Nucor ups HR spot price by $5/ton

Nucor increased its weekly hot-rolled coil spot list price by $5 per short ton (st) on Monday, Nov. 24. This was its fifth increase in as many weeks.

Nucor increased its weekly hot-rolled coil spot list price by $5 per short ton (st) on Monday, Nov. 24. This was its fifth increase in as many weeks.

Sources say domestic mill lead times and consumer spot prices have increased this week.

Most steelmaking raw material prices remained stable over the past month. Prices are mixed in comparison to this time last year.

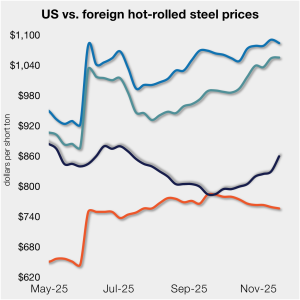

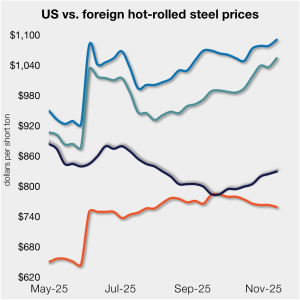

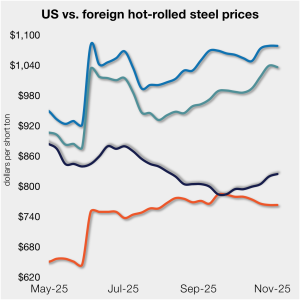

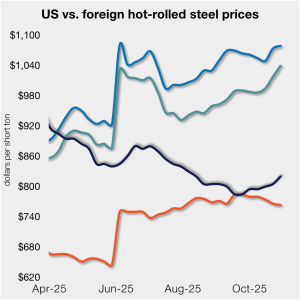

The price gap between stateside hot band and landed offshore product shrank week over week (w/w).

SMU’s price indices increased across the board this week, reaching new multi-month highs.

Nucor has increased its consumer spot price (CSP) for hot-rolled (HR) coil for a fourth consecutive week. Now at $910 per short ton (st), up $15/st from last week.

Global sheet markets face divergent trajectories into year-end, with Asian (excl. India) markets under pressure from oversupply. This, while Western markets experience temporary support from supply constraints.

Contract talks for U.S. value-added aluminum products are reaching a critical stage, with billet, primary foundry alloys, and wire rod upcharges diverging as buyers and producers race to finalized 2026 pricing.

US sheet market participants say demand for hot- and cold-rolled coils has not increased, leaving them confused by mill price increases and average lead times.

Just over half of the steel buyers who responded to our market survey this week reported that domestic mills are willing to talk price on new spot orders. Mills have begun to hold a firmer stance on prices over our last two surveys.

The price gap between stateside hot band and landed offshore product has marginally widened week over week.

NLMK USA is aiming to increase base prices on all products, effective immediately.

Plate market participants anticipated price increases from domestic producers. For weeks, sources predicted an increase. No one, however, was sure of timing due to subdued demand. Following the news that JSW increased its spot market plate prices by $40 per short ton (st), sources said they anticipate more mills will begin rolling out increases. From […]

SMU's sheet and plate steel prices moved higher in unison this week.

JSW Steel USA aims to increase steel plate prices by at least $40/short ton.

Nucor increased its weekly hot-rolled coil spot list price by $5 per short ton on Monday, Nov. 10.

US steel mills have received a boost from lower import levels because of sweeping tariffs this year. However, demand remained moderate in most sectors, aside from data center construction, after the summer.

The market has entered into a bit of a quiet recalibration, the kind of pause that feels like a held breath. Prices have stopped falling. Lead times have stretched just enough to create firmer footing. The urgency of downside risk has faded, but maybe (not quite yet) moved on.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

The gap between US hot band prices and imports narrowed slightly. But with the 50% Section 232 tariffs, most imports remain more expensive than domestic material.

ArcelorMittal Dofasco and Stelco joined recent moves by US mills to push sheet prices higher.

Most sheet prices inched up again this week following mill efforts to set a floor under tags and to increase them from there.

Nucor increases HR spot price by $5/ton

Most steel buyers think that steel prices will continue to rise into the 2026. But they don’t see the kinds of big gains that have characterized past market upturns, according to the results of SMU’s latest steel market survey.

Most steel buyers responding to our market survey this week reported that domestic mills are considerably less willing to talk price on sheet and plate products than they were in recent weeks.

In dollar-per-ton terms, US product is on average $141/st less than landed import prices (inclusive of the 50% tariff). That’s down from $148/st last week.

Sheet steel indices increased across the board this week, while plate prices held steady. All five of SMU’s price indices are higher than they were two weeks ago, and all but one are above levels recorded four weeks ago.

Nucor has raised its weekly spot list price on hot-rolled coil by $10 per short ton (st) after keeping it unchanged since Aug. 25.

Atlas Tube, in a leading move, said it aims to increase prices for mechanical tubing, hollow structural sections (HSS), and piling products by at least $50 per short ton (st).

US buyers want to drop pig iron prices to levels commensurate with the decline in prime scrap in their domestic market. Prime price shed $20 per gross ton (gt) in September and another $20/gt in October.