Analysis

April 5, 2024

US steel imports ramp up in March

Written by Brett Linton

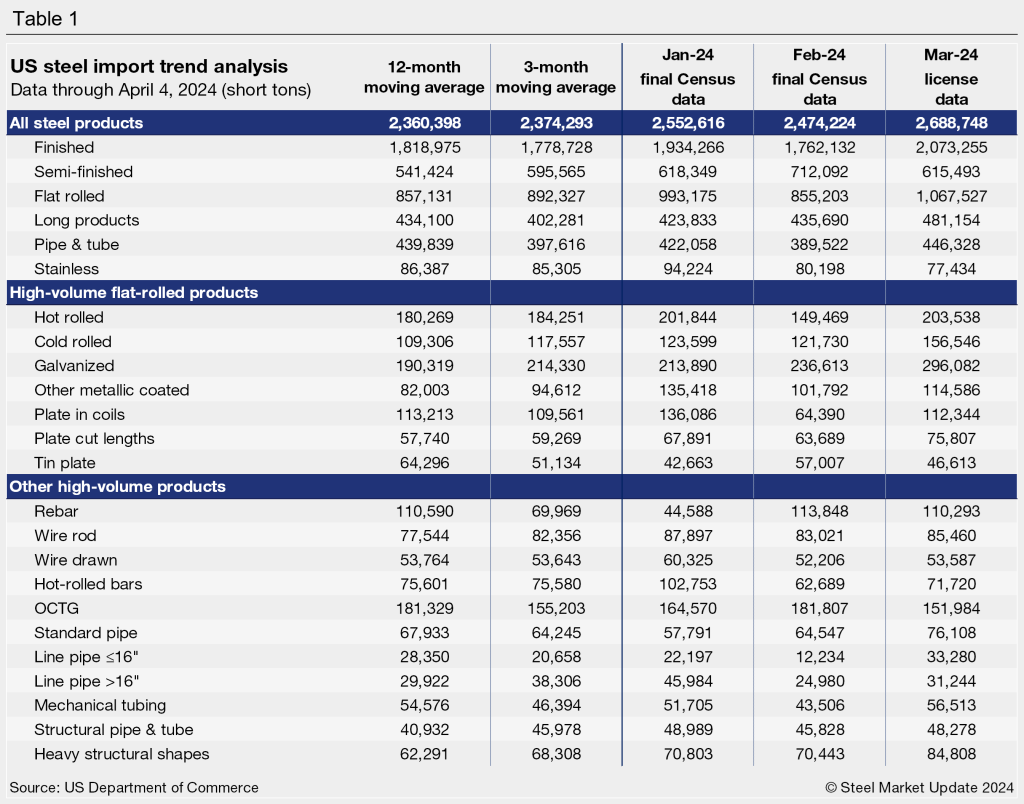

Steel import licenses through March have now reached a nine-month high, according to the latest data from the US Commerce Department. March import licenses total 2.69 million short tons (st) as of this week, the highest rate since June 2023, and one of the higher levels seen over the past two years.

Examining March licenses, two notable flat rolled products stand out above the rest: cold rolled and galvanized imports are now both up to two-year highs. (Note that license data is still being collected, so March levels will fluctuate from here).

Final February import data was also released this week, with shipments totalling 2.24 million st for the month. This is just 5,200 st higher than the preliminary figures SMU reported last week. March licenses are currently 9% higher than February levels and up 5% compared to January.

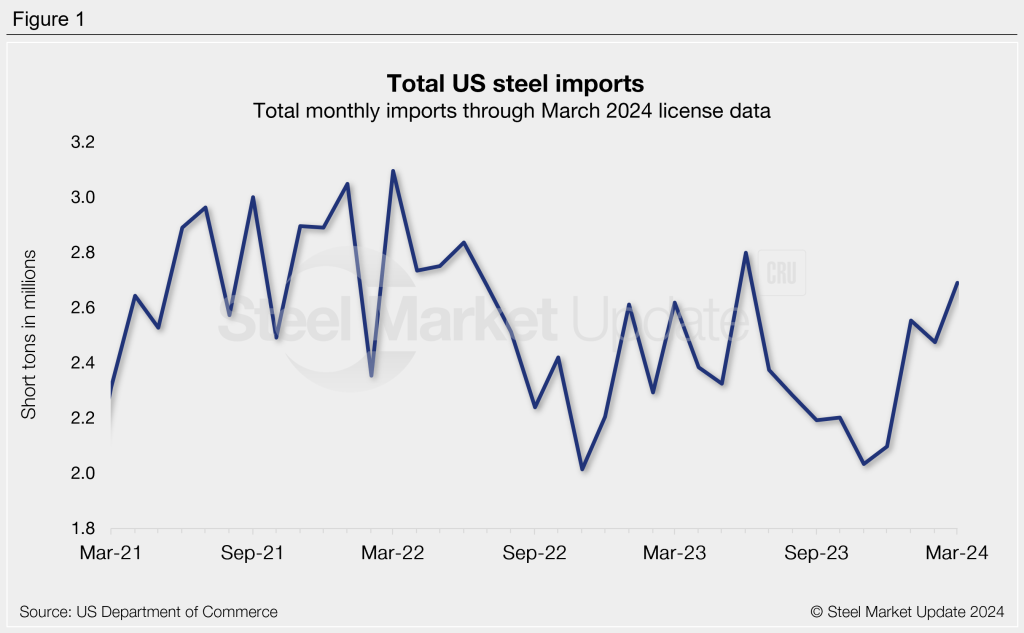

Imports as a 3MMA

Looking at imports on a three-month moving average (3MMA) basis smooths out the variability seen month to month. On a 3MMA basis, imports reached a 6-month high in February of 2.37 million st. Looking through March license data, the 3MMA is up to 2.57 million st, potentially a 19-month high.

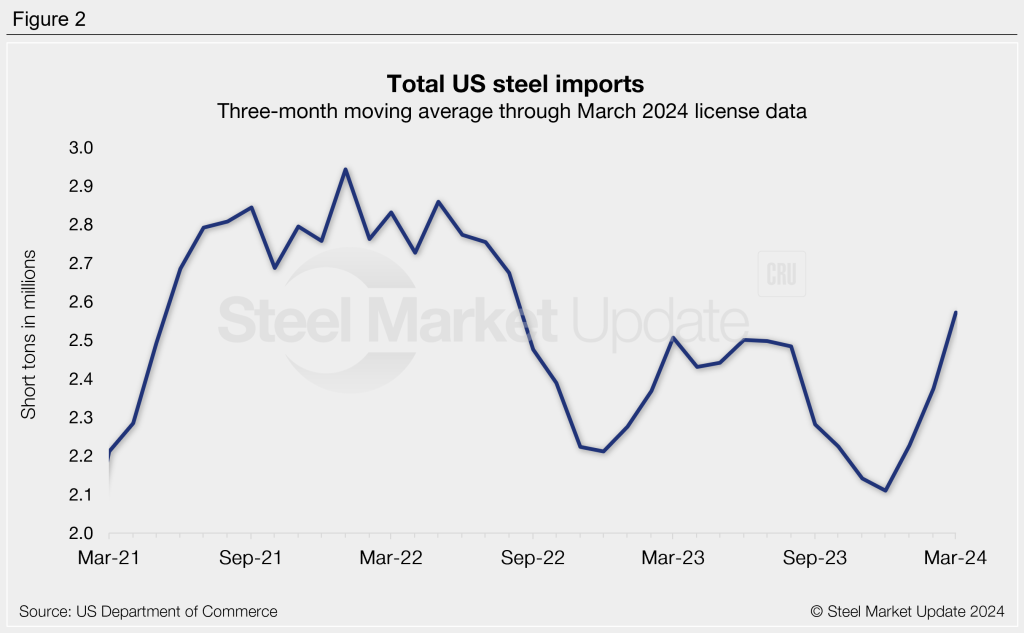

Semi-finished and finished steel

Imports of semi-finished steel products had risen to an 8-month high in February of 712,000 st. Levels eased 14% month on month (m/m) through March licenses to 615,000 st. Semi-finished imports have averaged 649,000 st per month across the first three months of this year, up 24% from 2023’s monthly average of 524,000 st.

Meanwhile, finished steel imports eased 9% in February to 1.76 million st. We saw an 18% jump through the latest March licenses, with finished imports now at a 19-month high. Finished imports have averaged 1.92 million st per month so far this year, up 5% from the 2023 monthly average of 1.83 million st.

Flat-rolled steel

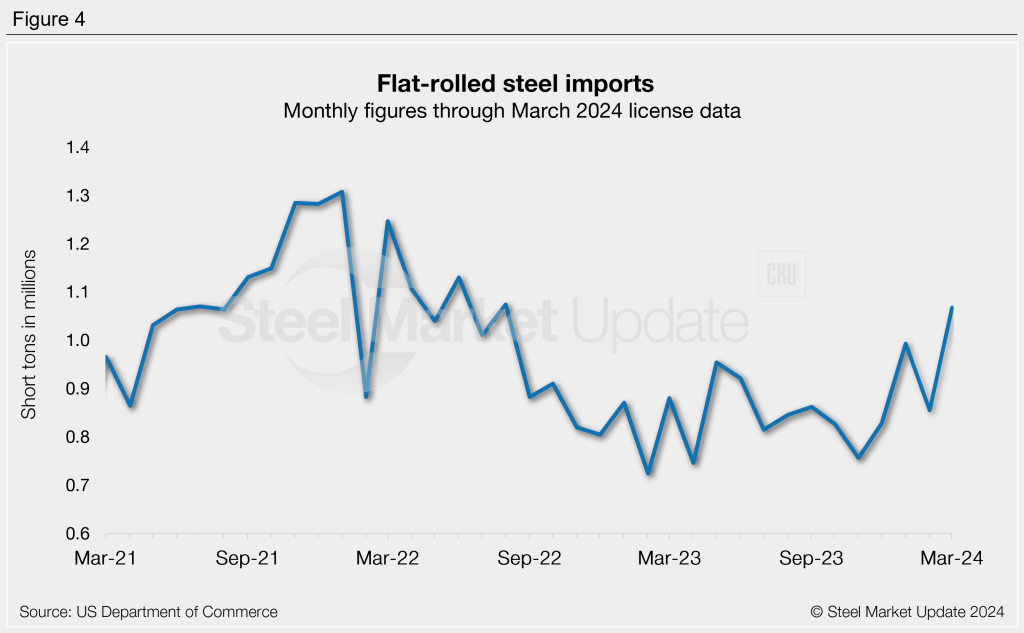

Flat-rolled steel imports had slipped 14% m/m into February to 855,000 st. Imports rebounded 25% through March licenses to a 19-month high of 1.07 million st.

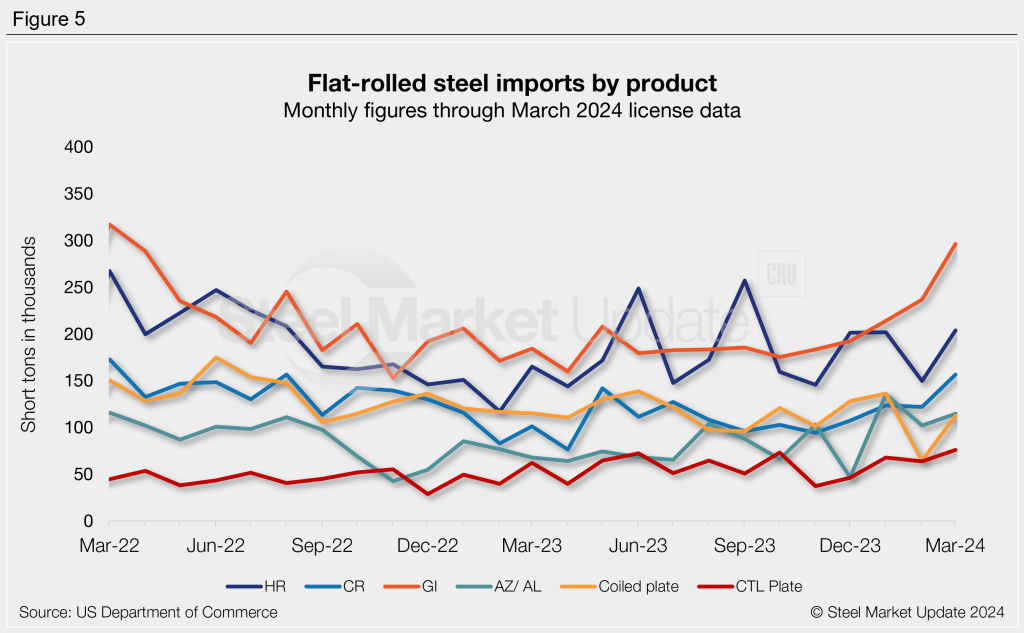

Figure 5 shows flat rolled imports by popular products. Most products declined from January to February, aside from galvanized (+11%). All products rebounded through March, with notable recoveries in plate in coils (+74%), hot rolled (+36%), cold rolled (+29%), and galvanized (+25%).

Pipe & tube

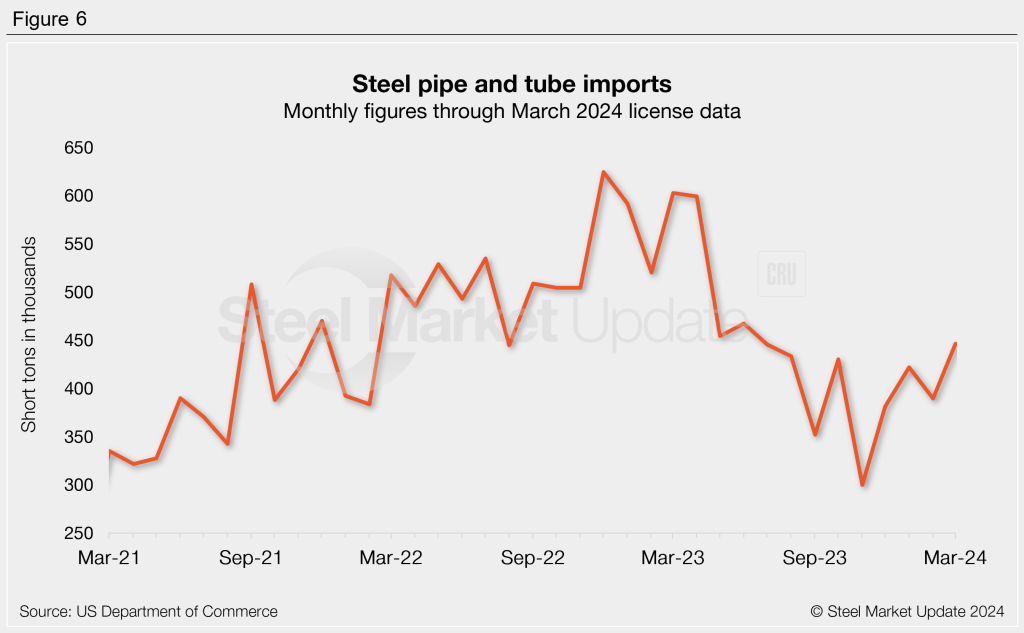

Pipe and tube imports are up 15% in March following February’s dip. March levels are at 446,000 st through the latest license data. While up, pipe and tube imports over the past year remain substantially lower in comparison to 2022 levels.

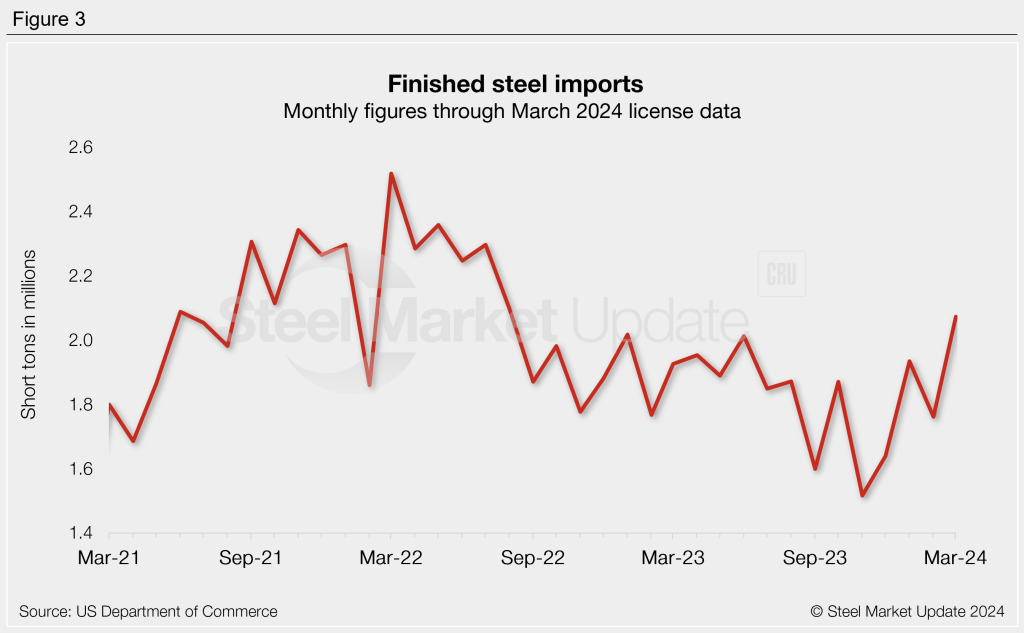

Imports by product

The chart below provides further detail into imports by product, highlighting high-volume steel products.