Market Data

March 13, 2014

Currency Update for Steel Trading Nations- March 10th 2014

Written by Peter Wright

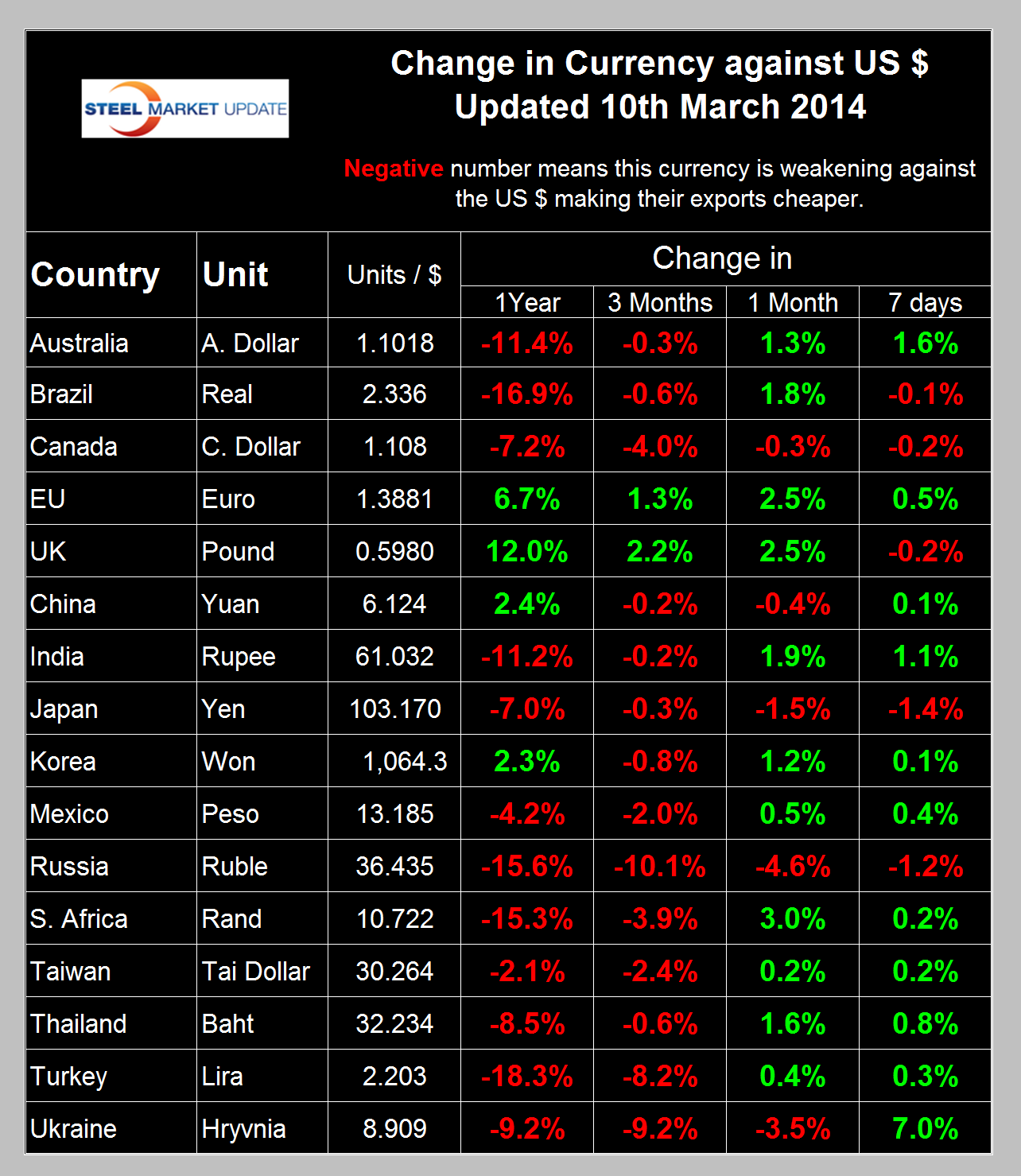

In the last three months the US dollar has strengthened against fourteen of the currencies of the major sixteen steel trading nations. In the last one month, that trend has reversed and eleven of the steel trading currencies have strengthened against the US dollar. Table 1 shows the number of currency units that it takes to buy one US $ and the percent change in the last year, three months, one month and seven days. In the last year, the currencies of the major iron ore producing nations, Australia, Brazil and Canada have weakened against the US$ by 11.4 percent, 16.9 percent and 7.2 percent respectively. A decline in these currencies has a downward influence on the price of iron ore.

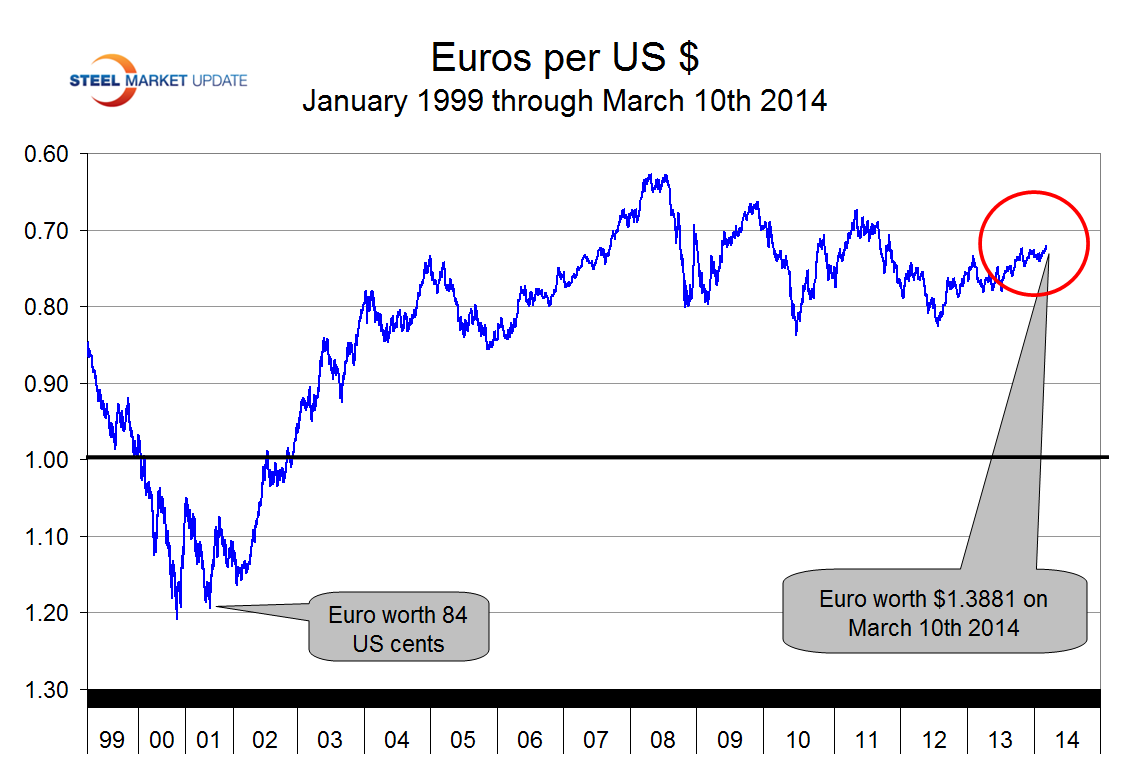

The Euro has strengthened against the US $ in each of the time periods considered (Figure 1). A fact that makes no sense to us at SMU who believe that a currency reckoning within Euro-land is inevitable.

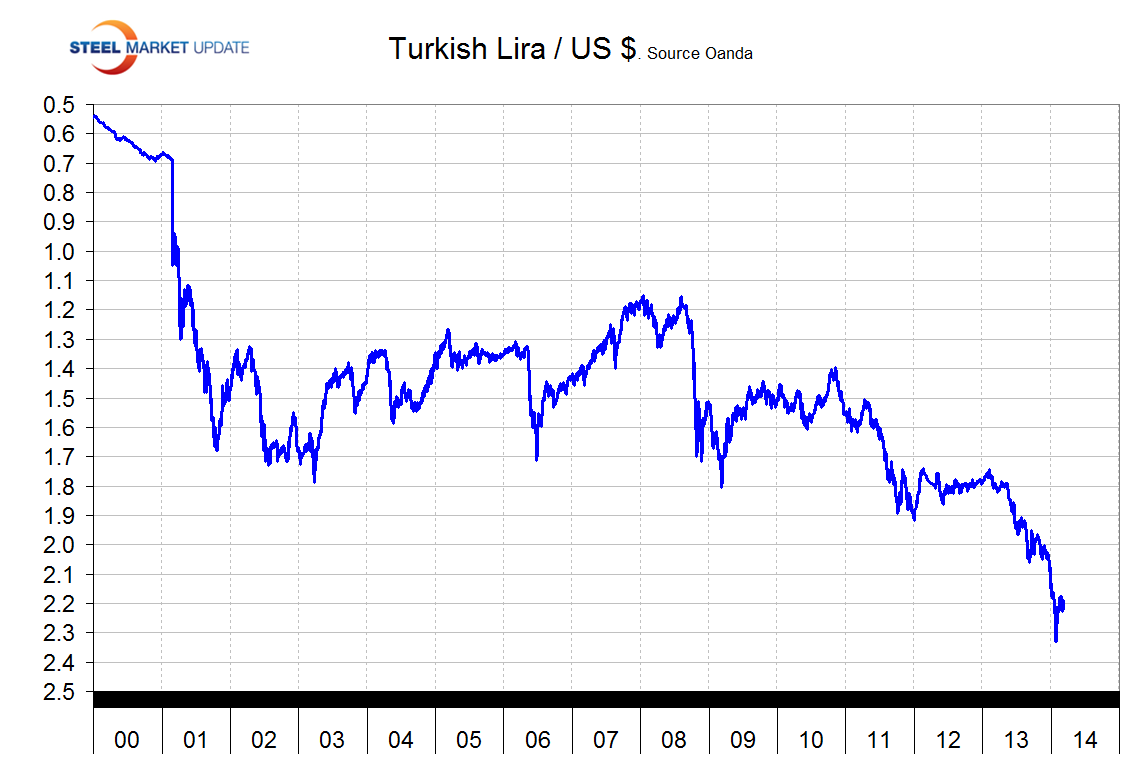

The Turkish Lira has stabilized and appreciated slightly in the last month and now stands at 2.203 to the $ (Figure 2).

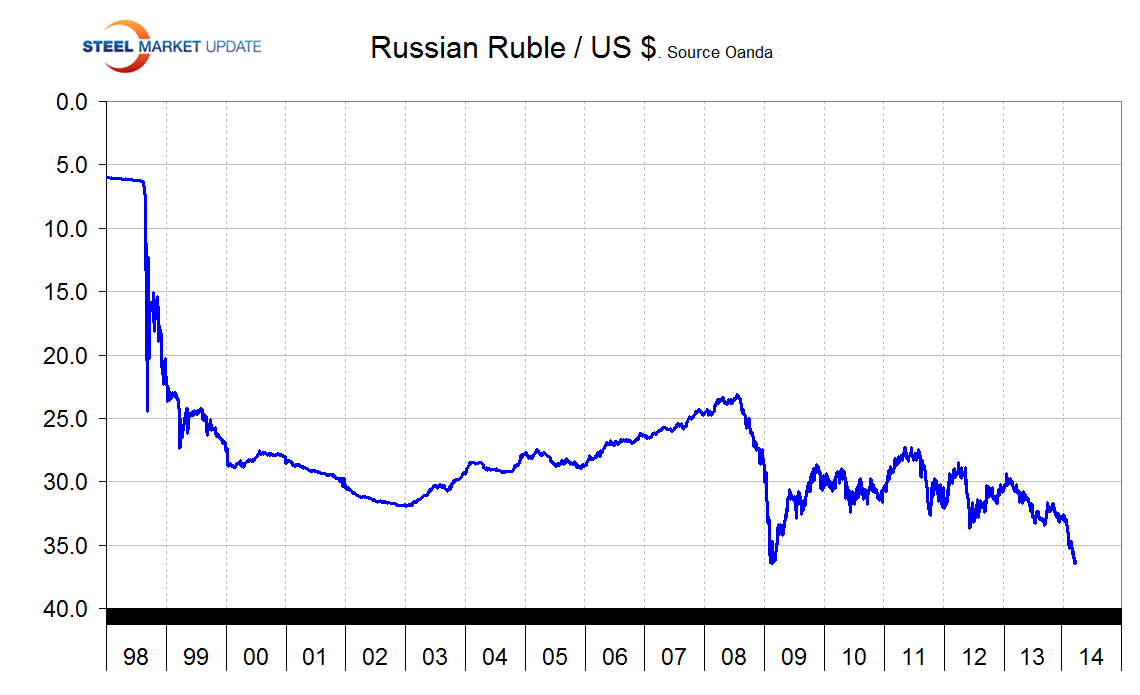

The Russian Ruble has depreciated by 10.1 percent in the last three months and that decline has continued into the last week (Figure 3).

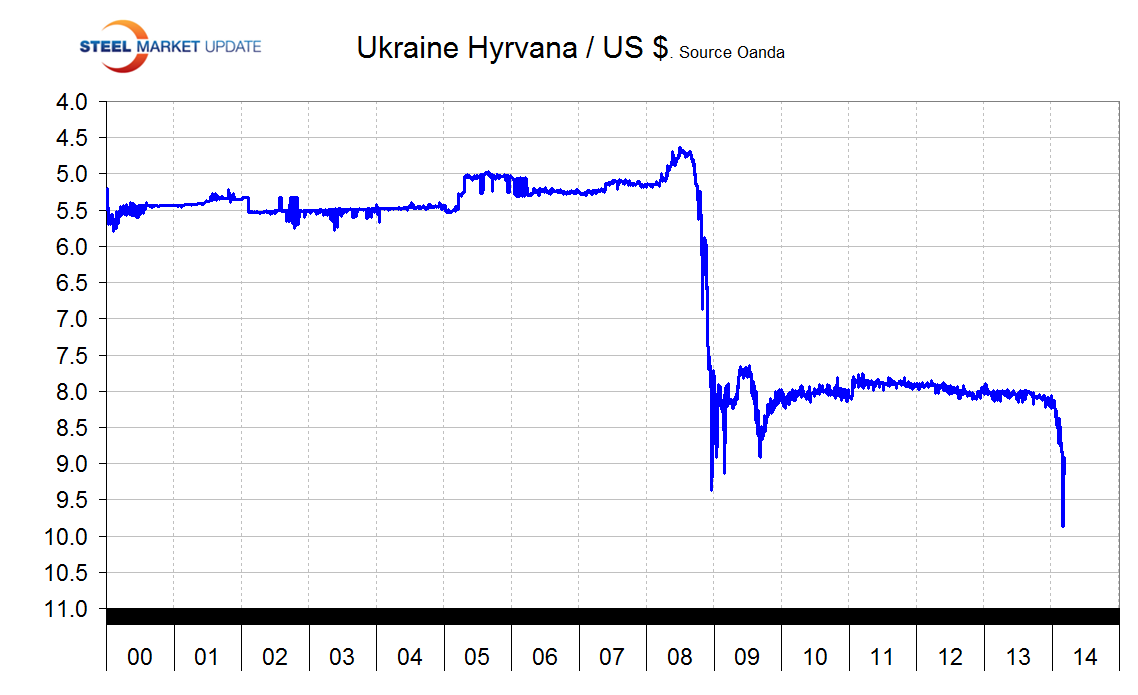

The Ukrainian Hryvnia has declined by 9.2 percent in the last three months but rebounded by 7 percent in the last seven days (Figure 4).

Originally published by John Maudlin March 4th: Putin is stuck now, cannot easily de-escalate. Further escalation is a possibility, with Ukraine cracking along the obvious ethnic fault lines and the West reacting with measures such as sanctions and visa restrictions. Tit-for-tat follows; gas supplies to the EU are disrupted. Russian capital outflows accelerate and the RUB [ruble] quickly gets to 40/$, fueling inflation and unnerving the Russian banking system, and also infecting the European banking system, in the manner that Chris Watling has envisaged. Meanwhile, the Chinese liabilities residing inside the European banking system are also in trouble, of course, and will continue to deteriorate. The CBR [Central Bank of Russia] hikes repeatedly with very little effect on slowing the RUB slide, further hurting GDP growth and economically sensitive segments of the market. The Russian RTX index revisits the GFC lows of 2008, Gazprom ADR’s are already within shouting distance of their 2008 lows today. In such a scenario, there is an obvious risk of market contagion spreading throughout Eastern and Western Europe, and in fact the rest of the world. It is likely to resemble something on the order of the 1998 LTCM + RUB collapse + Asian financial crisis magnitude. In fact, a number of hedge funds will fail precisely because they have loaded up so heavily with European debt instruments which will unravel.