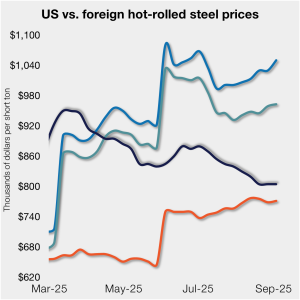

Some Asian HR prices theoretically lower than US HR tags despite 50% S232 tariff

Domestic hot-rolled (HR) coil prices ticked down this week after holding flat since mid-August. Offshore prices largely all moved higher week over week (w/w), widening the margin between stateside and foreign product.