Market Data

July 28, 2015

Durable Goods Shipments, Inventories and Orders

Written by Peter Wright

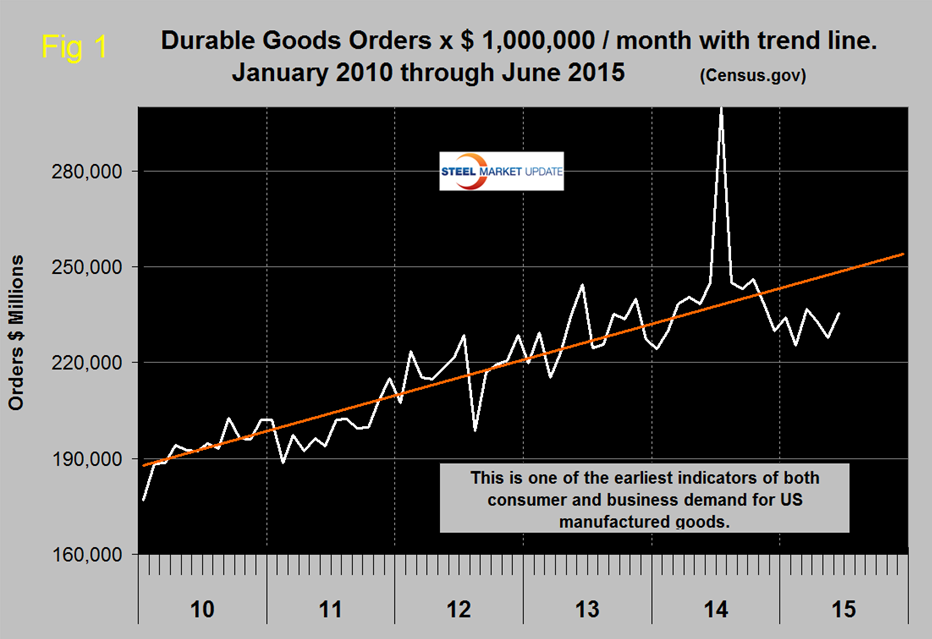

New orders for durable goods in June increased by 3.4 percent month on month to $235.337 billion. This exceeded analysts’ expectations but the strongest component was an increase in civil aircraft orders. Orders for motor vehicles and parts retained their strength. The three month moving average (3MMA) declined by 0.2 percent. The 3MMA has been trailing its trend for the last seven months (Figure 1)

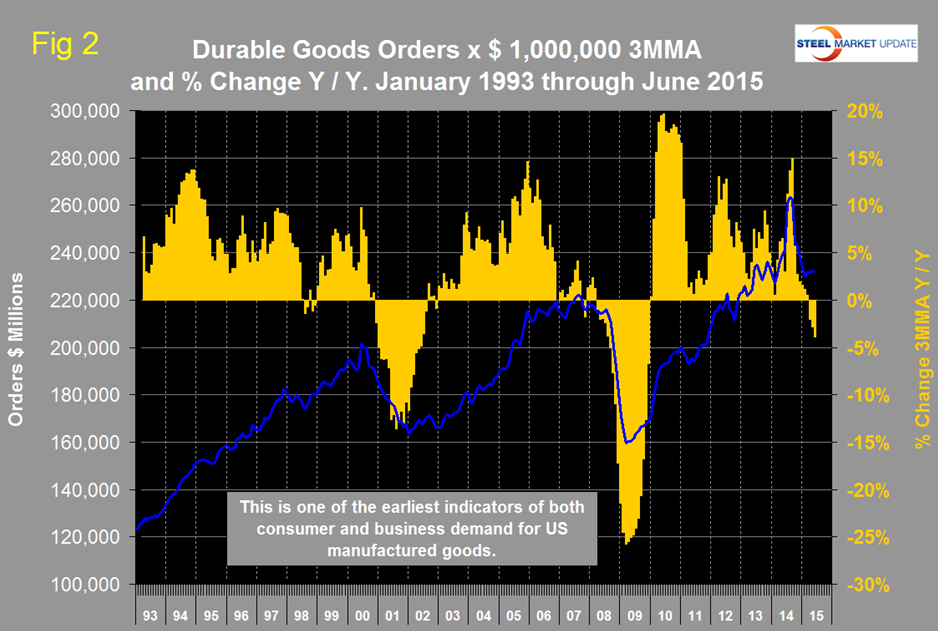

The huge spike in August was a manifestation of the surge in civil aircraft orders in July. The three month moving average, is shown in Figure 2 for the period January 1993 through June 2015.

The year over year growth rate of the 3MMA came in at negative 3.9 percent in June and has been deteriorating for nine straight months. This index is routinely whipsawed by both civil and military aircraft orders but we include it in our steel analyses because it is a reality check for other manufacturing data and is described by the Census Bureau as one of the earliest indicators for US manufactured goods.

The Federal Reserve Beige Book reported as follows on manufacturing on July 15th; “Manufacturing activity was uneven across Districts from mid-May through June. Philadelphia, Richmond, Atlanta, and Chicago reported that business activity increased. Boston reported mostly positive conditions, and St. Louis indicated that plans for manufacturing activity were positive since the previous report. In contrast, Cleveland, Kansas City, and Dallas reported a decline in activity. Minneapolis indicated mixed business activity, while New York and San Francisco reported flat conditions. Boston, Cleveland, and Dallas noted the strong dollar was dampening export demand, and slowdowns in the oil and gas industry were said to be negatively affecting orders in Cleveland, Chicago and Dallas.

Auto manufacturers and industry suppliers in some Districts reported strong demand, with the exception of Cleveland, which reported year-over-year declines in production at auto assembly plants. With only a few exceptions, fabricated and primary metal producers cited strong demand and solid growth was reported in the aerospace, construction, and plastics and rubber industries. Mixed or flat growth was reported in the chemical, electronics, food, and high-tech industries.

The Census Bureau press release issued on Monday read as follows:

Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders

New Orders for manufactured durable goods in June increased $7.7 billion or 3.4 percent to $235.3 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 2.1 percent May decrease. Excluding transportation, new orders increased 0.8 percent. Excluding defense, new orders increased 3.8 percent. Transportation equipment, also up following two consecutive monthly decreases, led the increase, $6.4 billion or 8.9 percent to $78.4 billion.

Shipments of manufactured durable goods in June, up following two consecutive monthly decreases, increased $0.3 billion or 0.1 percent to $239.4 billion. This followed a 0.3 percent May decrease. Transportation equipment, also up following two consecutive monthly decreases, drove the increase, $0.4 billion or 0.5 percent to $77.5 billion.

Unfilled Orders for manufactured durable goods in June, up following two consecutive monthly decreases, increased $1.0 billion or 0.1 percent to $1,195.8 billion. This followed a 0.5 percent May decrease. Transportation equipment, also up following two consecutive monthly decreases, led the increase, $0.8 billion or 0.1 percent to $799.5 billion.

Inventories of manufactured durable goods in June, up twenty-four of the last twenty-five months, increased $1.6 billion or 0.4 percent to $402.3 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 0.2 percent May decrease. Transportation equipment, up two of the last three months, led the increase, $0.7 billion or 0.5 percent to $130.8 billion.

Capital Goods: Nondefense new orders for capital goods in June increased $6.9 billion or 9.4 percent to $80.8 billion. Shipments decreased $0.1 billion or 0.2 percent to $78.6 billion. Unfilled orders increased $2.2 billion or 0.3 percent to $759.2 billion. Inventories increased $1.0 billion or 0.6 percent to $177.5 billion. Defense new orders for capital goods in June decreased $0.2 billion or 2.5 percent to $8.8 billion. Shipments increased $0.4 billion or 3.8 percent to $9.9 billion. Unfilled orders decreased $1.1 billion or 0.7 percent to $149.6 billion. Inventories increased $0.1 billion or 0.3 percent to $21.9 billion.