Analysis

February 23, 2015

S&P/Case Shiller: Home Prices Up Slightly in December

Written by Sandy Williams

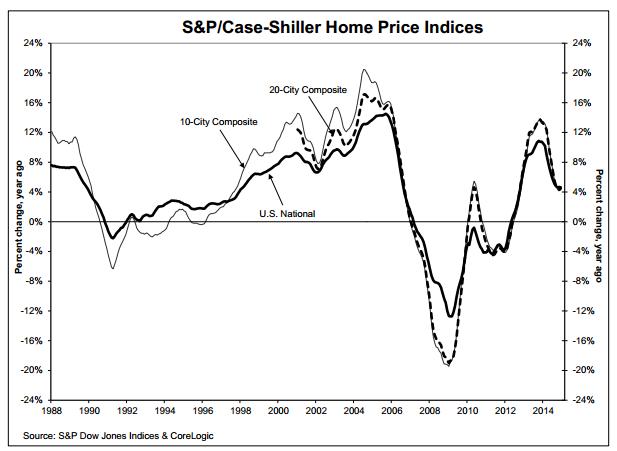

Home prices increased slightly in December according to data from the S&P/Case-Shiller Home Price Indices, climbing 4.6 percent year over year in the National Home Price Index. The increase was slightly less than November’s pace of 4.7 percent.

On a monthly basis, both the 10- and 20-City Composites reported increases of 0.1 percent in December. The monthly National Index, however, showed a -0.1 percent change from November.

Results were mixed nationally: nine cities reported higher monthly figures, six reported decreases, and five were flat for the month. Miami and Denver had the strongest increases at 0.7 percent and 0.5 percent, respectively.

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices, offered the following analysis:

“The housing recovery is faltering. While prices and sales of existing homes are close to normal, construction and new home sales remain weak. Before the current business cycle, any time housing starts were at their current level of about one million at annual rates, the economy was in a recession. The softness in housing is despite favorable conditions elsewhere in the economy: strong job growth, a declining unemployment rate, continued low interest rates and positive consumer confidence.

“Movements in home prices show clear regional patterns. The western half of the nation plus Miami and Atlanta enjoyed year-over-year increases of 5% or more. San Francisco and Miami were the strongest. Dallas, Denver, Las Vegas and Atlanta also experienced solid gains. Phoenix was an exception to the western strength with only a 2.4% increase; San Diego was a bit under 5% at 4.8%. The Midwest and Northeast lagged. Boston was the strongest among this weak group with prices up 3.8%. The regional patterns and the weakness in new construction and new sales may reflect decreasing mobility – fewer people moving to different parts of the country or seeking jobs in different regions.”

The full report can be accessed here.