Market Data

December 10, 2013

SMU Notes from Our HARDI Presentation

Written by John Packard

The other day Steel Market Update wrote an article about steel buyers anticipating a flat rolled steel price increase announcement out of the domestic mills prior to the end of the year. Not everyone is a believer that will occur and we got several emails and phone calls pointing out short lead times at a few mills and, in one case, a service center advised that one of their mills had just lowered their hot rolled coil price from $680 to $670 per ton.

Steel Market Update publisher John Packard was invited to present our analysis of the current steel markets with special emphasis on galvanized steel which is the major product purchased and distributed by the HARDI HVAC wholesalers. It is also a core ingredient in many of the supporting companies who manufacturer such products as furnace pipe and fittings, furnaces and air-conditioning units, vents and registers and a wide array of products for home, multi-housing and commercial construction.

During the SMU presentation we discussed the keys to watch as we ponder what direction prices will move from here. Over the past few weeks flat rolled prices have been relatively stable with benchmark hot rolled running close to $680-$685 per ton and galvanized base prices in the $38.50-$39.50/cwt base price range.

What are the key factors which will move market prices from here? From SMU perspective we believe the keys to focus on are the fundamentals: where are scrap prices headed both for the month of December as well as in January, lead times are they moving in/out or remaining the same (does the product matter?), are the mills willing to negotiate spot pricing, where are service center inventories headed and what impact will foreign steel have on the market come first quarter? We also are interested in any changes in demand – especially unexpected changes which might impact order flows one way or another.

As we have already reported, scrap prices rose from a low of sideways to $10 per gross ton on prime grades in Chicago and the east coast markets to a high of $45 per gross ton on shredded scrap (range was $20 to $45). As you will see in our scrap article in today’s issue market players believe scrap has more upside potential over the next couple of months.

Lead times have been a mixed bag with a couple of mills just now moving out of December on hot rolled to a few mills who are sold out into February. We have USS Fairfield blast furnace down for the month of December for maintenance and Nucor Berkeley is finishing expansion of their hot strip mill.

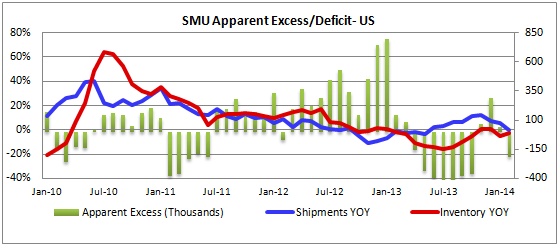

In our most recent survey we found service center inventories increasing. It will be interesting to see if the MSCI data will show carbon flat rolled inventories as of the end of November expanding. Steel Market Update is now forecasting inventories based on our Apparent Excess/Deficit Model. Here is how we see inventories developing over the next few months.

Foreign imports are expected to jump by the middle of first quarter. Exactly when and how they impact inventories will be critical to holding prices steady at current levels or allowing prices to move higher from here.

From the HARDI perspective, based on our many one-on-one conversations with the HVAC wholesalers as well as a number of manufacturing companies who service the wholesalers, we found a modestly upbeat crowd. Business conditions have improved off the lows of 2009-2010 and many expect mid-single digit growth in their steel related products for next year. We were told commercial construction will become a major driver but not until 2015-2017.

We do not believe the announced purchase of ThyssenKrupp Steel USA will have any impact on prices during the first quarter 2014 and it could take until the end of the second quarter 2014 before AM/NSSMC take possession of the mill. Until then the existing commercial team will dictate price levels and if the mill is able to collect the same (or higher) prices than their competitors in the markets they serve.

We also heard, during our discussions this week, that there are a couple of mills who have damaged their reputations with their customers during the negotiation process regarding 2014 contracts. We heard stories from many buyers that 2014 orders were impacted and a couple of mills lost tonnage to other steel mills who were more willing to negotiate things such as extras which were taken off the table by some suppliers.

We mention this because those mills may not wish to be the early leaders of a new round of price increases.

Our gut tells us the higher scrap prices and forecast for more increases in the future may force the mills to move prices higher but, when and how much, time will tell.