Final thoughts

We've used the word "unprecedented" a lot over the last four years to describe steel price volatility. Over the last two months – despite earlier predictions of a price surge - we've seen unprecedented stability.

We've used the word "unprecedented" a lot over the last four years to describe steel price volatility. Over the last two months – despite earlier predictions of a price surge - we've seen unprecedented stability.

With strength in the sector and customers needing the product it produces, Cleveland-Cliffs’ chief executive says the company will be more selective with the automotive customers it chooses to serve.

Steel Dynamics Inc.'s (SDI's) earnings fell in the first quarter of 2024 as the company cited steel order volatility early in the quarter and lower scrap prices.

Sheet prices were again mixed this week – all seemed to highlight the momentum shift seen over the past two weeks.

Nucor executives explained their recently introduced hot-rolled (HR) coil consumer spot price (CSP) is a way to serve their customers and deal with market volatility.

Global steel output jumped 8.3% in March, according to World Steel Association’s (worldsteel's) latest release. Production is now at the highest level seen in 10 months, rebounding from a near six-year low observed just three months prior.

Cleveland-Cliffs’ chief Lourenco Goncalves and US Secretary of Energy Jennifer Granholm stressed the importance of the US steel industry and domestic manufacturing at Cliffs' Butler Works in Pennsylvania on Monday.

Domestic raw steel production slipped last week and now stands at a four-week low, according to the American Iron and Steel Institute (AISI).

ArcelorMittal plans to build a new electrical steel manufacturing facility near its AM/NS Calvert joint-venture mill in Alabama.

I was in Las Vegas last week for ISRI’s annual convention. I like Vegas. I’ve had some fun there over the years. (I was married there nearly 20 years ago. We're still together.) And last week was no exception. So let’s start with the big news from Sin City. When the recycled materials industry meets for the big event next year, it will be under the banner of "ReMA" – not "ISRI".

Workers at Volkswagen's assembly plant in Chattanooga, Tenn., have voted overwhelmingly to join the United Autoworkers (UAW) union. More than 3,600 ballots were cast, with 73% of Chattanooga workers voting to join the UAW and only 27% voting against unionization, per the UAW.

Last week gave us a glimpse into the effect of the 2024 election campaign on trade policy. In a major announcement, the Biden administration pressed the US Trade Representative (USTR) to triple certain Section 301 tariffs on steel and aluminum. It’s a lot to unpack. You can find the full text of the announcement here. […]

Steel is a foundation of the global economy. It is an essential raw material for nearly every industry, from automotive and construction to transportation, machinery, and energy.

Steel sheet prices in many regions of the world were steady week over week in the week ended April 17.

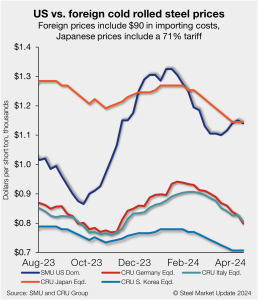

Foreign cold-rolled (CR) coil remains less expensive than domestic product, according to SMU’s latest check of the market.

Drilling activity increased in the US but declined in Canada, according to the latest data from Baker Hughes.

Here’s a roundup of the latest news in the global aluminum market from our colleagues at CRU. Biden calls for tripling of Chinese steel and aluminum tariffs President Joe Biden is calling on the US Trade Representative (USTR) to consider increasing the existing section 301 import duty on Chinese steel and aluminum three-fold. The current […]

To the surprise of many — myself included — flat-rolled steel prices appear to be in a holding pattern… again. This is not familiar territory for hot-rolled (HR) coil, at least not over the past few years. Its pricing volatility (as my colleague Michael Cowden has noted in past columns) may rival the elastic moves […]

While general economic conditions across the US improved slightly over the last six weeks, activity in the manufacturing sector was weak, according to the Fed’s latest Beige Book report.

Prices of steelmaking raw materials have moved in different directions over the last 30 days, according to Steel Market Update’s latest analysis.

A lot of economists were predicting a recession last year. Ken Simonson, chief economist for The Associated General Contractors of America (AGC), wasn’t one of them.

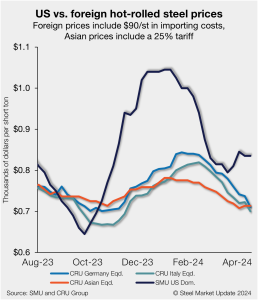

US hot-rolled (HR) coil has become gradually more expensive than offshore hot band in recent weeks, as stateside prices have stabilized while imports moved lower.

In this Premium analysis we cover North American oil and natural gas prices, drilling rig activity, and crude oil stock levels.

Metalformers expect economic activity to remain level over the next three months, according to the April Business Conditions Report from the Precision Metalforming Association (PMA).

North American auto assemblies ticked up in March vs. the prior month, according to LMC Automotive data. While assemblies were up month on month (m/m), they are down 4.5% year on year (y/y).

The Biden administration on Wednesday announced measures to support the domestic steel industry.

Russel Metals Inc.’s planned purchase of seven service centers in western Canada from Samuel, Son & Co. has been delayed.

Earlier this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market chatter.

The steel market appears to be finding a new, higher normal with the shocks of the pandemic and the Ukraine in the rearview mirror. The good news: a more profitable and consolidated post-Covid US steel industry has been able to invest in operations. That includes efforts to decarbonize. The bad news: That “new normal” could be tested. Because it’s not just domestic sheet prices that have been volatile. Geopolitics are too.

I’m writing these Final thoughts from the 2024 ISRI Convention and Exposition in Las Vegas. I wasn’t the only one with the good idea to attend. Approximately 6,625 others did – a new record for the event. So, a big congratulations to ISRI.