Market Data

October 13, 2015

Global Steel Demand to Gain 0.7% in 2016 After Drop in 2015

Written by Sandy Williams

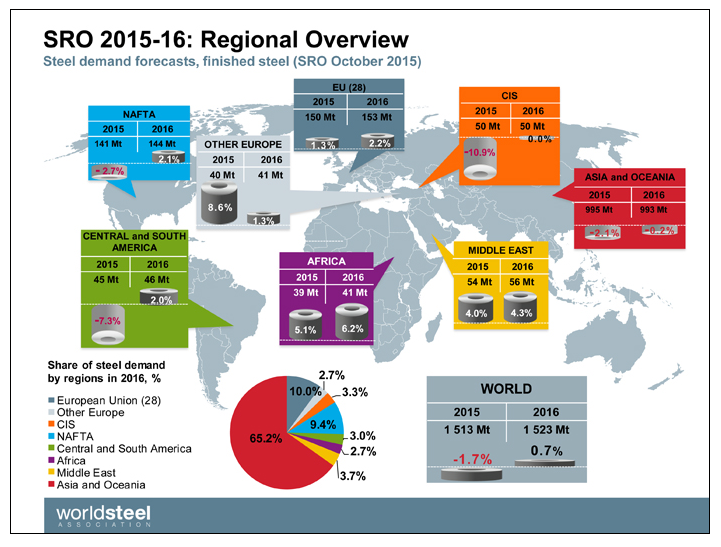

Global steel demand will decrease by -1.7 percent to 1,513 million tonnes in 2015, according to the World Steel Association’s Short Range Outlook for 2015 and 2016.

The 2015 decrease follows a gain of 0.7 percent in 2014, the same amount of growth that WSA expects to see again in 2016 as steel demand reaches 1,523 million tons.

“It is clear that the steel industry has, for the time being, reached the end of a major growth cycle which was based on the rapid economic development of China,” commented Hans Jürgen Kerkhoff, Chairman of the Worldsteel Economics Committee.

In addition to the China slowdown, the world steel industry has been affected by low investment, financial market turbulence and geopolitical conflict. The World Steel Association believes the headwinds will moderate in 2016 as the Chinese economy stabilizes. Emerging economies continue to be vulnerable to “external shocks” but demand in developed economies remains on track, said WSA, although slowing in momentum.

China negative growth during the rebalancing of its investment and real estate sector resulted in significant slowing of construction and manufacturing. As domestic demand for steel decreased, steel exports from the China increased, putting downward pressure on global steel pricing. Steel demand in China is expected to fall by -3.5 percent in 2015 and -2.0 percent in 2016.

China’s slowdown and widespread political instability has impacted emerging and developing economies. Russian and Brazil suffered severe contraction in steel demand and negative effects from geopolitical tension continue in the Middle East, Africa and Ukraine. ASEAN and MENA regions are expected to maintain growth momentum due to reform progress and positive domestic demand.

Steel demand in emerging and developing economies, excluding China, is forecast to grow by 1.7 percent in 2015 and 3.8 percent in 2016.

The World Steel Association expects a steel demand setback in the developed economies in 2015 followed by a return to growth in 2016. Currency appreciation and a struggling energy sector will result in negative growth in U.S. steel demand in 2015. Demand in the EU is expected to pick up as economic recovery expands aided by low oil prices, low interest rates and a weak Euro. Japan and Korea are expected to show negative growth in 2015.

Steel demand in the developed economies is expected to contract by -2.1 percent, followed by growth of 1.8 percent in 2016.

Steel demand in the world, excluding China, will grow by -0.2 percent in 2015 and 2.9 percent in 2016.

In an analysis for Steel Market Update, Peter Wright noted that there is a relationship between the growth of GDP and steel demand. In our premium newsletter Peter wrote:

“There are two interesting aspects to this relationship. First the cyclical change in steel demand is vastly more volatile than the change in GDP which we attribute to the inventory response throughout the supply chain. Secondly as discovered by our friends at “Steel Guru” 1% growth in GDP does not result in 1% growth in steel demand. At the global level it takes a 2.8% increase in GDP to get any increase in steel demand. This is a long term average over a period of 65 years and based on the added volatility of steel can be a predictor of the immediate future. For example, after the disastrous decline in steel demand in 2009 there was no doubt that a huge cyclical rebound would occur as inventory managers throughout the world began to react to the economic recovery. If the IMF forecast proves to be correct then the growth in steel demand will improve to around 3% by 2017.

“This is much better than current World Steel Association data through August which suggests that global steel demand will decline in 2015. In the US steel market it requires about 2% growth in GDP to generate growth in steel demand, therefore, again if current forecasts prove to be correct regarding the US economy, we can expect steel demand to expand through 2017 then tail off as we approach 2020.”

(Source: World Steel Association)