Prices

September 28, 2017

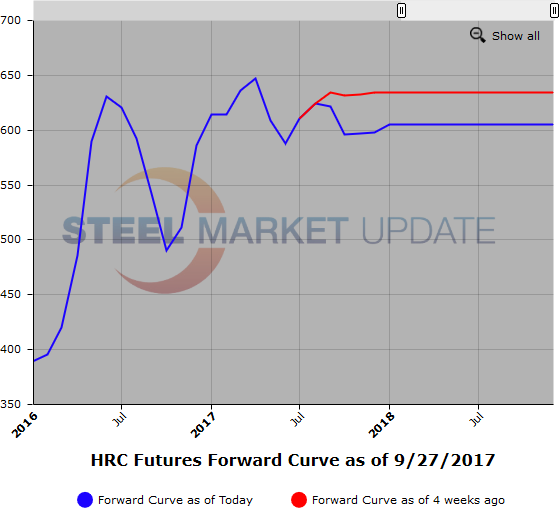

Hot Rolled Futures: Reaching New Near-Term Lows

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

HR futures have been pretty active the last week as sellers reached and we hit a new near-term low in prices touching $590/ST[$29.50/cwt] for Q4’17 on Monday. HR futures traded almost 33,000 ST in Q4’17 at an average weighted price of $596/ST[$29.80/cwt] and over 16,000 ST in Q1’18 at an average weighted price of $602/ST[$30.10/cwt]. The total volume was just shy of 60,000 ST with open interest at 15,700 lots or 314,000 ST. Softer global steel prices across the supply chain along with retracing scrap prices gave the U.S HR futures a push below the September $622/ST CME settlement.

The shape of the futures curve from spot month forward is slightly upward sloping with Q4’17 trading at over a $20/ST discount to recent reported spot prices. The latter part of this week, HR futures have consolidated and found some support following no change in the latest week’s HR index that the CME tracks. Today Nov-Dec’17 traded at $600/ST in 1,000 ST per month.

The higher volumes have resulted from price levels that appear to represent better value than just a few weeks back.

Below is a graph showing the history of the hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.

Scrap

LME steel scrap prices continue to retreat. Spot is down over $15/MT from a week and a half ago. Lack of Turkish buying in the export scrap market has helped to push prices lower along with falling global steel prices. Futures volumes have also retreated as the market awaits the next round of negotiated cargoes to gauge demand going into year end.

The soft export markets also have put pressure on BUS markets as last month’s sideways values and softer purchases by mills left potential excess material. Impact of storm damage in both Texas and Florida is clouding the picture going into year end. The chatter for October has BUS prices falling $10/$20 per GT. This past week, Dec’17 traded at $340/GT in 1,000 GT. Futures sellers have been slow to reach lower. Last Q4’17 offers were coming in at $360/GT. Last Friday, the metal margin for Dec’17 futures was at $265 with Dec’17 HR trading at $605/ST and BUS trading at $340/GT.

Below is another graph showing the history of the busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.