Market Data

October 2, 2025

SMU Survey: Most buyers still report high mill negotiation rates

Written by Brett Linton

Steel buyers say mills remain slightly more willing to negotiate spot prices for sheet and plate products than they were mid-September, according to our latest market survey.

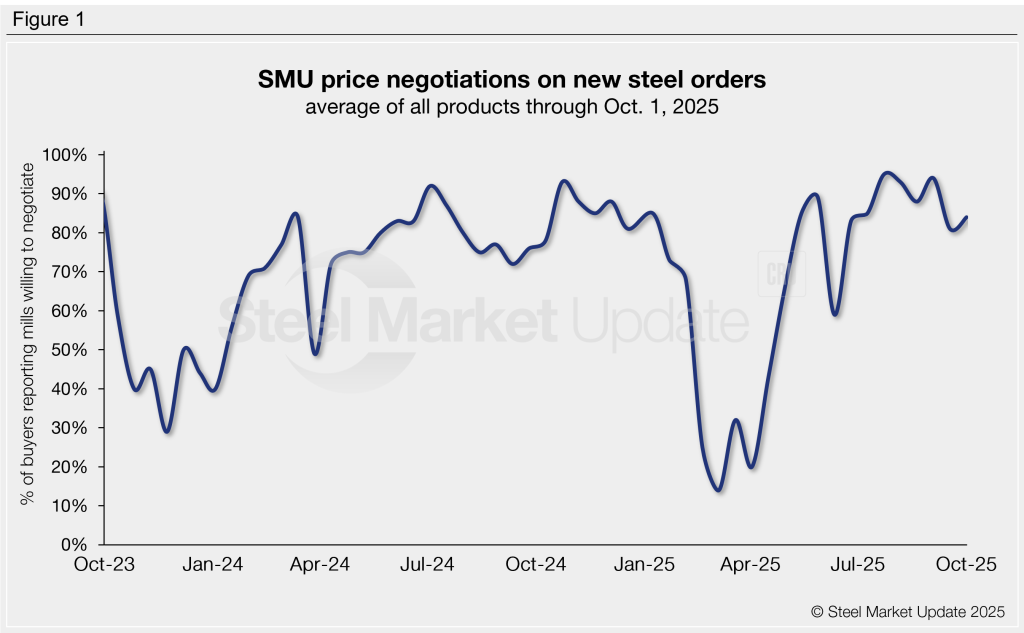

SMU polls hundreds of steel buyers at service centers and manufacturing companies every other week to see if domestic mills are willing to negotiate prices for new spot orders. This week, 84% of respondents said mills were open to talking price to secure an order. This is up three points from our previous survey, which had marked the lowest rate since June (Figure 1).

In February and March, mills briefly held the pricing power as tariff headlines drove prices higher. That leverage shifted back to buyers in April and May and has mostly stayed there since, apart from a short-lived rebound in June when renewed tariff headlines briefly allowed mills to adopt a slightly firmer pricing stance.

Negotiation rates higher on sheet than plate

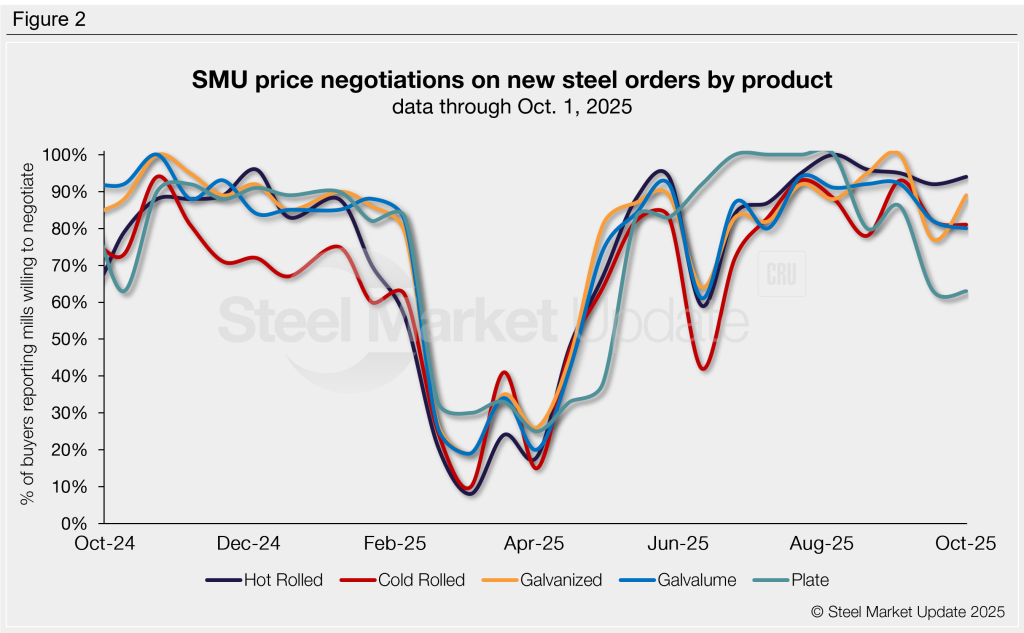

Of the five products we tracked, two saw higher negotiation rates this week, two moved lower, and one was unchanged. Sheet product prices remain slightly more negotiable than plate (Figure 2). Current rates are:

- Hot rolled: 94% of buyers said mills are negotiable on price, up two points from mid-September.

- Cold rolled: 81%, down one point to a six-week low.

- Galvanized: 89%, up 12 points.

- Galvalume: 80%, down two points to a three-month low.

- Plate: 63%, unchanged, holding at a five-month low.

Buyer remarks:

“Mills will negotiate [on hot rolled and galvanized], but you’d better bring tons or else you are not getting the deal.”

“Some mills are still willing to talk price.”

“Negotiable [on galvanized] but some mills are starting to move out lead times due to planned outages.”

“Negotiable on plate with tons.”

Note: SMU surveys active steel buyers every other week to gauge their steel suppliers’ willingness to negotiate new order prices. The results reflect current steel demand and changing spot pricing trends. Visit our website to see an interactive history of our steel mill negotiations data.