Analysis

December 19, 2013

NAFTA Vehicle Production Exceeds 16 Million Units

Written by Peter Wright

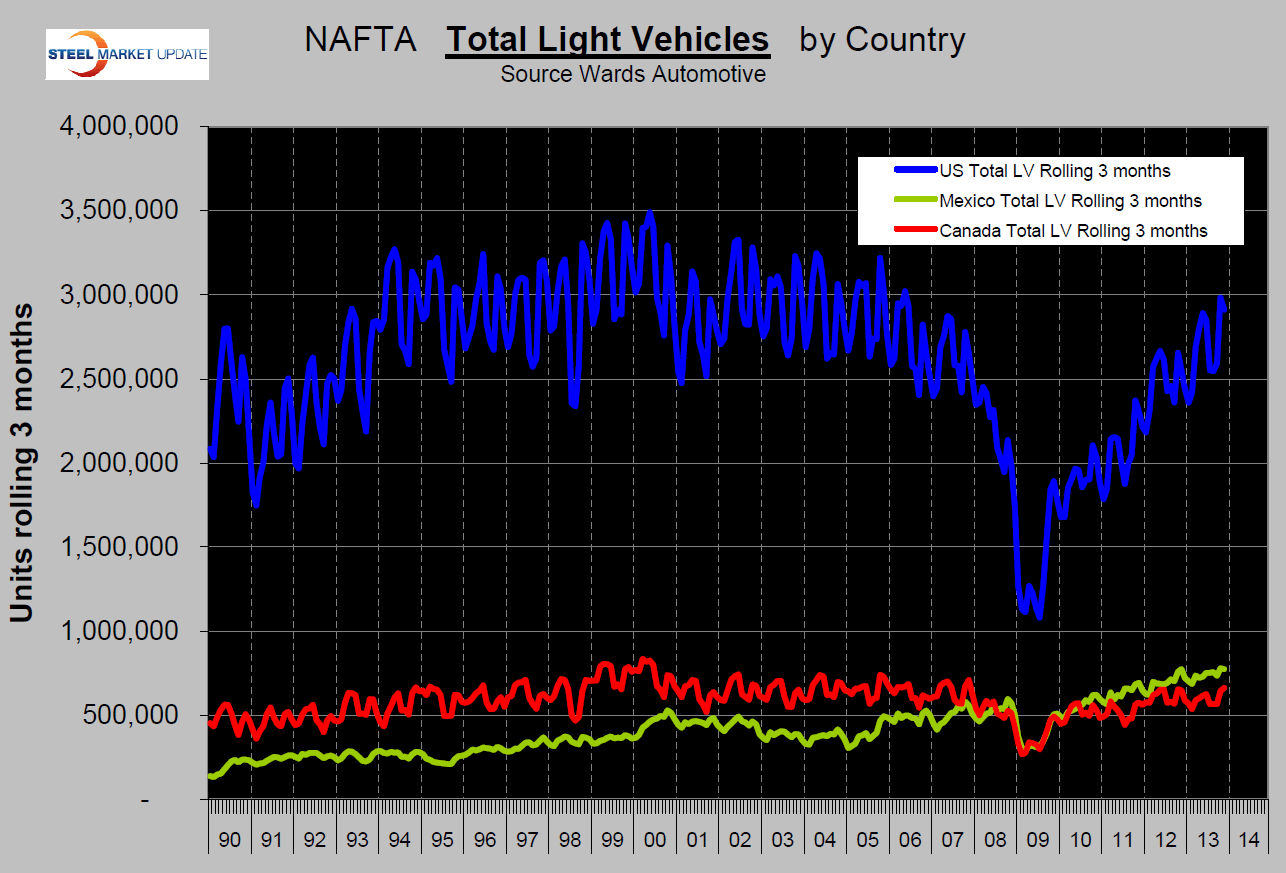

In a rolling 12 months through November, light vehicle production (automotive) in NAFTA reached 16,093,000 units, a level not seen since May 2003. In three months through November production was up by 9.4 percent year over year. Light trucks, which include crossovers, are surging faster than cars, the year over year growth rates were 15.4 percent and 2.4 percent respectively.

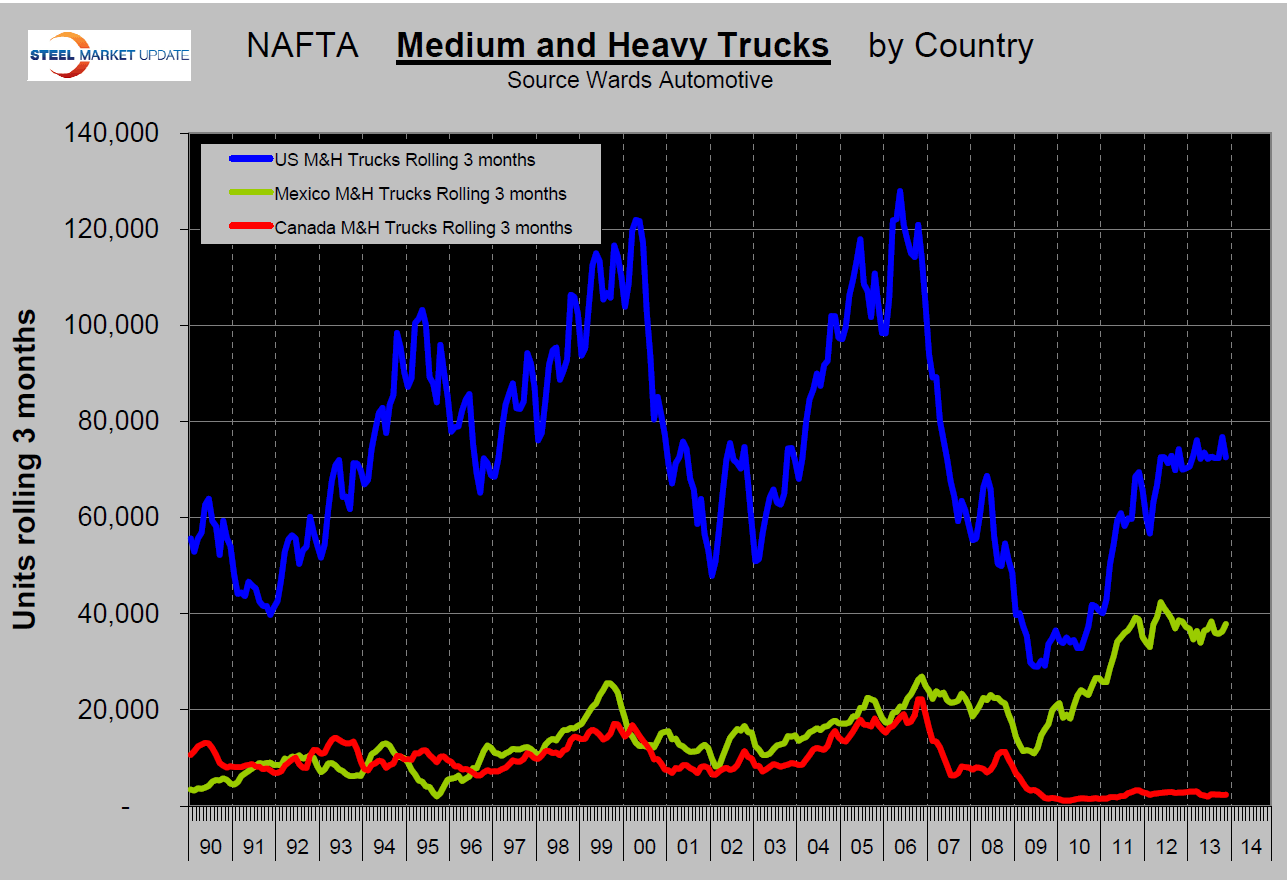

The growth of light vehicle production by country year over year was: US 14.2 percent, Canada 2.0 percent and Mexico negative 0.1 percent. The US continues to be the success story of NAFTA auto production (Figure 1), though it must be said that the US had the more ground to make up from the recession. The growth of medium and heavy truck production has stalled overall and become negative in Canada and Mexico (Figure 2). Growth rates for this class of vehicles in three months through November year over year were, total NAFTA 1.4 percent, US 3.7 percent, Canada negative 15.6 percent and Mexico negative 1.4 percent.

The growth of light vehicle production by country year over year was: US 14.2 percent, Canada 2.0 percent and Mexico negative 0.1 percent. The US continues to be the success story of NAFTA auto production (Figure 1), though it must be said that the US had the more ground to make up from the recession. The growth of medium and heavy truck production has stalled overall and become negative in Canada and Mexico (Figure 2). Growth rates for this class of vehicles in three months through November year over year were, total NAFTA 1.4 percent, US 3.7 percent, Canada negative 15.6 percent and Mexico negative 1.4 percent.

US sales of light vehicles surged in November and are on track for a 15.5 million unit year. Moody’s Economy.com expects sales to strengthen further as the economy gains momentum in 2014 and 2015 with sales of 16.7 million and 16.6 million units respectively.

US sales of light vehicles surged in November and are on track for a 15.5 million unit year. Moody’s Economy.com expects sales to strengthen further as the economy gains momentum in 2014 and 2015 with sales of 16.7 million and 16.6 million units respectively.