AMU: Does the US-EU trade deal shift attention to Mexico or Canada?

On Thursday, the U.S. and EU agreed to more concrete terms to their handshake deal of last month.

On Thursday, the U.S. and EU agreed to more concrete terms to their handshake deal of last month.

Domestic sheet prices in the US remained under pressure, limiting interest in imports, while domestic prices for longs products continued to rise.

SMU’s Steel Buyers’ Sentiment Indices moved in opposing directions this week. Our Current Steel Buyers’ Sentiment Index dropped to one of the lowest levels recorded in over five years, while Future Buyers’ Sentiment inched higher.

SMU’s latest steel buyers market survey results are now available on our website to all premium members. After logging in at steelmarketupdate.com, visit the pricing and analysis tab and look under the “survey results” section for “latest survey results.” Past survey results are also available under that selection. If you need help accessing the survey results, or if […]

With SMU Steel Summit starting in just a few days, I decided to go back and do a quick check on where things stand now compared to the week before Summit last year.

Steel buyers report steady lead times for sheet and plate products, a soft-sideways trend we've seen since May.

The majority of steel buyers responding to our market survey this week continue to say that mills are negotiable on new spot order prices. Negotiation rates have remained high since May.

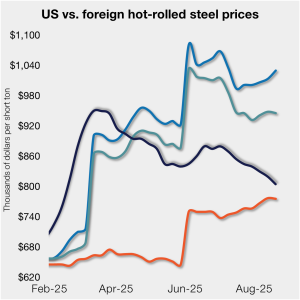

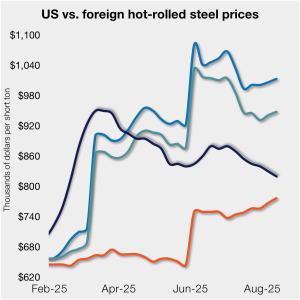

HRC prices in the US eroded further last week, while offshore prices varied week over week (w/w), widening the price margin between stateside and foreign product.

Is a pattern finally emerging in the post-Liberation Day tariff landscape?

Sheet and plate prices were flat or lower again this week on continued concerns about demand and higher production rates among US mills.

SMU’s Mill Order Index (MOI) moved higher in July after rebounding the month prior. The shift comes after mill orders declined from March through May.

Prices remain subdued in US pig iron market, sources said.

Don't be puzzled. Solve our crossword, and get ready for Steel Summit 2025!

With so much happening in the news cycle, we want to make it easier for you to keep track of it all. Here are highlights of what’s happened this week and a few things to keep an eye on.

While boarding Airforce One on Friday, US President Donald Trump stated that he would be setting more steel tariffs and putting ~100% tariffs on semiconductors and chips.

Cleveland-Cliffs Inc. has reportedly signed "unusually long" fixed-price supply agreements with multiple US automakers.

U.S. Steel, Allegheny County executive Sara Innamorato, and Pennsylvania Gov. Josh Shapiro clarified details from early reports about the Clairton Coke Works facility explosion just one day earlier.

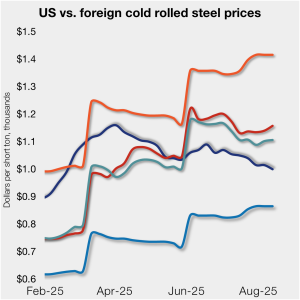

Cold-rolled (CR) coil prices continued to decline in the US this week, while prices in offshore markets diverged and ticked higher.

The CRUmpi rose by 0.8% month over month (m/m) to 286.1 in August, following four consecutive months of decline. Scrap prices showed mixed trends across major regions, largely influenced by local supply-and-demand dynamics, government policies, and the relative strength of finished steel markets. US prices were stable while Europe and Asia saw price increases, but […]

Reporting and enforcing steel tariffs are two top–of-mind concerns for US manufacturers, the US Customs and Border Protection agency, importers, and others across the supply chain.

Hardly a day goes by without someone writing about the expected rise in US electricity demand. This demand is largely driven by data center and AI’s appetite for power.

In July, US service centers’ flat-rolled steel supply increased month on month, following the seasonal summer trend of inventory build with slowing shipments.

We're getting ready to initiate the 10-day countdown until Steel Summit 2025 in Atlanta. Liftoff is on Aug. 25, and the conference goes through Aug. 27. With the speed at which things have moved this year, it will be great to take a breath and reflect on what's happened so far.

Market participants said they have high hopes that the stable hot-rolled spot market will improve as the year rolls on.

On Monday and Tuesday of this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

Hot-rolled (HR) coil prices in the US declined again last week, while offshore prices ticked higher again week over week (w/w).

The price spread between prime scrap and hot-rolled coil (HRC) narrowed in August, according to SMU’s most recent pricing data.

The latest SMU Community Chat webinar reply featuring Lewis Leibowitz, trade attorney and SMU columnist, is now available on our website to all members.

Yesterday’s tragedy and loss of life at U.S. Steel’s Clairton Works is a stark reminder of how important safety in the workplace really is.

All five of SMU's steel sheet and plate price indices declined this week, falling to lows last seen in February.