Final Thoughts

SMU's ferrous scrap survey celebrates its one-year anniversary this month.

SMU's ferrous scrap survey celebrates its one-year anniversary this month.

Steel mill lead times marginally declined on sheet products this week but edged higher on plate, according to responses from SMU’s latest market survey. Overall, lead times remain one to two weeks longer than levels seen three months ago.

The US domestic scrap market is largely settled on February pricing. Despite poor weather conditions that have been wreaking havoc on scrap flows and deliveries to consumers, the pricing initially agreed between dealers and steelmakers has been fairly conservative.

Sheet market participants said conditions this week were more stable than in past weeks, but they remain cautiously optimistic overall.

Market participant comments from this month's SMU ferrous scrap survey.

SMU’s February ferrous scrap market survey results are now available on our website to all premium members.

The USW's contracts with Cliffs and USS expire on Sept. 1 of this year.

Flat-rolled steel prices inched upward again this week as mixed demand appeared to be offset by limited supplies.

Steel imports remain weak in November and December according to recently released final US Commerce Department data. Many of the sheet and plate products we follow slipped to multi-year lows.

The US Department of Commerce has found that certain steel pipe rolled in Oman using Chinese hot-rolled coil is illegally circumventing anti-dumping and countervailing duties (AD/CVDs).

The export market from the US and Canada has held firm, while slightly strengthening ahead of the domestic buying for February shipment.

The Tampa Steel Conference will kick off just a few days after the Super Bowl, and I think it’s fair to say that we could be reacting to market developments in real time – again.

With just 10 days to go and nearing the final countdown, we are just shy of 600 registered (and counting) so far for the 37th annual Tampa Steel Conference.

The Chicago Business Barometer rose further in January, moving into expansion territory for the first time since November 2023, said MNI and ISM.

Tariffs affect different parts of the economy differently. Tariffs on steel imports have contributed to price increases from domestic mills, improving their bottom lines. But orders from customers are slowing down, hurting downstream industries’ profitability and job prospects.

Participants in the hot- and cold-rolled coil markets said winter storms in the East and Midwest may disrupt weekly order volumes and prices.

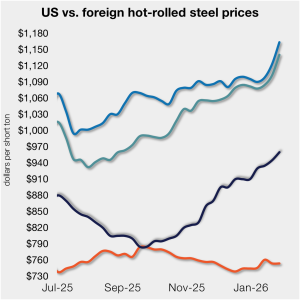

At SMU, we ask the big questions: To be or not to be? Hot band at a grand? On the one hand, whether hot-rolled coil price can or can’t go above $1,000 per short (st) is a silly argument. It’s just a number. On the other hand, round numbers are something that we tend to fixate on. They can be psychologically important to a market – even if they shouldn’t be.

All but one of the steelmaking raw materials we track increased in price over the last month

A coalition of US steel industry CEOs has formally urged President Trump to maintain—and fully enforce—current Section 232 tariffs on steel and steel‑containing goods.

SMU interviews Worthington Steel CEO Geoff Gilmore about the recent Kloeckner & Co. buy.

The price gap between US hot-rolled coil and landed offshore product inched higher, even as prices stateside and abroad mostly moved in tandem vs. last week.

SMU polled steel buyers on an array of topics earlier this week, ranging from market prices and demand, to inventories, imports, and evolving market events.

The pig iron market has entered an upward phase now that ferrous scrap in both Europe and North America has also been increasing in price.

What do SMU's latest survey results show about the current market take on tariffs and where HRC prices are going?

Sheet prices mostly continued their uneven but steady march higher this week, according to SMU’s latest check of the market.

Alton Steel Inc. (ASI), a special bar quality (SBQ) steel producer, said it will close operations later this week.

The US scrap market has come under pressure due to the extremely debilitating winter weather across the eastern half of the country.

President Donald Trump in a post on Truth Social threatened to impose 100% tariffs on all exports from Canada into the US. It would be boastful (but not entirely inaccurate) to say you read it in SMU and heard it on Aluminum Market Update (AMU) first.

A trip to Tampa is the perfect remedy for the winter blues. The 37th annual Tampa Steel Conference will bring together executives from across the steel supply chain, as well as leading analysts and policy experts.

A report on the sheet market this week.