Market Data

December 2, 2015

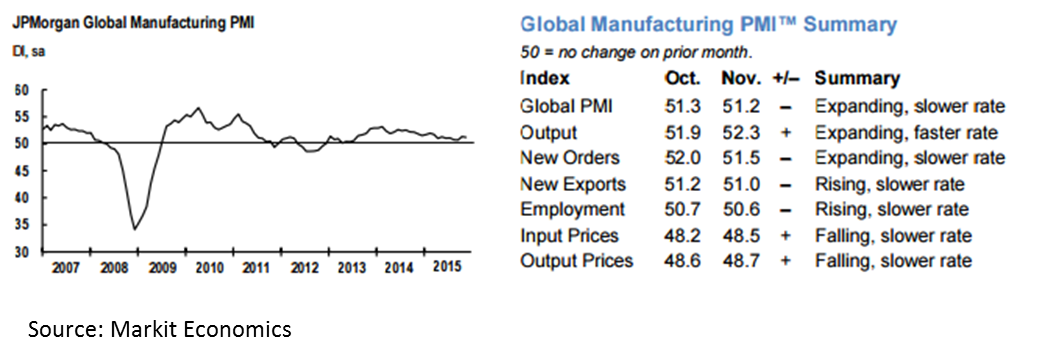

Global PMI Holds Steady at 51.2

Written by Sandy Williams

Global manufacturing was lackluster in November according to the Global Manufacturing PMI produced by JP Morgan and Markit Economics. The headline index registered 51.2, barely changed from 51.3 in October.

Commenting on the survey, David Hensley, Director of Global Economic Coordination at JP Morgan, said: “The global manufacturing PMI survey registered a second consecutive improvement in November. Based on the past relationship, the output index is consistent with 2.5% annualized growth in production. If realized, this would be a meaningful improvement over less than 1% pace recorded in the year-to-date.”

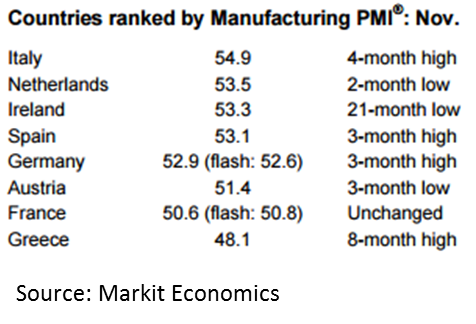

North America and Europe continued to show production expansion. Accelerated growth in Mexico more than offset a continued downturn in Canada. In the Eurozone output was at its fastest rate in 18 months. Almost all nations showed expansion except for Greece which saw a decrease in its rate of contraction.

Asian economies, other than Japan, mostly reported lower output. Input prices and output charges both fell.

North America

The Markit US PMI was at its lowest level in 25 months at a reading of 52.8. New orders rose at a weaker pace and new exports orders fell for the first time since August. Output slowed, backlogs decreased, and manufacturers continued to reduce pre-production inventory. Commodity prices and transportation costs declined in November. Markit said PMI results indicate an annualized growth rate of 2 percent for fourth quarter in the manufacturing sector.

“Growth is being driven by domestic demand, with exports falling back into decline,” said Chris Williamson, chief economist at Markit. ”The uncertain global picture and strong currency are key areas of worry to manufacturers, which led to a more cautious approach to hiring during the month. However, there’s nothing new that will overly concern policymakers, leaving the door open for rates to rise later in the month.”

Manufacturing in Canada remained in contraction in November but the decline in production slowed. New business levels dropped at a sharper rate although exports rebounded slightly. Input prices rose sharply due to higher costs for imported material. A slowing in the rate of cost inflation was linked by manufacturers to lower steel prices in the world market. The RBC Canadian Manufacturing PMI rose to 48.6 from 48.0 in October.

Mexico was a bright spot in North America with solid expansion of production volumes and new orders. Export demand was subdued with the slowest pace of growth in eight months due to weak global economic conditions. The PMI registered 53.0 in November, unchanged from the previous month.

The Eurozone Manufacturing PMI rose to 52.8 from 52.3 in October and has been in expansion for 29 consecutive months. Most nations saw an improvement in output and new orders. Inflationary pressure caused lower input costs and output charges. Employment levels rose for the fifteenth month. Although the Eurozone growth is modest, it is steady and providing new jobs. Greece posted a PMI reading of 48.1, the highest in seven months but still an indication of worsening operating conditions.

Asia

The Caixin China General Manufacturing PMI posted at 48.6 in November, up from 48.3 in October. Domestic demand continues to decline although export business picked up in November. Production output stabilized in November giving rise to hope of a recovery. Input prices continued to drop and savings were passed on to clients as lower selling prices. Dr. He Fan, Chief Economist at Caixin Insight Group said, “Overall, the economy is still on track to become more stable.”

Business conditions were relatively flat in Vietnam with new orders falling for the third month and exports for the sixth successive month. The PMI dropped to 49.4 from 50.1 in October. Andre Harker at Markit called the manufacturing sector “stagnant” and said challenging global economic conditions will slow Vietnam’s return to strong growth rates. South Korea business conditions were similar to Vietnam in November. An unstable economy and a drop in both domestic and export orders kept the PMI at 49.1 and in contraction.

Japan reported strong manufacturing conditions in November as new orders and production increased at marked rates. Employment and buying activity expanded as a result. The PMI rose to 52.6 from 52.4, and to its highest reading in 20 months. High input costs continue to plague manufacturers but Markit says the rate of inflation was weak historically.

Russia

Manufacturing conditions were mostly flat in November with the PMI of 50.1 hovering just above the neutral no-change mark. Production increased modestly and was linked to agricultural activity. Domestically, new orders rose to a one year high, but new export orders continued to contract. Input buying is down, reflecting a shortage of raw material and semi-finished goods. Input prices rose in November as did output charges. Finished goods inventories declined for the nineteenth consecutive month.