Market Data

September 30, 2025

SMU Price Ranges: A newsy week sees modest price gains despite a quiet spot market

Written by Brett Linton & Michael Cowden

Sheet and plate prices were mixed this week as industry sources weighed the impact of several important news developments in the market.

Among them were Canadian steel producer Algoma Steel Inc. officially announcing its exit (at least for now) from the US market, domestic plate mills rolling out price increases of $60 per short ton (st), and the final injury determination in the coated trade case.

Several market participants predicted that prices should be at or near a bottom. But while most seemed to agree on that point, many also said they saw little upside given a quiet spot market and ongoing concerns about demand.

Sheet prices mixed

On the hot-rolled (HR) coil side, SMU’s price stands at $795/st on average. That’s up $10/st from last week and marks the first gain for HR prices since early July – when President Trump’s increasing of Section 232 tariffs to 50% briefly led prices higher. SMU’s average cold-rolled coil price also tracked higher. It is now at $995/st, up $5/st from last week.

Several market participants said Algoma’s exit from the States had provided at least a temporary opportunity to firm prices. That’s because some buyers who had relied on the Canadian mill had to turn to US suppliers.

But not all sheet prices rose. On the coated front, SMU’s base price for galvanized product slipped to $945/st, down $10/st from a week ago. The market showed no immediate price reaction to an International Trade Commission (ITC) decision that resulted in the Commerce Department issuing duties on imports from 10 countries.

And, in the meantime, the wide spread between HR-base galv prices and CR-base galv prices continued to drag our overall average lower. Our Galvalume price remained unchanged at $960/st on average.

Plate ticks higher

SMU’s plate price stands at $975/st on average, up $10/st from last week. The modest gain came following a wave of $60/st price hikes from domestic mills. It was too early to tell on Tuesday evening whether the price increases would stick. In plate, as in HR, news of Algoma’s exit from the US market was offset in part by ongoing demand concerns.

Momentum shifts – at least for now

SMU has shifted its sheet and plate momentum indicators from lower to neutral. We had been at lower for six weeks.

SMU made the move based on Algoma’s decision to exit the States for now, the coated trade case landing in favor of domestic mills, and the plate price hikes. We note, however, that in a stronger market, such events would probably have led to sharply higher prices.

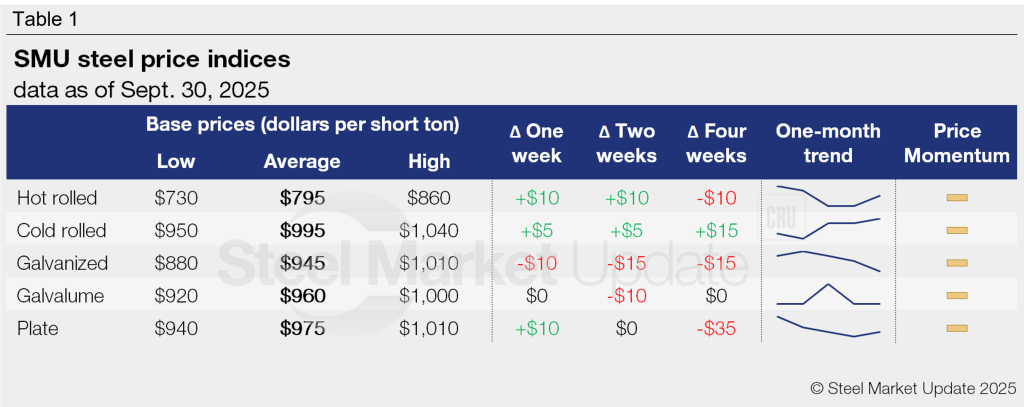

Refer to Table 1 (click to enlarge) for our latest price indices and trends.

Hot-rolled coil

The SMU price range is $730–860/st, averaging $795/st FOB mill, east of the Rockies. The lower end of our range is unchanged w/w, while the top end is up $20/st. Our overall average is up $10/st w/w. Our price momentum indicator for HR steel has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

HR lead times range from 3 to 6 weeks, averaging 4.6 weeks as of our Sept. 18 market survey. We will publish updated lead times this Thursday.

Cold-rolled coil

The SMU price range is $950–1,040/st, averaging $995/st FOB mill, east of the Rockies. The lower end of our range is up $10/st w/w, while the top end is unchanged. Our overall average is up $5/st w/w. Our price momentum indicator for cold rolled has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Cold rolled lead times range from 5 to 8 weeks, averaging 6.4 weeks through our latest survey.

Galvanized coil

The SMU price range is $880–1,010/st, averaging $945/st FOB mill, east of the Rockies. The lower end of our range is down $20/st w/w, while the top end is unchanged. Our overall average is down $10/st w/w. Our price momentum indicator for galvanized steel has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Galvanized .060” G90 benchmark: SMU price range is $958–1,088/st, averaging $1,023/st FOB mill, east of the Rockies.

Galvanized lead times range from 5 to 8 weeks, averaging 6.4 weeks through our latest survey.

Galvalume coil

The SMU price range is $920–1,000/st, averaging $960/st FOB mill, east of the Rockies. Our entire range is unchanged w/w. Our price momentum indicator for Galvalume steel has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Galvalume .0142” AZ50, grade 80 benchmark: SMU price range is $1,274–1,354/st, averaging $1,314/st FOB mill, east of the Rockies.

Galvalume lead times range from 5 to 8 weeks, averaging 6.9 weeks through our latest survey.

Plate

The SMU price range is $940–1,010/st, averaging $975/st FOB mill. Our entire range shifted $10/st higher w/w. Our price momentum indicator for plate has been adjusted to neutral, meaning we see no clear direction for prices over the next 30 days.

Plate lead times range from 3 to 7 weeks, averaging 5.1 weeks through our latest survey.

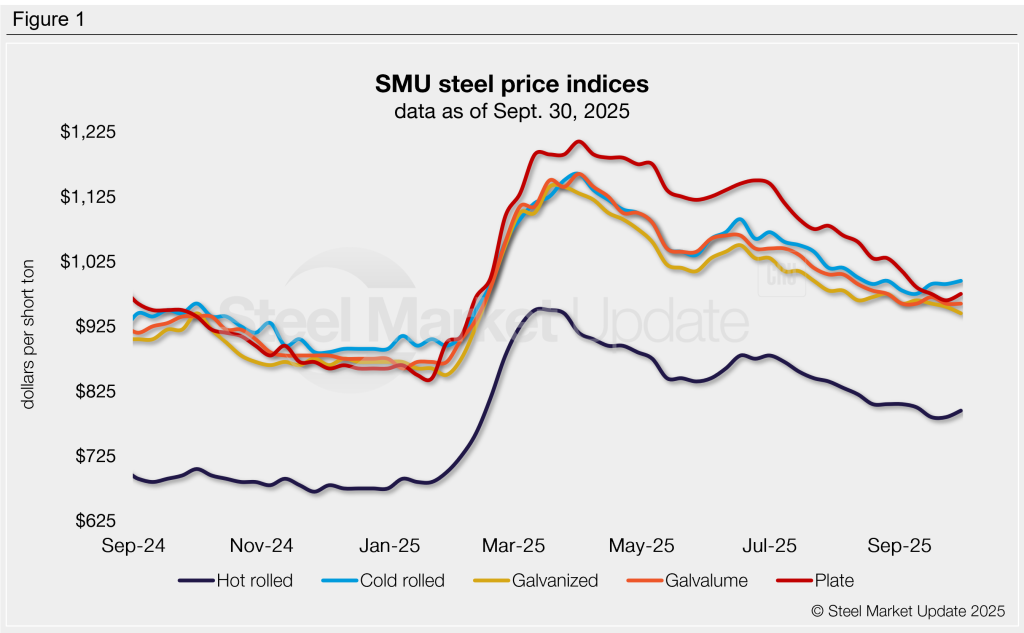

SMU note: The graphic above shows a history of our hot rolled, cold rolled, galvanized, Galvalume, and plate prices. This data is also available on our website with our interactive pricing tool. If you need help navigating the site or logging in, contact us at info@steelmarketupdate.com.

Brett Linton

Read more from Brett Linton