Prices

July 26, 2015

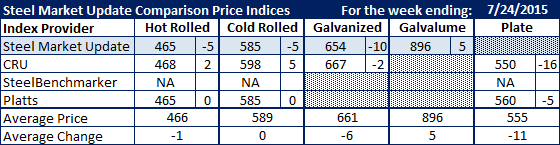

Comparison Price Indices: Out of the Shadows?

Written by John Packard

Flat rolled steel prices saw little movement this past week in benchmark hot rolled but, we did see some cracks in the “shadow” effect as the spreads between CRU and the other indexes started to widen. These small gyrations in the numbers in any one week may be due to what is being collected and from whom on a weekly basis. Platts may have taken the best approach by putting a number out there and never moving off it until the data is impressive enough to make a move.

Benchmark hot rolled is pretty much stuck at the $465 per ton average (remember the numbers we are reporting are averages of a wider range +/-). Both SMU and Platts are at $465 while CRU went up $2 per ton to $468 this past week. SteelBenchmarker did not report prices last week.

Cold rolled is seeing a bit of a split in the numbers as CRU went up $5 per ton to $598 per ton (.060” G90) while SMU moved back by $5 to $585 per ton and Platts remained the same at $585.

The galvanized index saw both SMU and CRU taking their averages lower by $10 and $2 per ton respectively. Like cold rolled, galvanized saw a widening of the spread between the two indexes with a $13 per ton difference between the indexes (same as cold rolled).

The Galvalume average was up $5 per ton according to the SMU index (.0142” AZ50, Grade 80) while plate prices dropped by $16 per ton according to CRU (Platts remained the same).

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.