Analysis

October 2, 2025

SMU Survey: Sheet and plate lead times stabilize

Written by Brett Linton

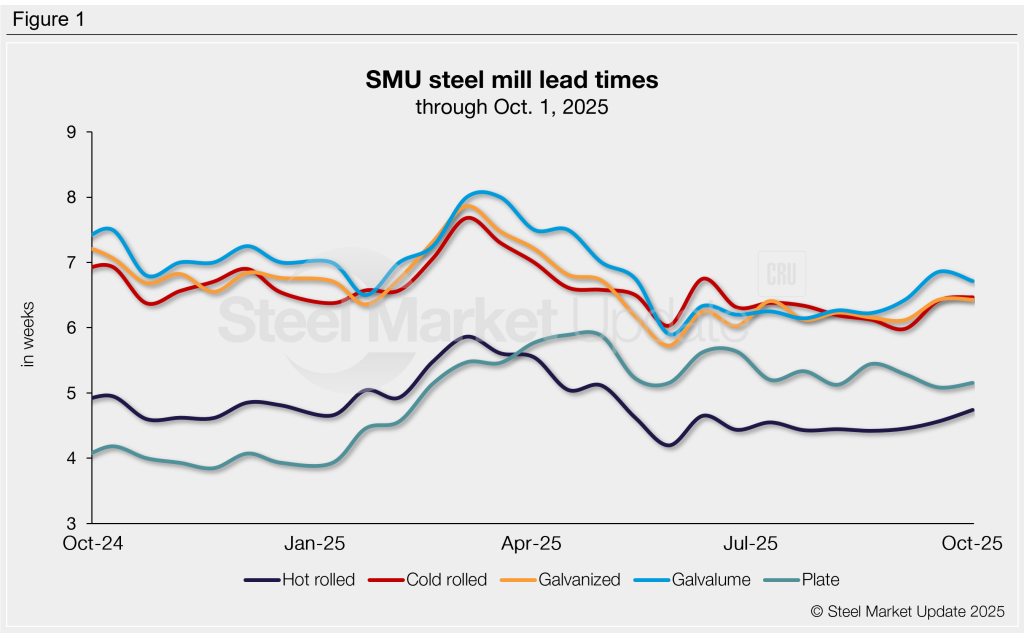

Sheet and plate lead times saw minor shifts this week, according to SMU’s latest market survey. Lead times for sheet products have inched higher over the last month, but, as they have since May, remain within days of multi-year lows. Plate lead times have bobbed within a tight range for months, hovering roughly a week longer than this time last year.

The average lead time for hot-rolled coil is just over 4.5 weeks. Cold-rolled and coated product lead times are all around 6.5 weeks. Plate’s average lead time is just over 5 weeks.

Table 1 summarizes current lead times and recent changes by product (click to expand).

Compared to our mid-September market check, three of our lead time ranges shifted this week:

- The shortest cold rolled lead time considered decreased from five weeks to four.

- The shortest galvanized lead time considered also decreased from five weeks to four.

- The shortest plate lead time considered increased from three weeks to four.

Buyer predictions

The majority (62%) of buyers expect lead times to hold steady through the next two months, similar to our past three surveys. A third (33%) foresee longer lead times in the near future, a rate that has steadily grown across the last few months. The remaining 5% anticipate contractions, similar to previous expectations.

Here are some of the comments we collected:

“Lead times are moving out fast. Some have sat on the sideline too long… it is showing in the day-to-day transactional spot market.”

“Once a bottom in price is reached, the ‘herd’ will rush in to place orders, pushing lead times out.”

“After extending in the current environment, we would see them as flattening out.”

“They cannot get much shorter. Mill outages should push lead times out a few weeks in mid-November, maybe sooner.”

“We will not recover without government policies that stimulate the business climate to recover.”

“Shortening, we have major supply > demand concerns heading into 2026.”

Trends

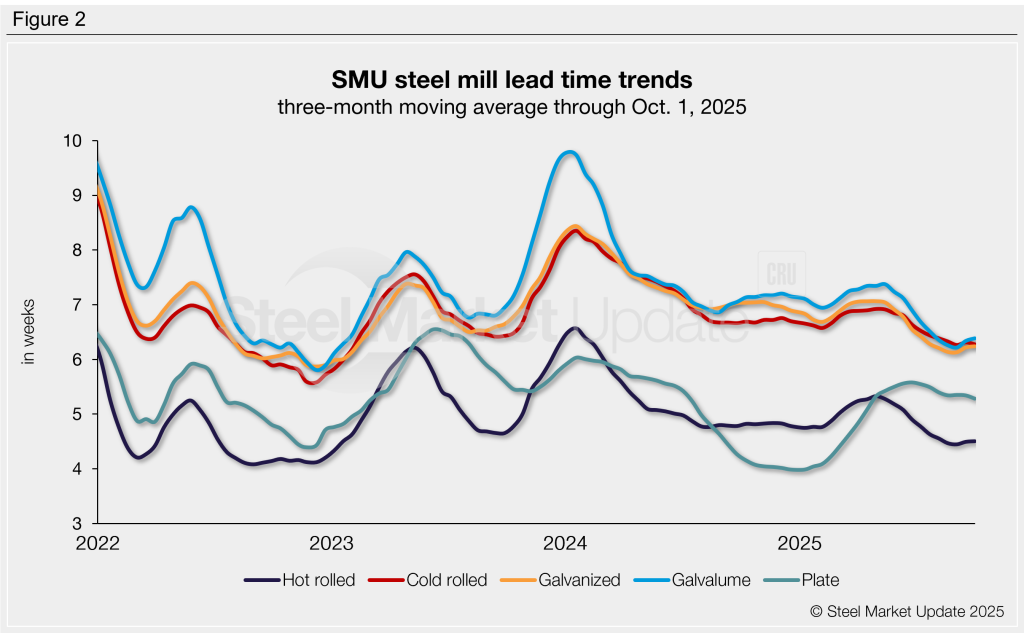

To highlight broader trends, lead times can be calculated on a three-month moving average (3MMA) basis (Figure 2). Four of the five 3MMAs were unchanged this week compared to mid-September; only Galvalume extended slightly. Overall, 3MMA lead times are trending higher following their lows in early September.

Average lead times by product across the past three months were: hot rolled at 4.5 weeks, cold rolled at 6.3 weeks, galvanized at 6.2 weeks, Galvalume at 6.4 weeks, and plate at 5.3 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers participating in this week’s SMU market trends analysis survey. SMU measures lead times as the time it takes from when an order is placed with the mill to when it is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Consult your mill rep for actual lead times. To see an interactive history of our steel mill lead times data, visit our website. If you’d like to participate in our survey, contact us at info@steelmarketupdate.com.