SMU Price Ranges: Sheet floor holds as market debates upside

Our average HR coil price increased $5/short ton from last week, marking a second consecutive week of modest gains. Market participants generally attributed the increase to...

Our average HR coil price increased $5/short ton from last week, marking a second consecutive week of modest gains. Market participants generally attributed the increase to...

A former CEO goes to court for swiping tin. An OEM distributor slams the bankruptcy trustee for failing workers and creditors. The steelmaker fires back. Angry employees demand back pay as tensions rise in Monclova's steel saga.

Medium- and heavy-duty trucks (MHDV) and buses imported to the US will start being charged Section 232 tariffs beginning Nov. 1.

Cleveland-Cliffs Inc. pointed to signs of recovery in its third-quarter earnings report on Monday. Improved automotive volumes and a better product mix drove sequential gains, but the steelmaker’s financials continue to bled red.

US-based Ampco-Pittsburgh has placed its forged and cast rolls plant in Gateshead, northeastern England, into administration through voluntary insolvency after years of losses.

We just wrapped up another Steel 101 workshop, easily the most hands-on industry workshop on steelmaking and market fundamentals.

Drilling activity increased in both the US and Canada last week, according to the latest oil and gas rig count data released by Baker Hughes.

International trade is going through one of its most significant upheavals in decades. Allies and partners are coping with disruption caused by unfair trade practices and overcapacity, particularly in the steel sector. However, as advanced economies are finding new ways to protect their national industries from the impacts of these disruptive elements, it’s important to […]

US domestic sheet prices have remained rangebound in recent weeks as supply tightness met weak demand. Demand for steel produced in the US increased among some Mexican industrial buyers....

SMU’s Steel Buyers’ Sentiment Indices both fell this week, with Current Steel Buyers’ Sentiment notching the lowest reading since May 2020.

Economic growth in some US regions in September was offset by challenges in others, causing the market to appear largely unchanged overall, according to the Federal Reserve’s latest Beige Book report.

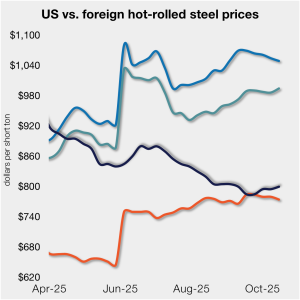

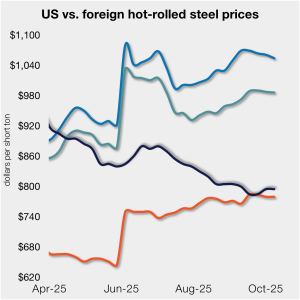

SMU’s average price for domestic hot-rolled (HR) coil was $800 per short ton (st) this week, up $5/st week on week (w/w). In offshore markets last week, prices were varied.

Steel mill lead times ticked lower across most sheet and plate products this week, according to responses from SMU’s latest market check.

Mills are more willing to negotiate spot prices for both sheet and plate products, according to our latest market survey results.

Musings on decarb, tariffs, and technology, and where it might be leading.

SMU’s HR price stands at $800/st on average, up $5/st from last week. The modest gain came as the low end of our range firmed, and despite the high end of our range declining slightly.

The Department of Commerce received 97 submissions from producers, manufacturers, and groups seeking Section 232 tariff coverage for steel and aluminum derivative products.

The World Steel Association (worldsteel) Short Range Outlook for global steel demand predicts that 2025’s steel demand will clock in at the same level as in 2024. In its October report, the Brussels-based association stated that this year’s steel demand will reach ~1,750 million metric tons (mt). The organization forecasts a 1.3% demand rebound in 2026, pushing […]

There are days when this feels like a “nothing ever happens” market. Don’t get me wrong. Plenty is happening in the world. It’s just that none of it seems to matter when it comes to sheet and plate prices.

Any steel imports into the EU that exceed the new, lower quota level would be subject to a 50% tariff, which represents a major increase from the EU’s current 25% out-of-quota tariff. This move would largely align the EU’s steel tariff rate with Canada and the United States.

More liberal access to the Northwest Passage could play into trade negotiations between Canada and the United States.

ncreases through September, according to the latest Baker Hughes rig count data.

The boom in China’s direct steel exports has not stopped this year, even with a rise in protectionist measures globally. The increase is driven by...

here has been considerable activity in the export scrap market in the Mediterranean Basin over the last 10 days. Prices have inched up after recovering from a brief dip in September. Prices range from...

SMU’s average price for domestic hot-rolled (HR) coil was $795 per short ton (st) this week, sideways week on week (w/w). The move was different in offshore markets last week, as prices eased marginally.

The US hot-rolled coil (HRC) market feels steadier as the 4th quarter begins - not strong, but no longer slipping either.

Usually, I write about steel in this column because, well, we’re Steel Market Update. But before I get to steel, I want to give a shoutout to my colleagues at Aluminum Market Update (AMU) – SMU’s new sister publication.

SMU spoke with a large channel in Brazil who confirmed his company sold a cargo of 50,000 metric tons (mt) to a US buyer at $383/mt FOB Brazil. That's down $12/mt from the last cargo sold in September.

The European Commission proposes cutting its steel import quota by almost half, with volumes exceeding the limit facing 50% duties. The region’s steel industry welcomes the move, while other steel-producing nations fear the consequences. CRU published an insight before this announcement, noting that more restrictive trade policy could significantly raise the cost of marginal supply […]

SMU’s sheet and plate prices see-sawed this week as hot-rolled (HR) coil prices held their ground while prices for galvanized product slipped.