Market Data

September 15, 2013

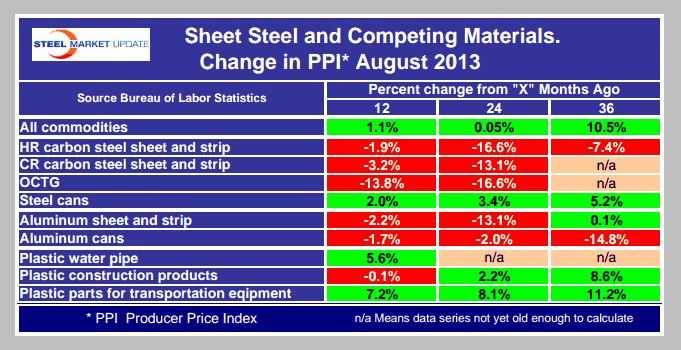

Producer Price Indexes, (PPI): Sheet Steel and Competing Materials

Written by Peter Wright

Each month the Bureau of Labor Statistics puts out its series of producer price indexes, for thousands of goods and materials. The latest release on Friday reported August results. These statistics are a useful way to evaluate any changes in the competitive position of steel against competing materials. For the purpose of this report, Steel Market Update extracts comparative statistics for sheet steel, aluminum and plastic products. The headline on Friday was that the composite PPI rose 0.3 percent in August, after being flat in July and advancing in May and June. Finished energy goods and food prices drove the August headline index higher despite continued weakness in core goods prices.

Moody’s reported as follows in Economy.com: “Headline producer prices rose at a healthy pace in August, defying the forecast decline. Finished food prices were surprisingly strong thanks to spikes in isolated categories. The strength is unlikely to persist, however, as crude foods including key crops such as corn and soybeans suffered steep sell offs last month. Producer prices at early stages of production were generally weak in August.

Crude oil prices rose sharply last month amid supply outages in some exporting countries and the threat of conflict in the Middle East. Fear has subsided a bit this week with diplomatic efforts aimed at avoiding a U.S. led strike against Syria, causing the crude oil rally to moderate. Aside from unpredictable geopolitics, prices should stay within range of current levels. Saudi Arabia is pumping crude at a record pace and rising production in U.S. and other non-OPEC countries should keep the global market well-supplied.

Encouragingly, gasoline prices have been relatively tame despite the recent spike in crude oil prices. While some catch-up will occur in coming weeks as refiners pass along higher input costs, gasoline prices should remain substantially below 2012 levels. Prices of other inputs such as industrial metals should also be range-bound. Better economic data out of China suggests demand will improve, but supplies are adequate for most key metals including copper, and investor buyers will remain wary of reduced liquidity as the Federal Reserve gets ready to taper bond-buying.”

The table below is a summary of steel, aluminum and plastic indexes. Four cells in this table contain the code n/a. In the last two years the BLS has expanded its range of products within the PPI series with the result that long term comparisons cannot yet be made in these four cases. What the PPI data shows is that except for steel cans, steel moved contrarily to the headline index. Aluminum sheet has declined in line with cold rolled steel sheet over the last 24 months. Presumably both aluminum and plastic are negatively affected by high energy prices but the future energy economy of the US could work against the competitive position of steel. Product designers are well aware of these trends and will plan accordingly. Their design decisions are typically under consideration for many years and then in implementation for much longer.

The price of steel food and beverage containers is steadily becoming less competitive against aluminum, a situation that has worsened drastically since the end of 2008. (SMU note: Steel could become even less competitive as ArcelorMittal is asking for a 12 percent price increase in tin mill products out of their Weirton mill).

The PPI data are helpful in monitoring the competitive price of steel and steel products against competing materials and products. As far as we can tell from comparison with real world prices, these indexes are a good representation of the real world.