Great Lakes iron ore cargoes down in September as Cleveland tonnage slips

Iron ore shipments from US Great Lakes ports fell sharply in September, per the latest from the Lake Carriers’ Association (LCA) of Westlake, Ohio.

Iron ore shipments from US Great Lakes ports fell sharply in September, per the latest from the Lake Carriers’ Association (LCA) of Westlake, Ohio.

Although total HVAC shipments fell in August, YTD volumes remain relatively strong. Nearly 15 million units were produced in the first eight months of the year, the fourth-highest rate in our 19-year data history.

Some sources also speculated that plate could see further price increases thanks to modest but steady demand, lower imports, mill maintenance outages, and end markets less immediately affected by tariff-related disruptions.

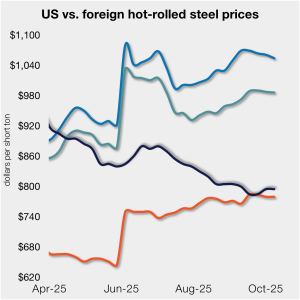

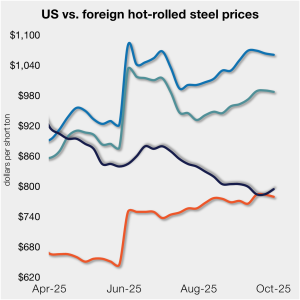

SMU’s average price for domestic hot-rolled (HR) coil was $795 per short ton (st) this week, sideways week on week (w/w). The move was different in offshore markets last week, as prices eased marginally.

Usually, I write about steel in this column because, well, we’re Steel Market Update. But before I get to steel, I want to give a shoutout to my colleagues at Aluminum Market Update (AMU) – SMU’s new sister publication.

Tariffs are ultimately to blame for stagnant demand in the hot-rolled coil market, domestic market sources tell SMU.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to tariffs, imports, and evolving market events.

Most mills sought a drop of $20-40 per gross ton (gt) in busheling prices and a $20/gt dip for shredded and HMS. Despite efforts to buy cheaper, the busheling price settled at down only $20/gt.

If I could change something, it’d be this: Political news would get more boring. And news about steel prices and steel demand would get a little more exciting.

SMU’s sheet and plate prices see-sawed this week as hot-rolled (HR) coil prices held their ground while prices for galvanized product slipped.

Nucor is keeping hot-rolled (HR) coil prices unchanged again this week, according to its latest consumer spot price (CSP) notice issued on Monday, Oct. 6

SMU’s latest survey results indicate that steel market participants think sheet prices are at or near a bottom. But most also think there is limited upside once they inflect higher.

SMU’s Current Sentiment Index for scrap decreased this month, a move mirrored by our Future Sentiment Index, according to the latest data from our ferrous scrap survey.

Let’s take a quick tour of some key stories from SMU in the week of Sept. 29 - Oct. 3.

Participants in the hot-rolled sheet market expressed frustration with the continuing lack of demand this week.

Each of our Sentiment Indices continues to reflect that steel buyers are positive about their present and future business prospects, though that confidence has eased considerably compared to the beginning of the year.

SMU’s October ferrous scrap market survey results are now available on our website to all premium members.

The price gap between stateside hot band and landed offshore product narrowed this week. Still, with the 50% Section 232 tariff, most imports remain much more expensive than domestic material.

SMU’s latest steel buyers market survey results are now available on our website to all premium members.

A recent IIMA meeting in Brazil shows how the US and much of the rest of the world are operating in parallel realities.

Sheet and plate lead times saw minor shifts this week, according to SMU’s latest market survey. Sheet times have inched up over the last month but remain within days of multi-year lows, as they have since May. Plate lead times have bobbed within a tight range for months, hovering roughly a week longer than this time last year.

Steel buyers say mills remain slightly more willing to negotiate spot prices for sheet and plate products than in mid-September, according to our latest market survey.

Following spot market plate price increase notices issued by domestic mills this past week, participants are contemplating the rationale behind the increases and whether they will stick. Some sources anticipate that current market conditions will shift in November and believe the increases may set a new "pricing floor."

NEMO Industries has announced a venture to build a pig iron plant in Louisiana. The plant will use advanced technologies, including integrating AI.

We moved our pricing momentum indicators from “lower” to “neutral” for all sheet products this week. For those keeping score, we had been at “lower” for six weeks. And I know some of you think we should have been there for even longer.

Market participants predicted that prices should be at or near a bottom. But while most seemed to agree on that point, many also said they saw little upside given a quiet spot market and ongoing concerns about demand.

Nucor aims to increase prices for steel plate by $60 per short ton with the opening of its November order book.

Raw steel production has stayed historically strong over the past four months, holding near multi-year highs since June.

Metallus and the United Steelworkers (USW) union extended their contract to Oct. 15 as talks continue on a new labor deal.

Nucor is keeping hot-rolled (HR) coil prices unchanged again this week, according to its latest consumer spot price (CSP) notice issued on Monday, Sept. 29.