Market Data

April 1, 2014

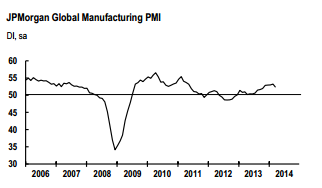

Global Manufacturing PMI at 5 Month Low but Still Expanding

Written by Sandy Williams

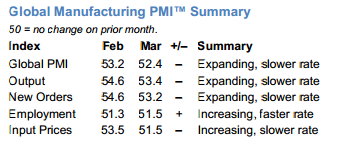

The JP Morgan Global Manufacturing PMI was at a five month low in March registering 52.4, down from 53.2 in February. The index has indicated expansion for sixteen months with March’s reading above its average for the period.

All components of the Global Manufacturing PMI remained in growth territory for the month with expansion slowing in output, new orders and input prices. Employment rates increased at a faster rate in March.

US manufacturing production led the expansion along with higher output in the Eurozone and Brazil. Slowing production was reported in the UK, Canada, Mexico, Japan, Taiwan and India. Russia and China both continued in contraction in March.

“The March PMI confirms the anticipated downshift in the global manufacturing sector, as the headline index resumes its slowing trend following the weather-related distortions from the US and Japan surveys in recent months,” said David Hensley, Director of Global Economics Coordination at J.P. Morgan. “Although growth is cooling from the highs reached at the end of last year, the picture remains one of continued expansion, suggesting manufacturing will remain a contributor to both global economic growth and job creation.”

Eurozone

The Eurozone Manufacturing PMI edged down slightly by 0.2 points to 53.0 in March. The average reading for the first quarter of 2014 was the best since Q2 2011. All countries in the region continued to expand except for Greece, which fell into contraction for the first time in three months. Germany, the Netherlands and Austria showed signs of slowing in March with faster growth in Ireland, Spain, Italy and France.

Markit Chief Economist Chris Williamson said manufacturing output growth remains “encouragingly robust” but warned that an “easing in the rate of new order inflows raises the risk of production growth weakening further in April.”

China

Business conditions fell for the third month in China. The HSBC PMI slid to 48.0 from 48.5 in February as orders and output contracted at faster rates and employment levels dropped. Both input and output prices fell to the lowest levels since August 2012. On the flip side, export orders picked up for the first time in four months with strongest demand from Europe and the US. GDP growth is likely to be below the 7.5 percent target for first quarter.

Russia

Manufacturing conditions in Russia declined for the fifth month with output and new orders dropping at the fastest rate in five years. The PMI fell to 48.3 from 48.5 in February. The average PMI for the quarter was 48.3, the lowest since Q2 2009. Input and output prices have soared as the rouble depreciates. Higher interest rates are seen as a possible solution to “stabilizing the exchange rates and reducing depreciation and inflationary expectations,” said Alexander Morozov, Chief Economist (Russia & CIS) at HSBC. Shrinking export demand is an indicator that more contraction is ahead.

Brazil

The Brazil economy had a sluggish month in March with the PMI rising from 50.4 in February to 50.6. Output increased slightly but new orders slowed. Input purchases and costs both rose. In general, growth was below the average for the month.

Mexico

Manufacturing output and new orders slowed in March. The HSBC Manufacturing PMI registered 51.7 falling from 52.0 in February. Input costs remained high resulting in the fastest increase in factory gate charges since September 2012. Export orders rose slightly in March after a decrease in February. Expectations are that the manufacturing sector will continue growing but at a slower pace.

Canada

Strong new order growth pushed the RBC PMI to a three month high at 53.3, up from 52.9 in February. The influx in orders was partially due to acceleration of new export orders. Lead times were at their longest in 2.5 years due to adverse weather in the US. The inflation rate accelerated for the fourth month pushing input costs up sharply. “We continue to expect that underlying economic conditions – a strengthening U.S. economy and a weaker Canadian dollar – will lay the foundation for a boost in domestic manufacturing in the near-term,” said Craig Wright, senior vice-president and chief economist, RBC.