Overseas

September 19, 2025

Price gap between US CR, most imports narrows

Written by David Schollaert

Cold-rolled (CR) coil prices ticked up in the US this week, matching a similar trend seen in offshore markets as well.

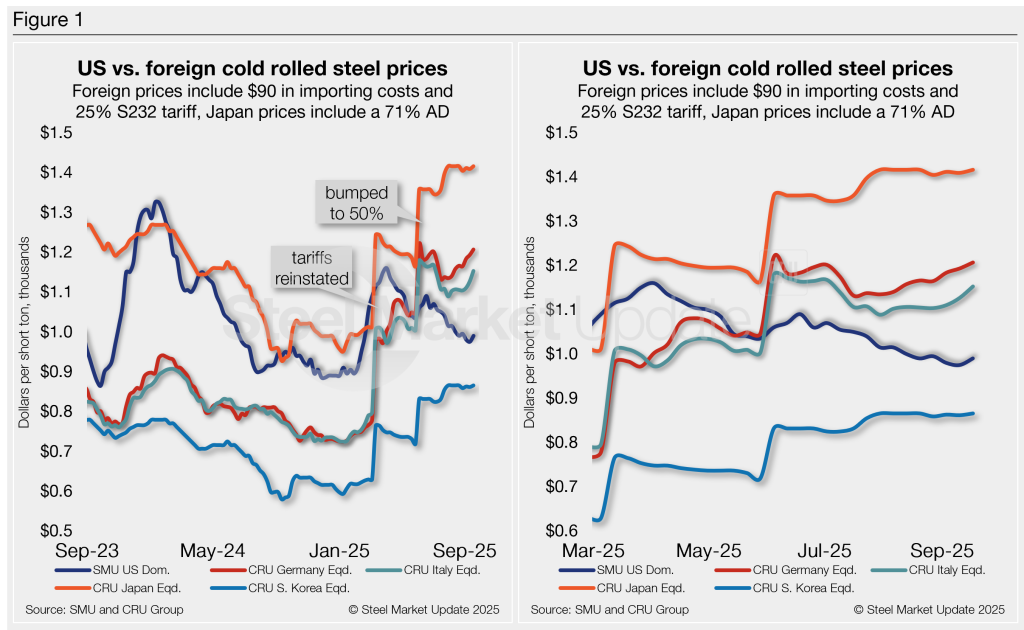

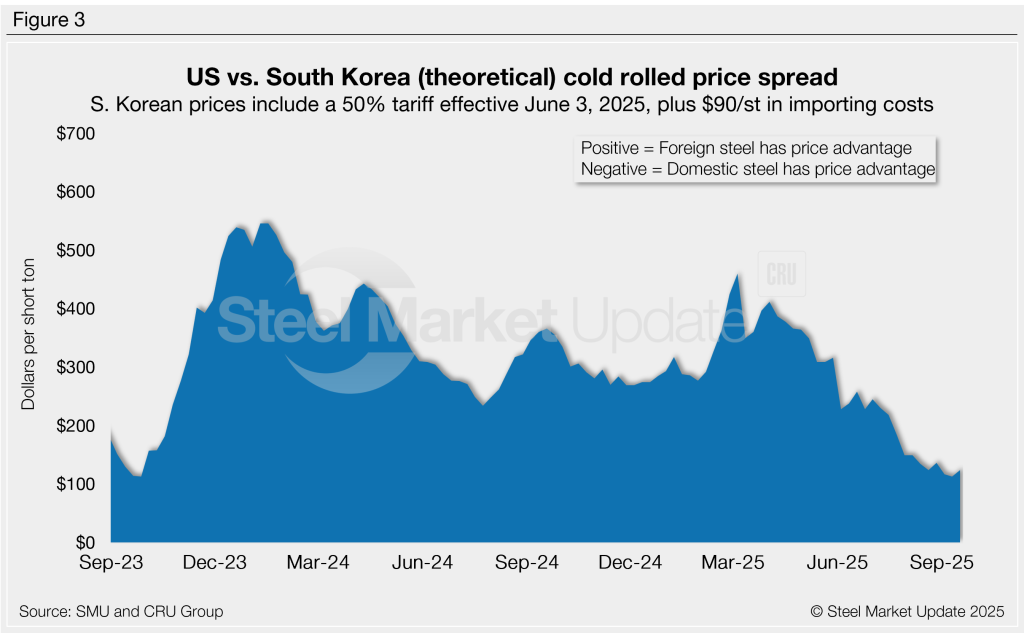

CR imports from Germany, Italy, and Japan on a landed basis remain much more expensive than domestic product. But South Korean imports remain competitive, in theory, even with the 50% Section 232 tariff.

By the numbers

In our market check on Tuesday, Sept. 16, US CR coil prices averaged $990 per short ton (st), up $15/st from the previous week.

Domestic CR prices are now, theoretically, 16.8% cheaper than imports on a landed basis, tightening slightly from a 17.4% gap the week prior.

In dollar-per-ton terms, US CR is, on average, $171/st cheaper than offshore product (see Figure 1).

If South Korean CR prices weren’t at a discount to US prices, stateside product would be roughly 27% cheaper than imports. As noted above, German, Italian, and Japanese CR are at a significant premium to US cold rolled on a landed basis.

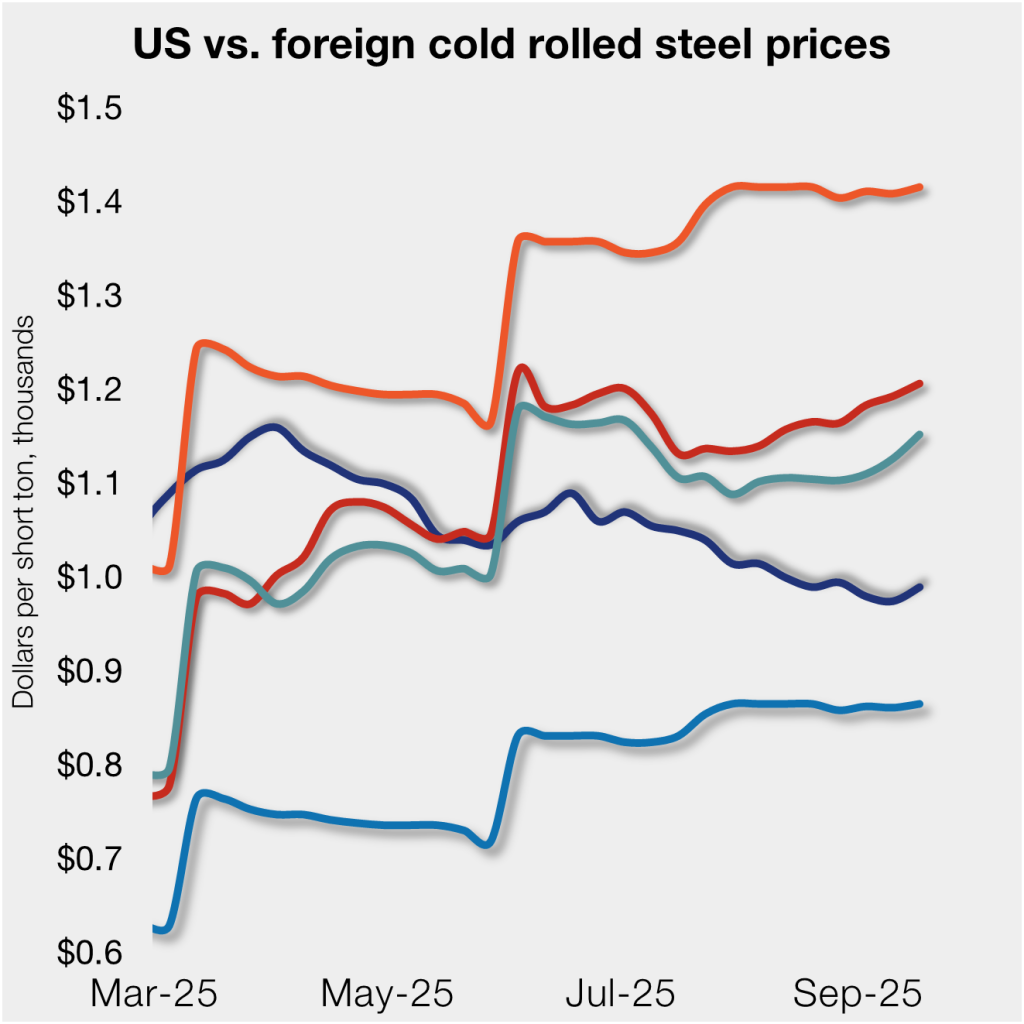

The charts below compare CR coil prices in the US, Germany, Italy, South Korea, and Japan. The left side shows prices over the last two years, and the right side zooms in to highlight more recent trends.

Methodology

SMU calculates the theoretical price difference between domestic and imported cold-rolled (CR) steel by comparing our US CR price (FOB domestic mills) with CRU’s indices (DDP US ports) for Germany, Italy, and East Asia (Japan and South Korea). This is an estimate, and actual import costs vary.

To approximate the cost of foreign steel delivered to US ports, SMU adds $90/st to foreign prices to cover freight, handling, and trader margins. This benchmark can be adjusted based on individual shipping costs. (If you import steel and have insights on these costs, you can contact the author at david@steelmarketupdate.com.)

East Asian CR coil

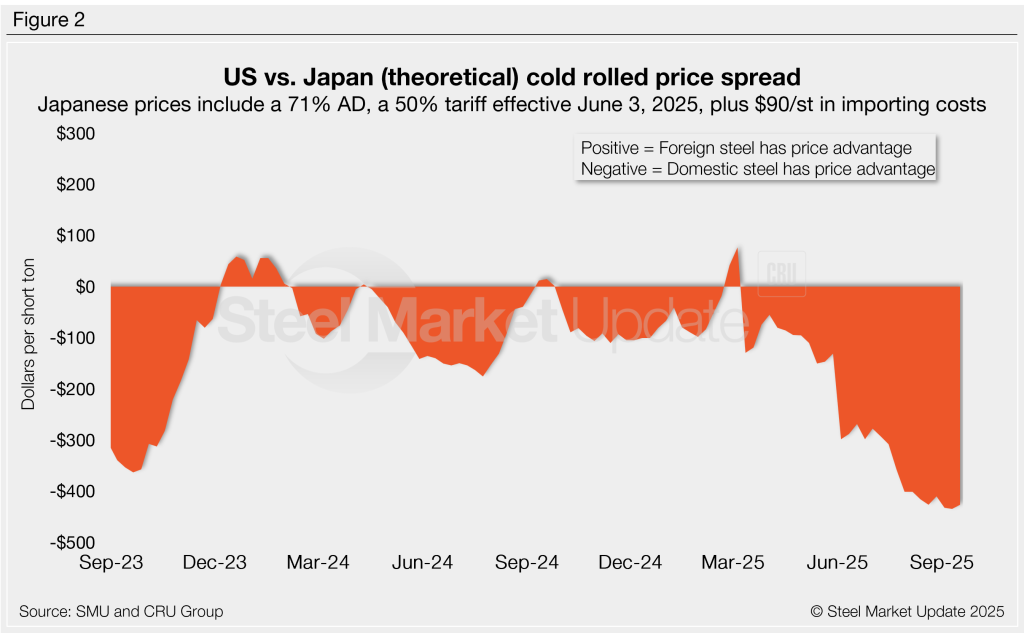

As of Thursday, Sept. 18, the CRU Asian CR price stood at $517/st, up $3/st week over week (w/w). Factoring in a 71% anti-dumping duty (Japan, theoretical), a 50% S232 tariff, and $90/st in estimated import costs, the delivered price to the US is $1,416/st. The theoretical landed price of South Korean CR exported to the US is $866/st.

With the latest SMU CR price up $15/st to an average of $990/st, US-produced CR is now theoretically $426/st below CR from Japan but $124/st above CR from South Korea.

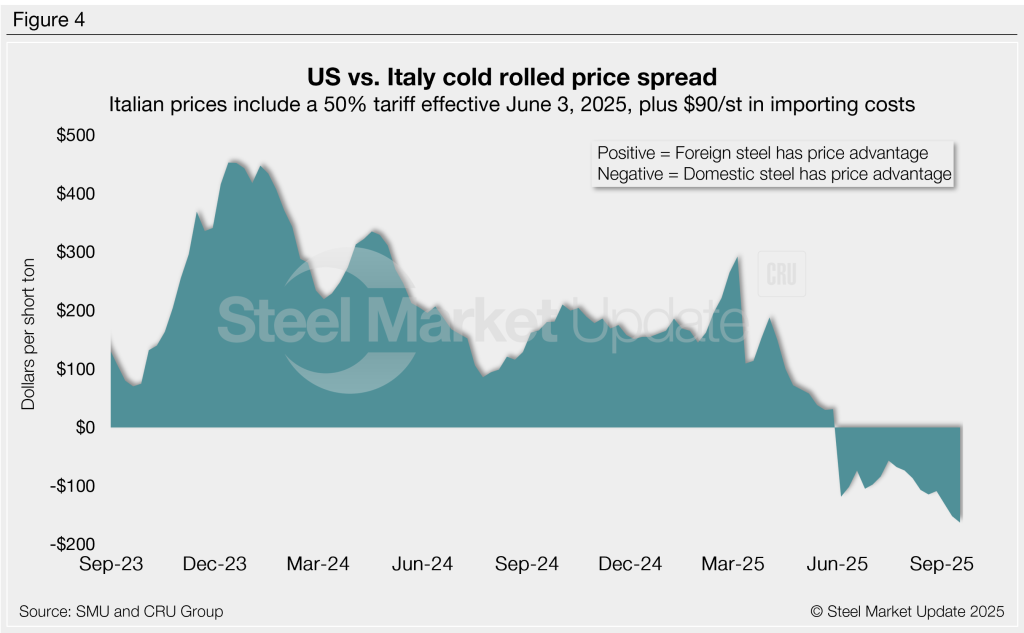

Italian CR coil

Italian CR prices were $18/st higher this week at $709/st. After adding import costs and a 50% tariff, the price of Italian CR delivered to the US is, in theory, $1,153/st. That means domestic CR is theoretically $163/st cheaper than CR coil imported from Italy.

German CR coil

CRU’s German CR price was up $9/st vs. the previous week. After adding import costs and a 50% tariff, the delivered price of German CR is, in theory, $1,207/st. The result: Domestic CR is theoretically $217/st cheaper than CR imported from Germany.

Editor’s note

We reference domestic prices as FOB the producing mill, while foreign prices are CIF the port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight from either a domestic mill or a port is important to keep in mind when deciding where to source from. It’s also important to factor in lead times. In most market cycles, domestic steel will deliver more quickly than foreign steel. Note also that, on March 12, 2025, undiluted Section 232 tariffs were reinstated on steel imports. Section 232 tariffs were then doubled to 50% on June 3, 2025. Therefore, the price comparisons for Japan, South Korea, Germany, and Italy in this analysis now include a 50% tariff.