive survey, while Future Sentiment reversed direction and moved higher.

The Current Sentiment 3MMA eased this week to a six-month low of +37.85 (Figure 3, left). That’s just above the lowest post-Covid reading of +37.51 in December 2024. Recall that back in mid-April, the 3MMA had reached a nine-month high of +53.97 after trending upwards since the beginning of the year.

Following ten consecutive declines, the Future Sentiment 3MMA ticked higher this week to +51.00. This recovery comes just two weeks after the Future 3MMA fell to +50.11, the lowest measure seen in over four years (Figure 3, right).

About the SMU Steel Buyers’ Sentiment Index

The SMU Steel Buyers Sentiment Index measures the attitude of buyers and sellers of flat-rolled steel products in North America. It is a proprietary product developed by Steel Market Update for the North American steel industry. Tracking steel buyers’ sentiment is helpful in predicting their future behavior. A link to our methodology can be found here. If you would like to participate in our survey, please contact us at info@steelmarketupdate.com.