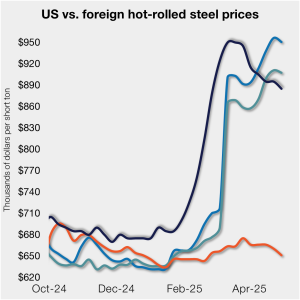

Steel exports rose in March, but remain weak vs past years

The volume of steel exported from the US marginally increased from February to March, according to the latest US Department of Commerce figures. Although up month over month (m/m), export levels have generally trended downward over the past year.