Analysis

September 4, 2025

SMU Survey: Most buyers say mills remain negotiable on prices

Written by Brett Linton

The majority of steel buyers responding to this week’s market survey continue to report that mills are open to negotiating spot prices on sheet and plate products.

Every other week, SMU polls thousands of buyers to ask if domestic mills are willing to negotiate on new spot order pricing. This week, 94% of respondents said mills were willing to talk price to secure an order. This is six percentage points higher than our previous survey, just 1 point shy of the highest rate seen in our 13-year data history (Figure 1).

Earlier this year, in February and March, mills briefly held the pricing power as tariff headlines drove prices higher. This advantage shifted to buyers throughout April and May and has mostly held there since. The only notable exception was in mid-June, when renewed tariff headlines briefly allowed mills to adopt a slightly firmer pricing stance.

Negotiation rates by product

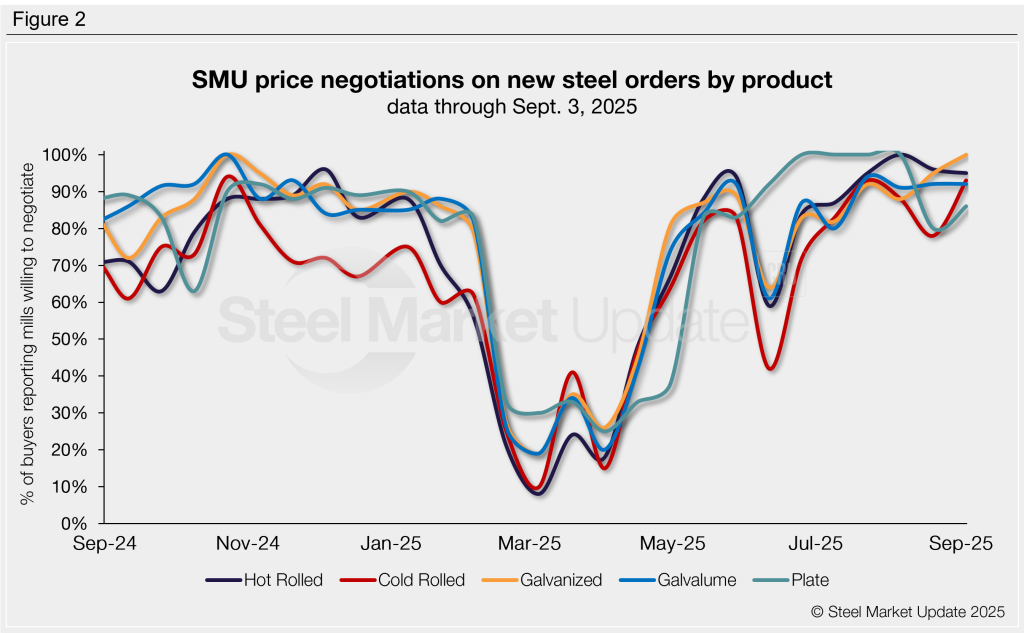

Negotiation rates rose this week for three of the five products we track, remaining high across the board (Figure 2). Current rates are:

- Hot rolled: 95% of buyers said mills are negotiable on price, down one percentage point from two weeks ago.

- Cold rolled: 93%, up 15 points to a 10-month high.

- Galvanized: 100%, up five points to a 10-month high.

- Galvalume: 92%, unchanged.

- Plate: 86%, up six points.

Steel buyer remarks:

“Tons talk right now. The higher HRC volume brought to the table, the closer prices get to $700/st.”

“Negotiable on galvanized, but they want volume and the discount is minimal.”

“Depends on the mill.”

“[Negotiable on plate] with tons of course.”

“Everything depends on tonnage.”

“Only a few mills will negotiate [on hot rolled].”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.