Analysis

March 23, 2016

US Vehicle Sales and NAFTA Vehicle Production in February 2016

Written by Peter Wright

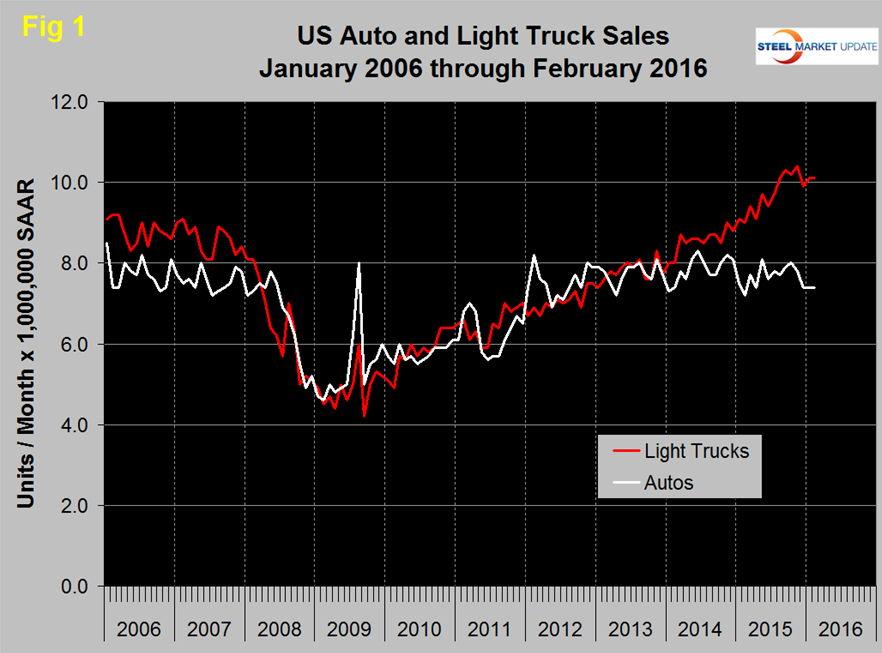

US vehicle sales in February were the strongest for that month in 15 years with a seasonally adjusted annualized rate (SAAR) of 17.5 million units, up from 16.4 million in February last year. Figure 1 shows auto and light truck sales since January 2006.

Auto sales have been essentially flat for four full years as all the growth has occurred in light trucks which include crossovers. Improved unit fuel consumption and low gasoline prices are no doubt two of the major drivers of this change. In February auto sales were 7.4 million units or 42.3 percent as light trucks were 10.1 million units or 57.7 percent. In February, import market share at 20 percent was the lowest since September 2009 when our import data began.

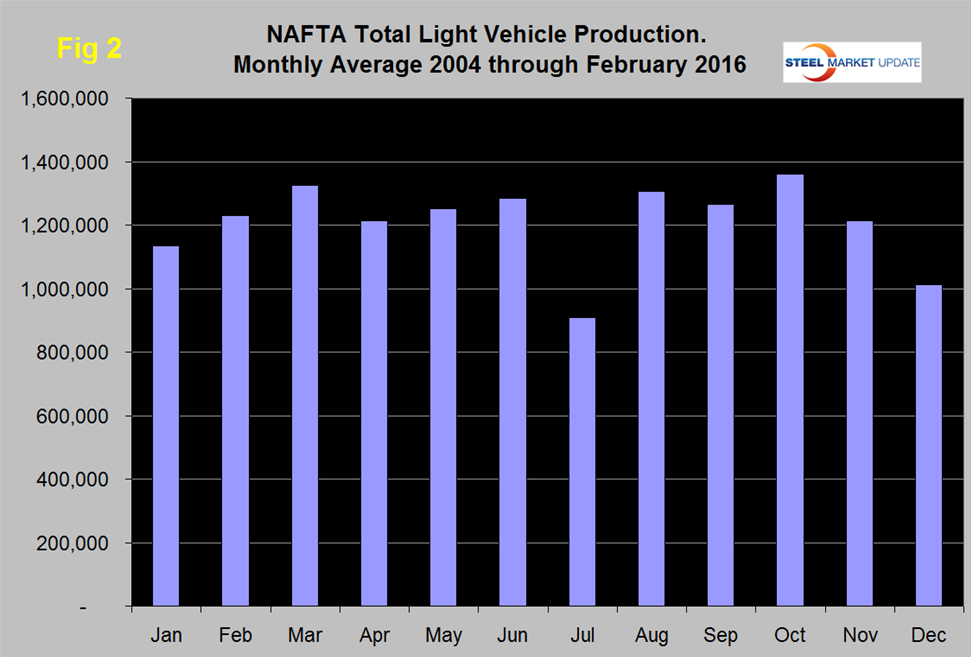

Total light vehicle (LV) production in NAFTA in February was at an annual rate of 18.216 million, up from 16.137 million units in January. Total production in 2015 was 17.361 million units. In cases where seasonality is more than a weather effect we like to compare the monthly result with the monthly norm over a number of years. On average since 2004, February’s production has been 8.2 percent more than January. This year February was 12.9 percent more than January (Figure 2).

Note that these production numbers are not seasonally adjusted, the sales data reported above are seasonally adjusted. On a three month moving average basis (3MMA) February production was up by 4.8 percent year over year. February production was the highest for that month since February 2000. History tells us that we can expect assemblies to continue to expand in March.

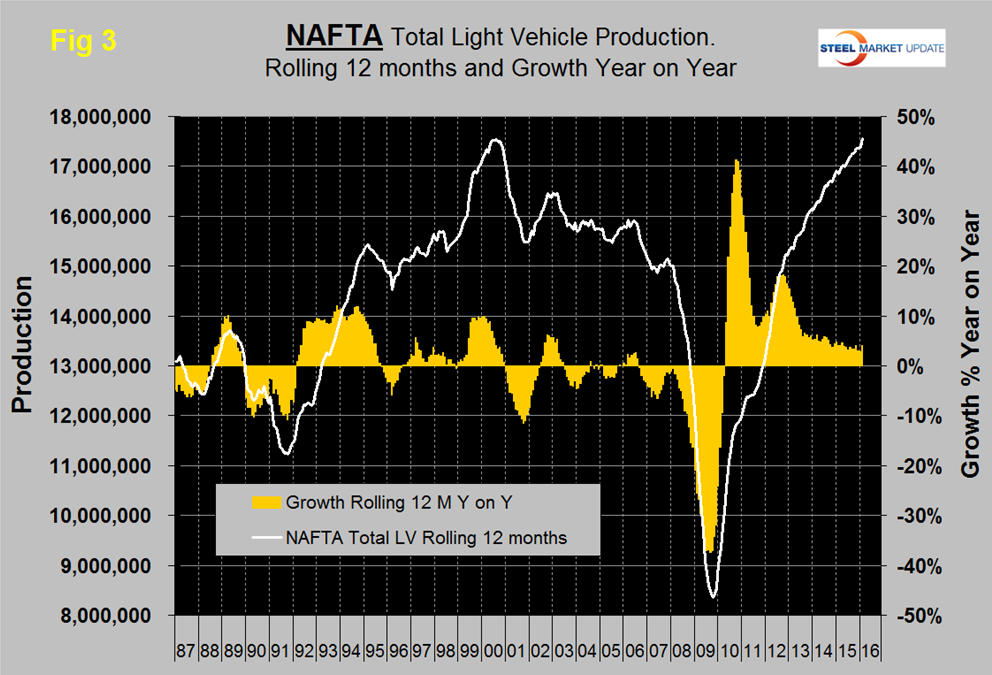

On a rolling 12 months basis y/y through February, LV production in NAFTA increased by 4.1 percent up from 2.6 percent in 12 months through January. LV production in NAFTA on a rolling 12 month basis was at an all-time high in February at 17.551 million units which slightly exceeded the previous high of 17.530 set in 12 months through August 2000 (Figure 3).

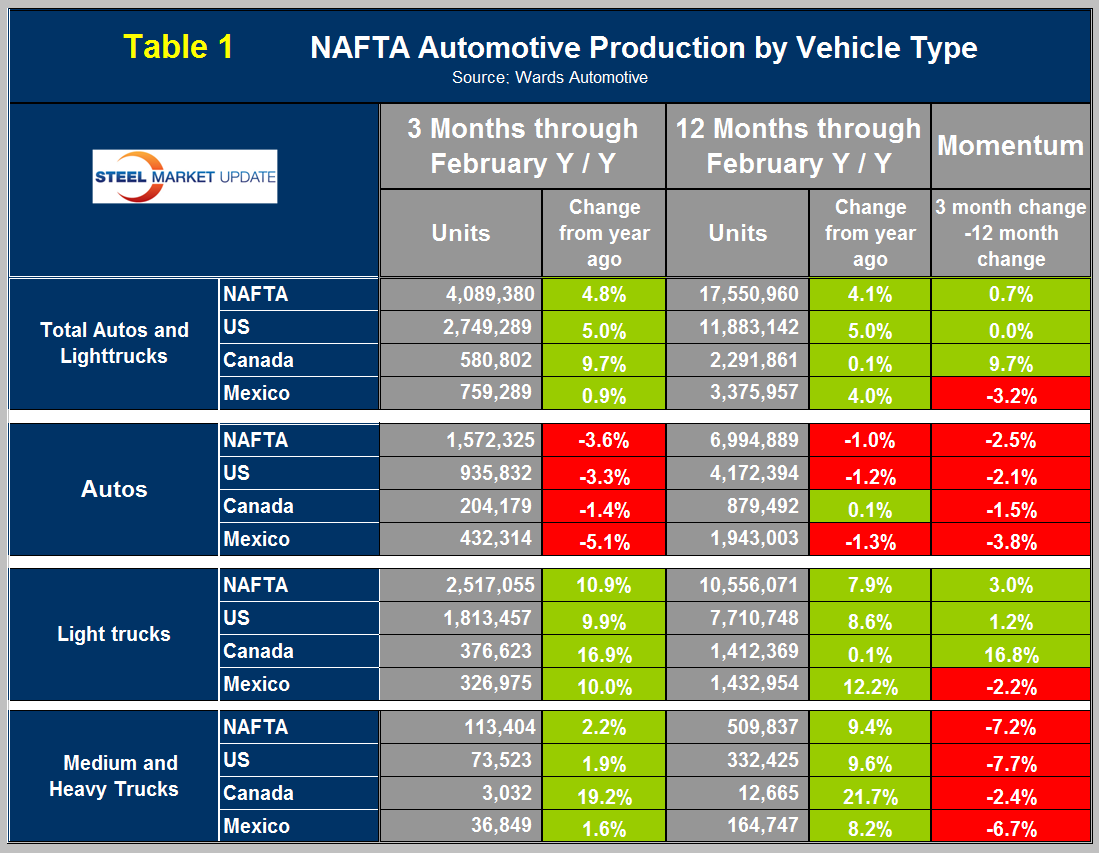

On a rolling 12 months basis y/y the US is up by 5.0 percent with zero momentum, Canada is up by 0.1 percent with positive momentum and Mexico is up by 4.0 percent with negative momentum (Table 1).

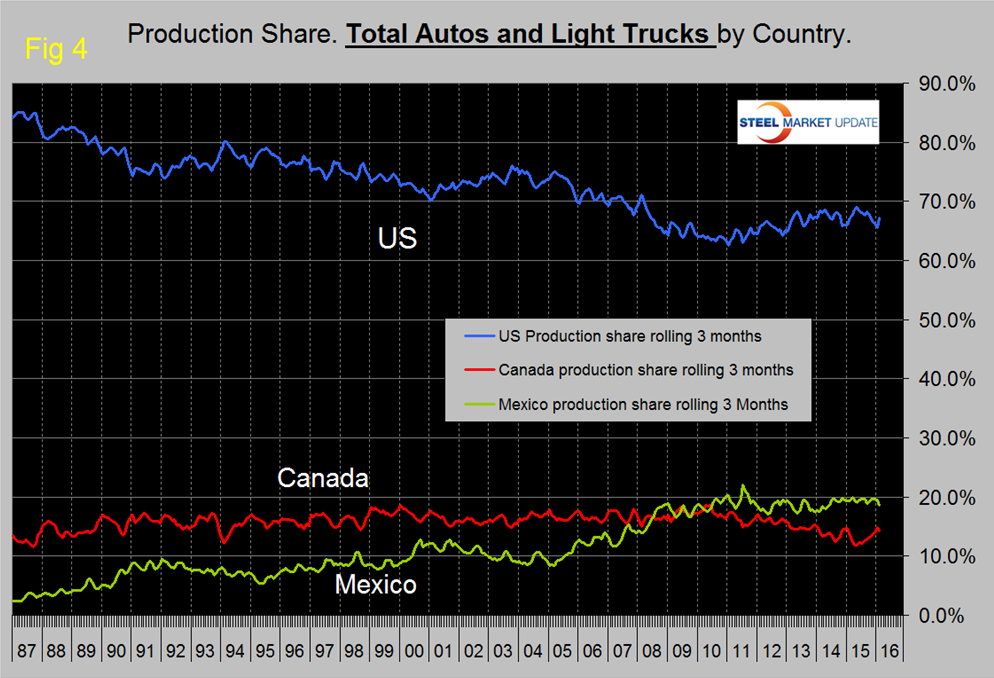

Mexico has had negative momentum for ten straight months and in eleven of the last twelve months. The US has gained production share in the most recent 3.5 years (Figure 4) at the expense of Canada though that trend has slowed.

Mexico’s share has been fairly flat for five years and extremely flat for the last 18 months. In February on a rolling three month basis, the US production share of total light vehicles was 67.2 percent, Canada’s was 14.2 percent and Mexico’s was 18.6 percent.

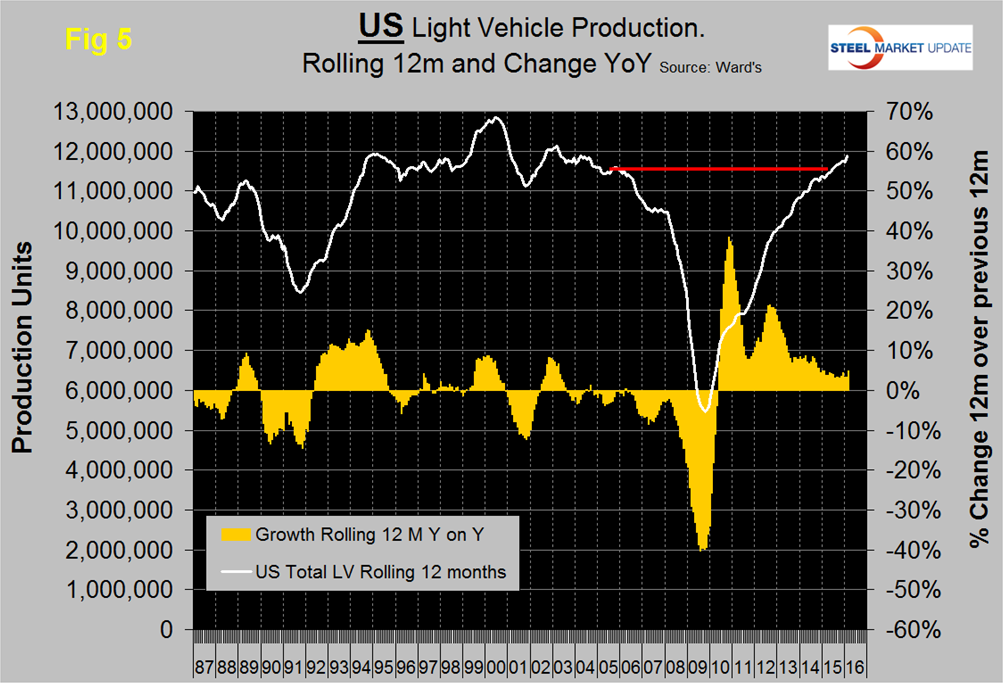

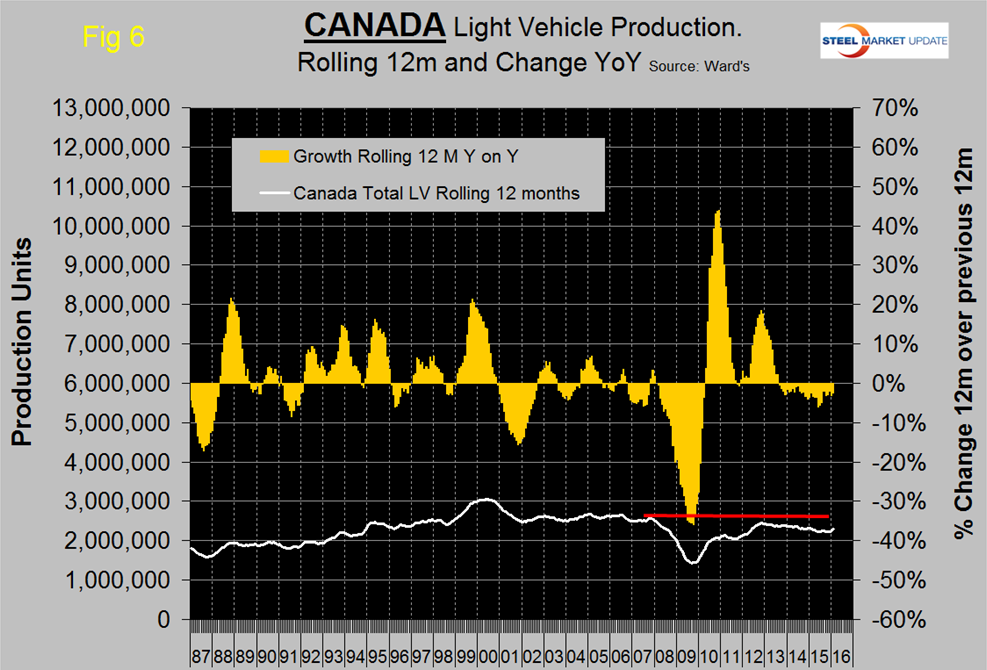

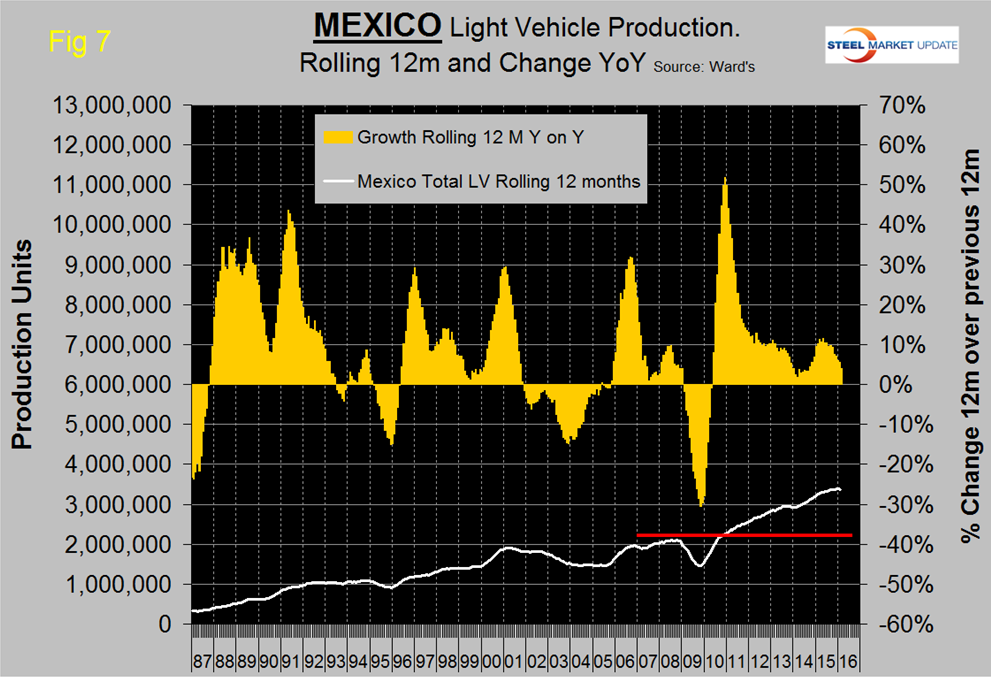

Figure 5, Figure 6 and Figure 7 show total LV production by country with y/y growth rates and on each the red line shows the change in production since Q2 2006.

Note the scales are the same to give true comparability and that Mexican growth has slowed significantly this year and is now the same as the US. Canada continues to contract. During the recession Mexico declined by less than the US and bounced back by more during the recovery. This caused Mexico’s production share to surge until Mid-2011 at the expense of the US.

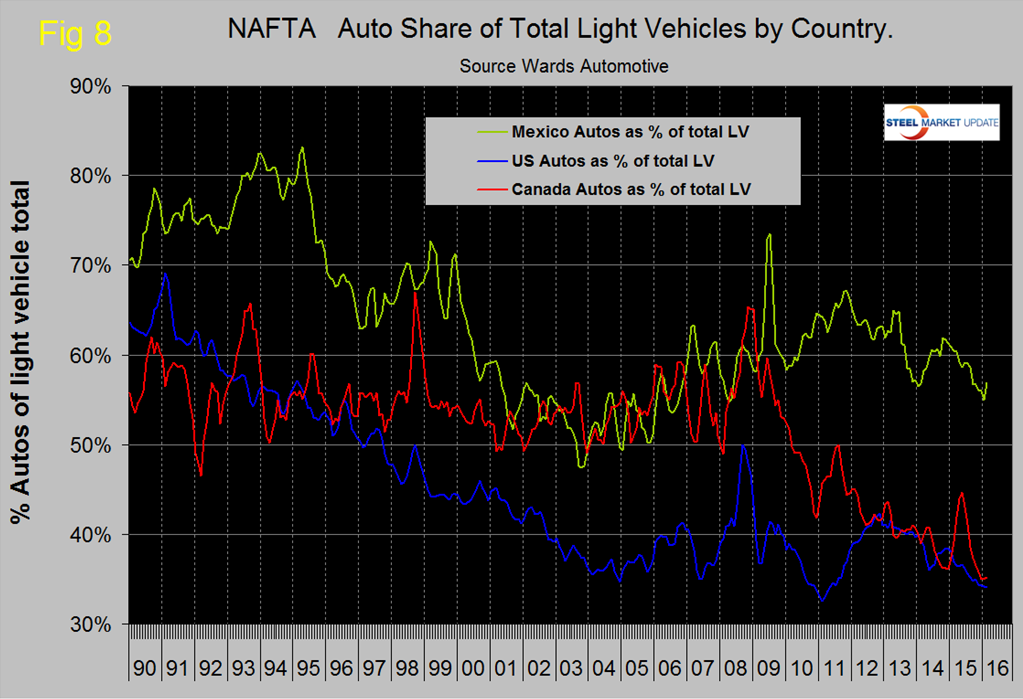

The percentage of light trucks in the production mix of all three countries has been increasing, driven by consumer buying preferences as described above, however in February the share of autos in Mexico’s product mix increased by 2.0 percent. The change in preference for light trucks tends to favor the US and Canada over Mexico because the mix of light vehicles is very different by country (Figure 8).

The percentage of autos in the Mexican mix in the last three months was 56.9 percent but only 34.0 in the US and 35.2 percent in Canada. This means that Mexico has staked out a higher relative capacity in autos which will serve it well when gas prices eventually rebound. The light truck component of the US light vehicle mix has been increasing for over three years and in Canada for six years.

Ward’s Automotive reported this week that total light vehicle inventories in the US decreased by 9 days of sales in February to 69 days which was the same as February last year. Month over month FCA (Fiat Chrysler Automotive) was down by 14 days to 89, Ford was down by 16 to 84 and GM down by 7 to 67 days.

The SMU data file contains more detail than be shown here in this condensed report. Readers can obtain copies of additional time based performance results on request if they wish to dig deeper. Available are graphs of auto, light truck and medium and heavy truck production and growth rate and production share by country.