SMU Price Ranges: Sheet and plate prices continue to grind higher

Flat-rolled steel prices inched upward again this week as mixed demand appeared to be offset by limited supplies.

Flat-rolled steel prices inched upward again this week as mixed demand appeared to be offset by limited supplies.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $970 per short ton, up $5/st from last week.

Participants in the hot- and cold-rolled coil markets said winter storms in the East and Midwest may disrupt weekly order volumes and prices.

All but one of the steelmaking raw materials we track increased in price over the last month

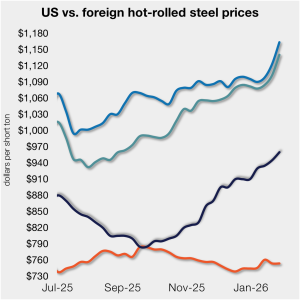

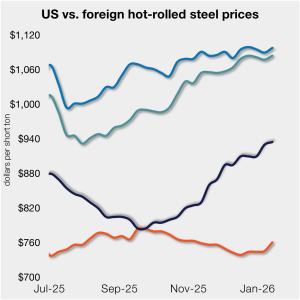

The price gap between US hot-rolled coil and landed offshore product inched higher, even as prices stateside and abroad mostly moved in tandem vs. last week.

SMU polled steel buyers on an array of topics earlier this week, ranging from market prices and demand, to inventories, imports, and evolving market events.

Sheet prices mostly continued their uneven but steady march higher this week, according to SMU’s latest check of the market.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $965 per short ton (st), up $5/st vs. the prior week.

A report on the sheet market this week.

Lower finished steel imports continued to support US domestic prices this month. HR coil prices are up more than $40 per metric ton (mt) month-on-month (m/m) due to higher seasonal demand in January and tightening domestic supply.

The plate market’s swell of optimistic sentiment marking the start of 2026 dissipated this week.

The price gap between US hot-rolled coil (HR) and landed offshore product has been relatively flat to begin the year.

Just over a third of the steel buyers who responded to our market survey this week reported that domestic mills are willing to talk price to secure new spot orders.

SMU’s sheet price indices climbed to new multi-month highs this week, while plate prices marginally declined.

Nucor’s consumer spot price (CSP) for hot-rolled coil increased to $960 per short ton (st), up $10/st vs. the prior week.

SSAB Americas, Nucor, and Oregon Steel Mills all announced higher plate prices on Friday.

Sheet prices are set to stay weak in China, hold steady in India, while they are set to rise in the EU and US due to protectionist limits on imports.

Though they’re hopeful, domestic sheet market sources didn’t share a bullish outlook on the market this week.

The opening weeks of 2026 are revealing a subtle but important change in the HRC futures market, as tightening physical conditions begin to exert greater influence over pricing dynamics.

Participants in the domestic steel plate market said they are maintaining strong order books, experiencing longer lead times, and finding mills are less open to negotiating prices.

The price spread between domestic hot-rolled coil and prime scrap widened for a fourth consecutive month in January, based on SMU’s most recent pricing data.

The majority of SMU’s sheet and plate price indices rose this week, with multiple products climbing to new multi-month highs

Ferrous scrap prices jumped on all the products SMU tracks in January, scrap sources said.

Nucor’s consumer spot price (CSP) for hot-rolled coil remains unchanged at $950 per short ton (st) for the fourth consecutive week.

Steel plate market participants think increasing spot prices and growing order volumes could stick around. That’s two encouraging signs for the year ahead, they said. Oregon Steel Mills, SSAB, and Nucor all increased base prices for plate products by $40 per short ton (st) in the final weeks of December. SMU data also indicates that mills […]

Sources in the domestic hot-rolled sheet market say they are standing by for an uptick in customer demand. These service center market participants, located in various regions of the US, expect to handle an influx of customer orders this month.

Steel sheet and plate prices rose across the board to start the year on limited spot availability at some mills, expectations of higher scrap prices, and hopes of stronger demand in 2026.

Nucor kept its consumer spot price (CSP) for hot-rolled coil unchanged at $950 per short ton (st) for a third week.

Oregon Steel Mills has joined other producers, announcing a price increase of at least $40 per short ton (st) for steel plate. The Portland, Ore.-based company told customers on Monday that the minimum increase was effective immediately with all new orders. It applies to all carbon, HSLA, hot-rolled coil, normalized, and quenched and tempered products, […]

Nucor kept its consumer spot price (CSP) for hot-rolled coil unchanged at $950 per short ton (st).