Market Data

December 1, 2017

BLS: Another Strong Jobs Report in November

Written by Tim Triplett

The U.S. employment situation in November was excellent, according to the Bureau of Labor Statistics’ (BLS) net job creation report released on Friday. While employment was down by 14,000 jobs from October, it was still the third best month of the year and in agreement with the other data streams tracked by Steel Market Update.

Net job creation in November totaled 228,000 positions. September was revised up by 20,000 and October down by 17,000. Wall Street Breakfast reported that this strong result will likely prompt the Fed to hike interest rates next week for the third time and will push central bank officials toward a more aggressive monetary policy in 2018.

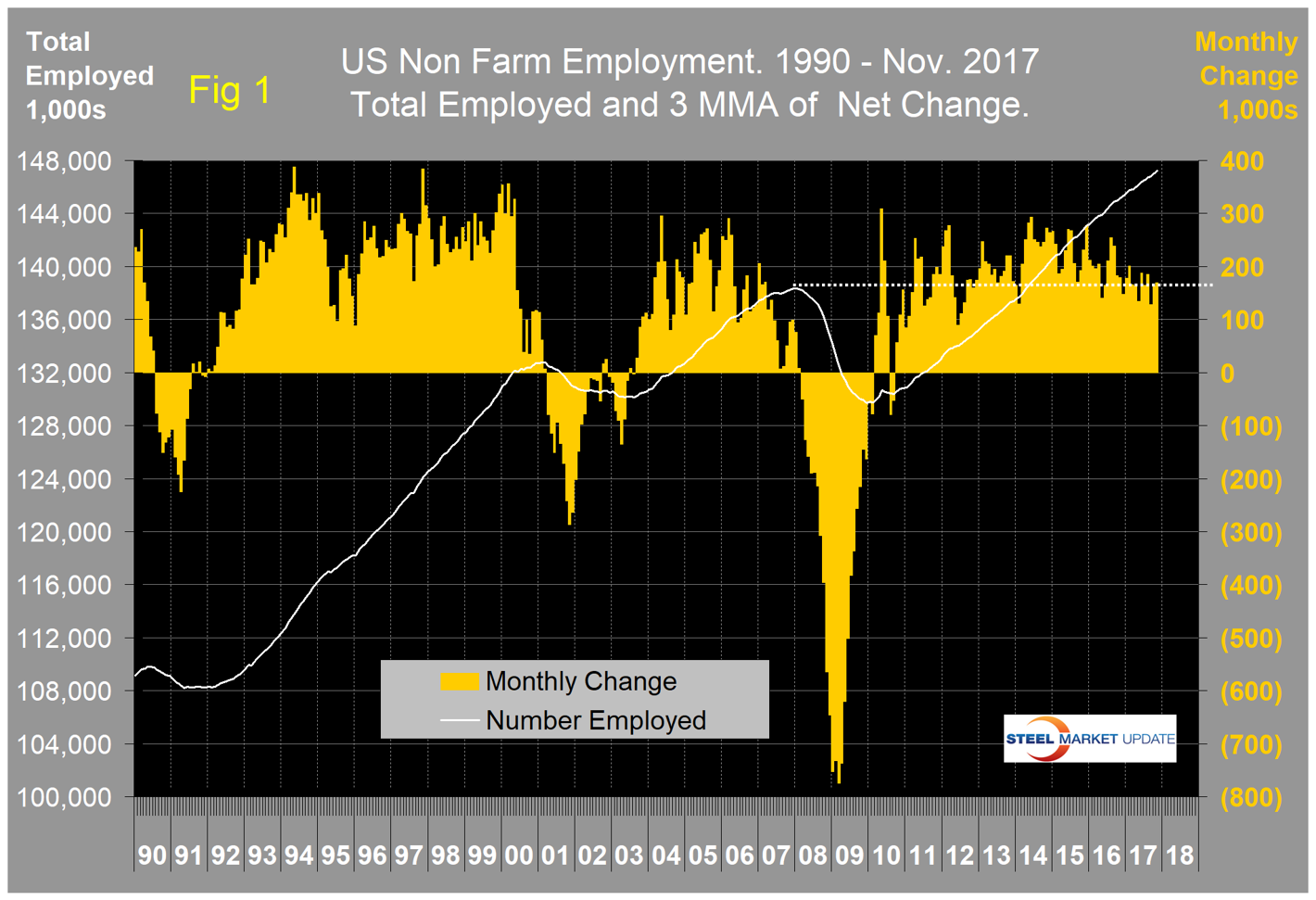

Figure 1 shows the three-month moving average (3MMA) of the number of jobs created monthly since 1990 as the brown bars. The white line tracks the number employed. The results are seasonally adjusted by the BLS.

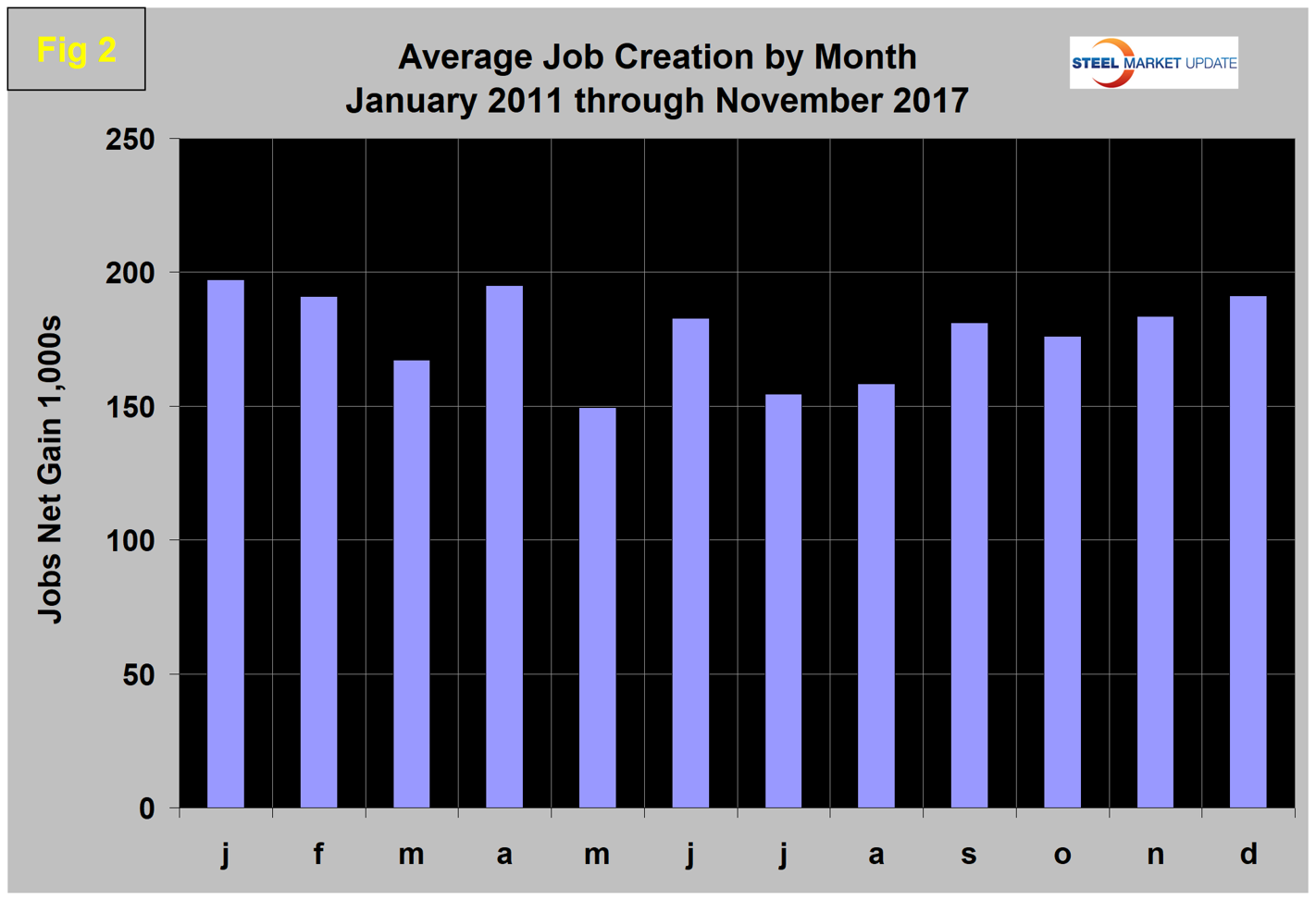

To examine if any seasonality is left in the data after adjustment, we have developed Figure 2. In the seven years since and including 2011, job creation in November has been up by 4.4 percent. This year, November was down by 7.0 percent. September job creation was severely depressed by the Texas and Florida hurricanes, October rebounded strongly, which made the November/October comparison unfavorable.

Total nonfarm payrolls are now 8,876,000 more than they were at the pre-recession high of January 2008. At the end of November, 147,241,000 people were employed. Economy.com reported: “There is little on the horizon that could dampen growth thanks to a solidly improving global economy and improving domestic spending power. The economy is not developing serious imbalances or bubbles that could wreak havoc. While instability in certain parts of the globe could alter the situation, such events cannot be predicted.”

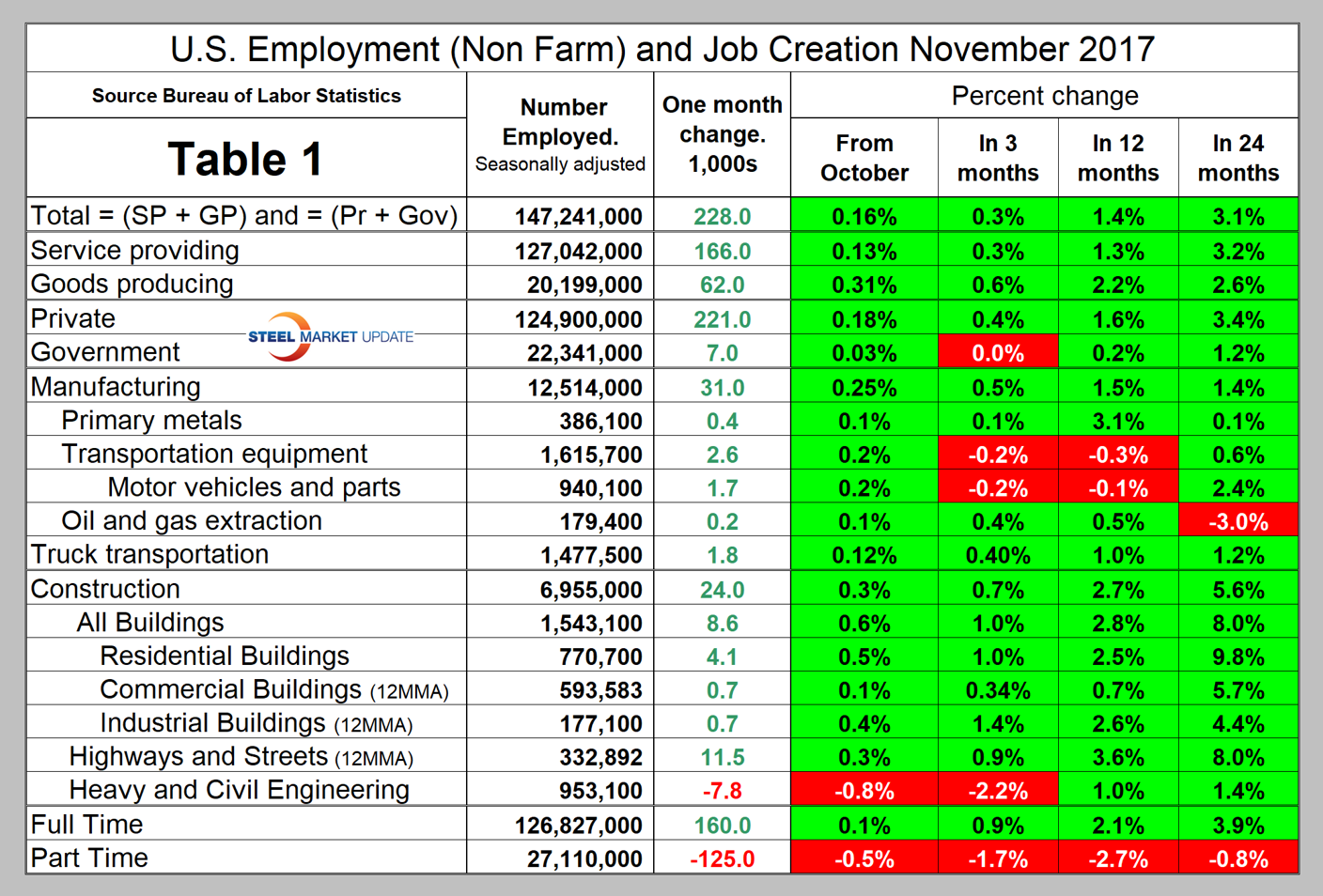

Table 1 breaks out the total number employed into private, government, service and goods-producing industries and the change in those sectors in the latest month of data. It includes the percentage growth in three, 12 and 24 months. Most of the goods-producing employees work in manufacturing and construction. We have identified the components of these two sectors that are most relevant to steel consumption. In November, 221,000 jobs were created in the private sector and government gained 7,000. Not relevant to steel but of interest from a taxpayer’s point of view, the federal government lost 3,000 jobs, state governments gained 1,000 and local governments gained 9,000 jobs.

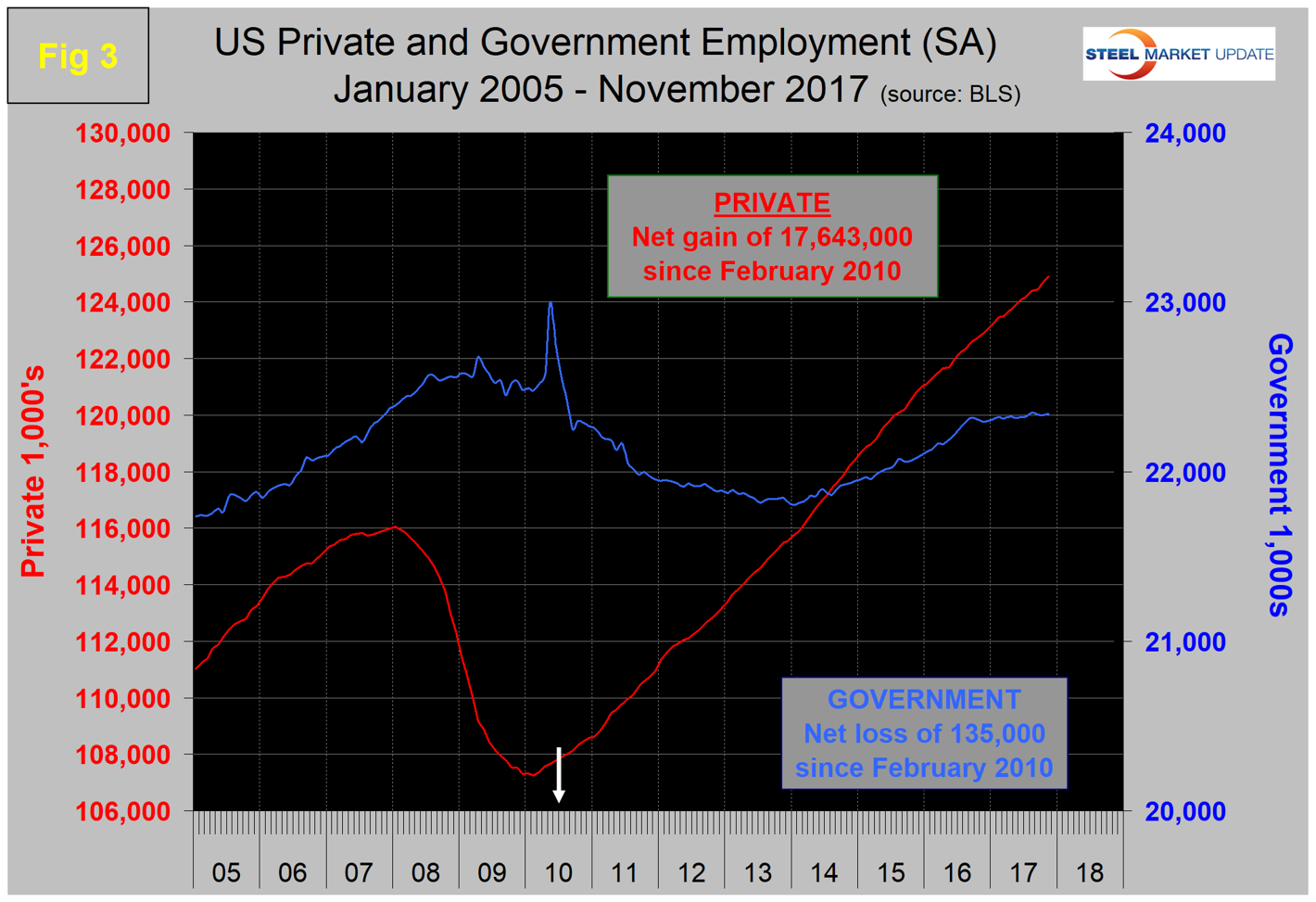

Since February 2010, the employment low point, private employers have added 17,643,000 jobs as government has shed 135,000 as shown in Figure 3. (The spike in government employees in May 2010 was the temporary employment of census workers). The increase in government employment has been stalled for over a year. In November, service industries gained 166,000 jobs as goods-producing industries gained 62,000. Goods-producing industries are mainly construction and manufacturing. February, August and November 2017 were the best months for goods-producing industries since April 2014. Service industries have added 14,936,000 and goods-producing 2,572,000 positions since the low point of the recession. The widening of the gap between services and goods-producing is part of the reason why wage growth has been slow since the recession as service industries on average pay less than goods-producing industries such as manufacturing.

In November, manufacturing gained 31,000 positions, which was the second-best month since October 2015. Manufacturing employment has increased by 0.5 percent in three months and by 1.5 percent in 12 months and has added 171,000 jobs this year. Table 1 shows that primary metals have done better than manufacturing as a whole in the last 12 months, but have lost ground in the last three months. Within the big picture of manufacturing, all the sectors that we routinely track have had positive growth in the last month except for transportation equipment, including vehicles and parts, which has lost jobs in the last year. Truck transportation lost ground in five of the first 11 months of this year, but the last three months have been positive. Note the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those that we think have most relevance to the steel industry.

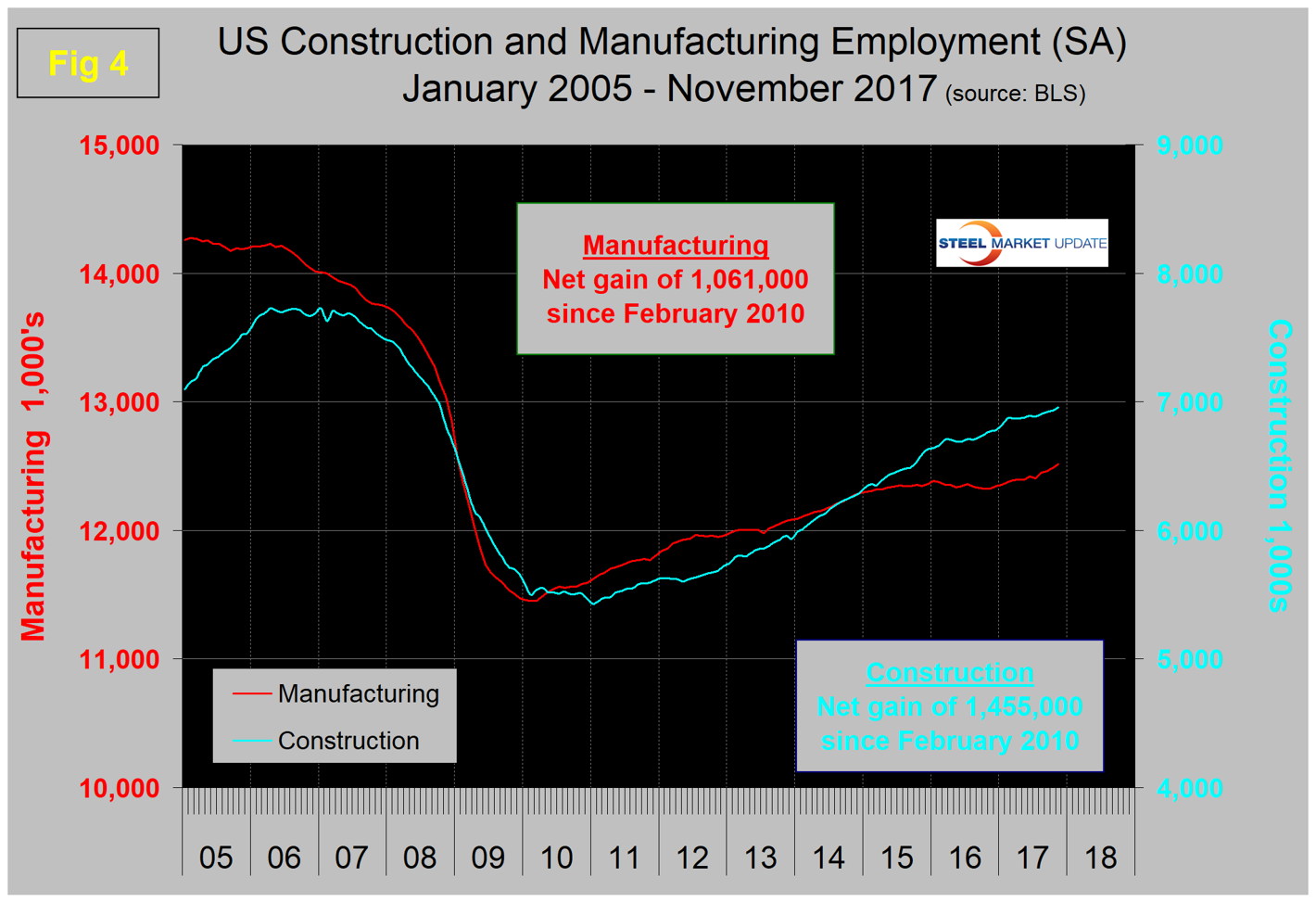

Construction was reported to have gained 24,000 jobs in November and is up by 172,000 in the first 11 months of 2017. Some of the major construction subcategories are routinely reported one month in arrears, which distorts the data in Table 1. These include industrial buildings, commercial buildings and highways and streets. Construction has added 1,455,000 jobs and manufacturing 1,061,000 since the recessionary employment low point in February 2010 (Figure 4). Construction has leapt ahead of manufacturing as a job creator, but the growth of construction productivity is very low (or non-existent) in contrast to manufacturing, which historically has been much higher. The difference is the difficulty of automating construction jobs.

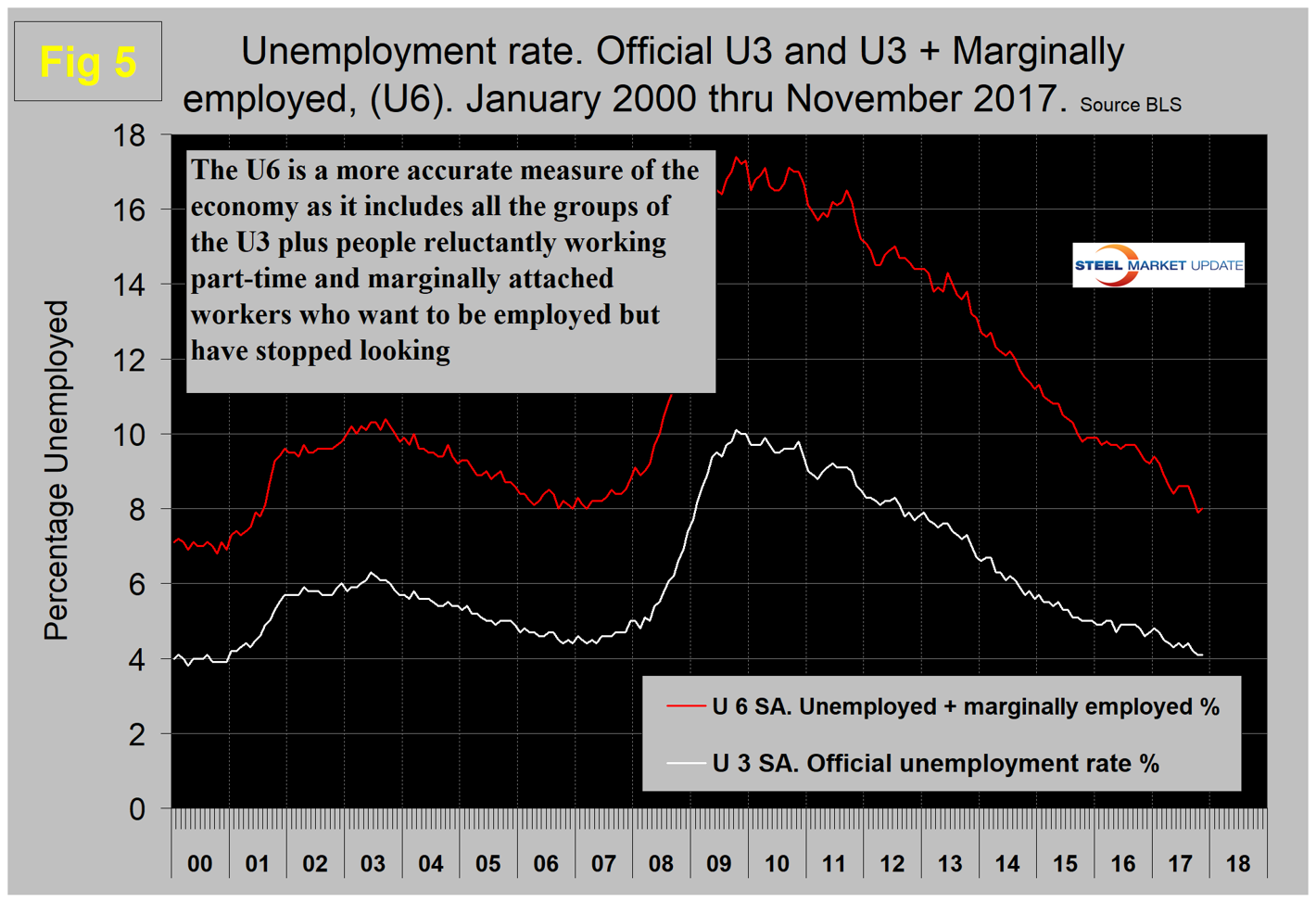

The official unemployment rate, U3, reported in the BLS household survey (see explanation below), came in at 4.1 percent in November, which was the same as October and down from 4.9 percent in September last year. This number doesn’t account for those who have stopped looking. The more comprehensive U6 unemployment rate was down from 9.7 percent in November 2016 to 8.0 percent in November 2017 (Figure 5).

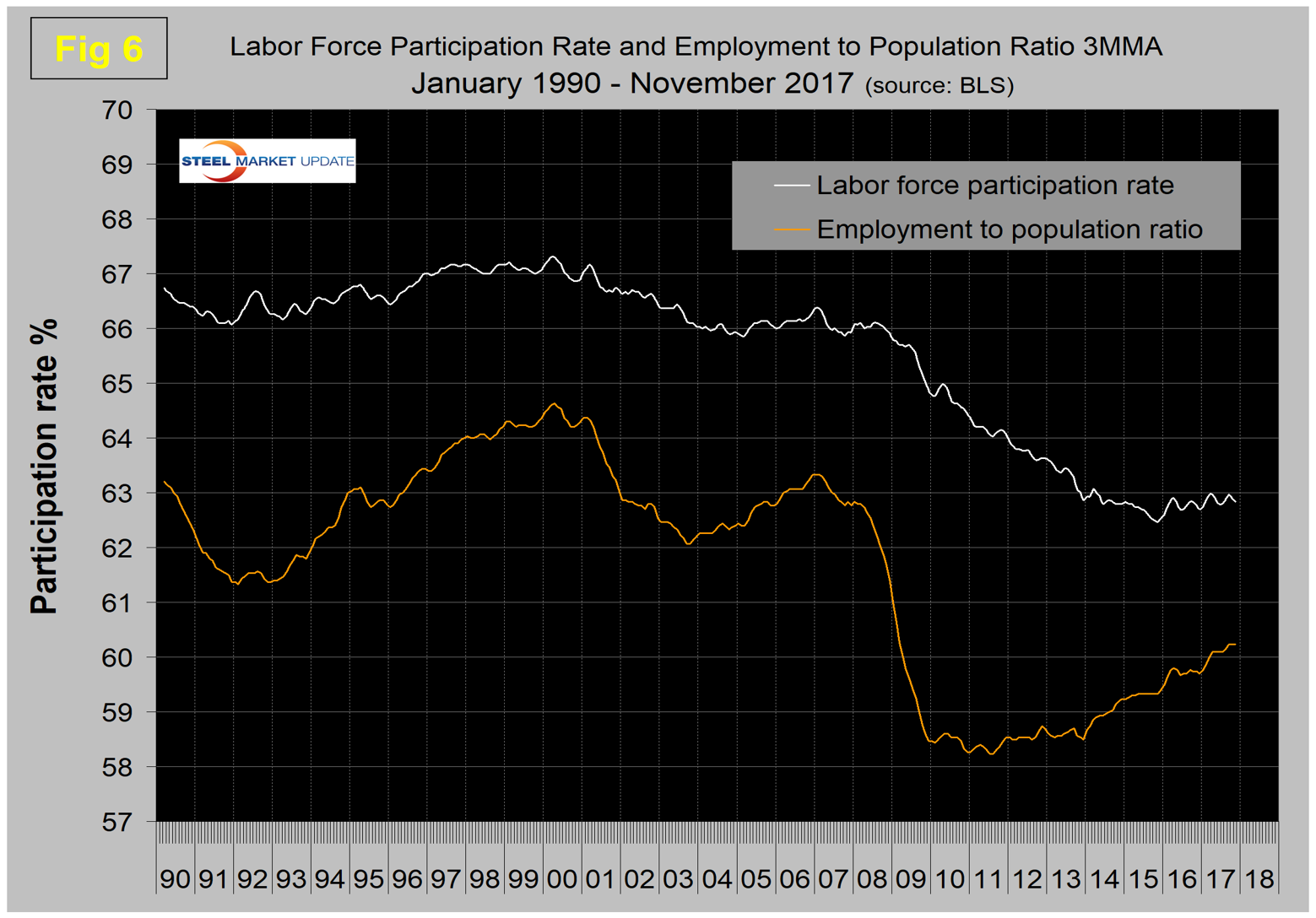

U6 includes workers working part time who desire full-time work and people who want to work but are so discouraged they have stopped looking. The differential between these rates was usually less than 4 percent before the recession. October and November were the first months to fall below a 4.0 percent differential since the recession. The employment participation rate at 62.7 percent in November hasn’t changed much in over 18 months. The Labor Force Participation Rate is a simple computation: the civilian labor force (people age 16 and over employed or seeking employment) divided by the civilian non-institutional population (those 16 and over not in the military or committed to an institution). The result is the participation rate expressed as a percent. Another measure is the number employed as a percentage of the population, which seems to us to be more definitive. In November, this measure was 60.1 percent, up from 59.7 percent in October last year and from 59.3 percent in November 2015. Figure 6 shows both the participation rate and the employment-to-population ratio on the same graph. It has been estimated that the economy needs to create about 150,000 jobs per month to keep up with population growth. In the last 12 months, the average monthly job creation has been 161,000, therefore the ratio to population has improved.

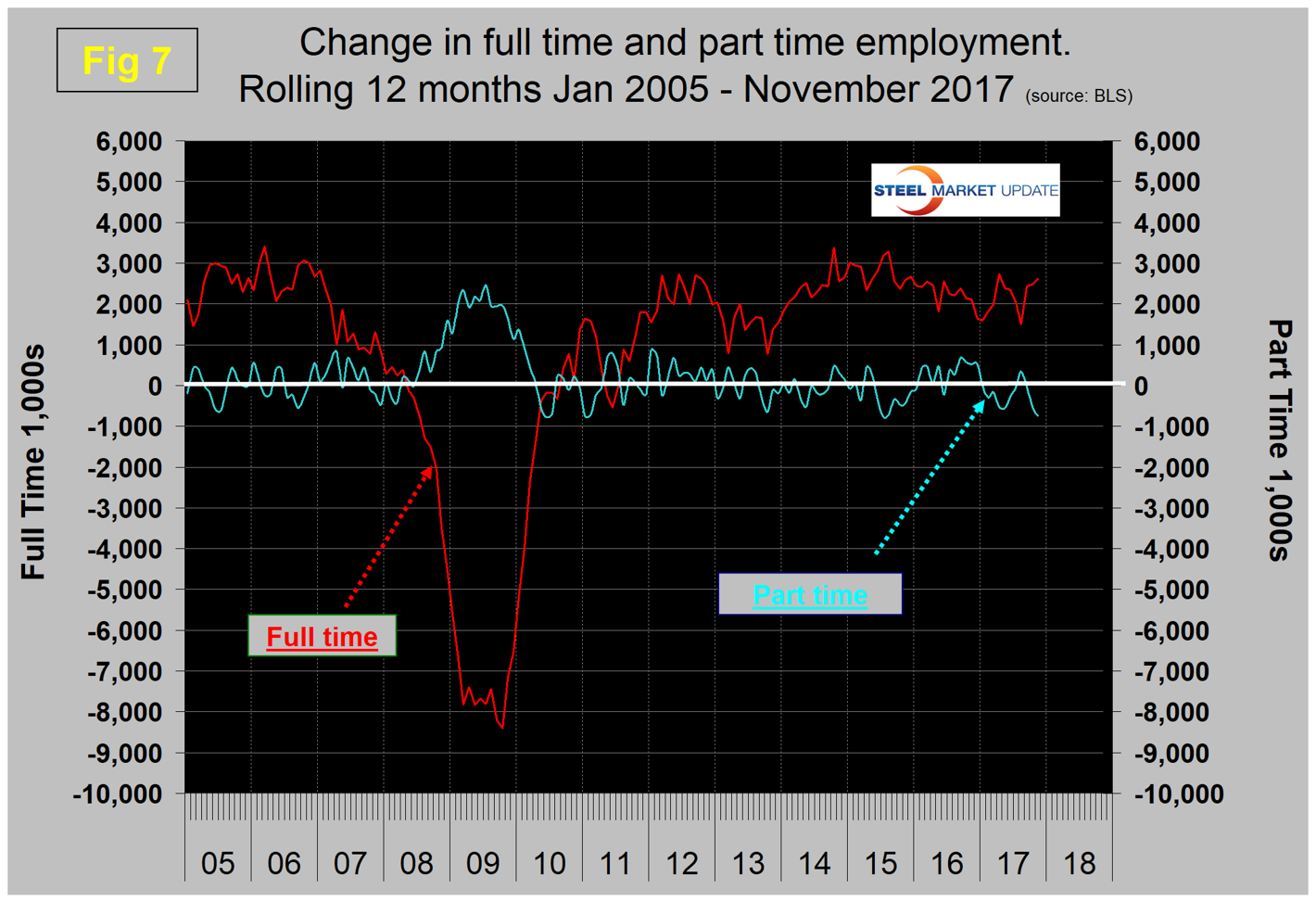

On a rolling 12-month basis, 2,614,000 full-time jobs have been created and 744,000 part-time jobs have been lost. Figure 7 shows the rolling 12-month change in both part-time and full-time employment. This data comes from the household survey and part-time is defined as less than 35 hours per week. Because the full-time/part-time data comes from the household survey and the headline job creation number comes from the establishment survey, the two cannot be compared in any particular month. To overcome the volatility in the part-time numbers, we must look at longer time periods than a month or even a quarter, which is why we look at a rolling 12 months for this component of the employment picture shown in Figure 7.

The job openings report known as JOLTS is reported on about the 10th of the month by the Federal Reserve and is over a month in arrears. Figure 8 shows the history of unfilled jobs through September when openings stood at 6,093,000 positions. July was an all-time high at 6,140,000. There has been an improving trend since mid-2009.

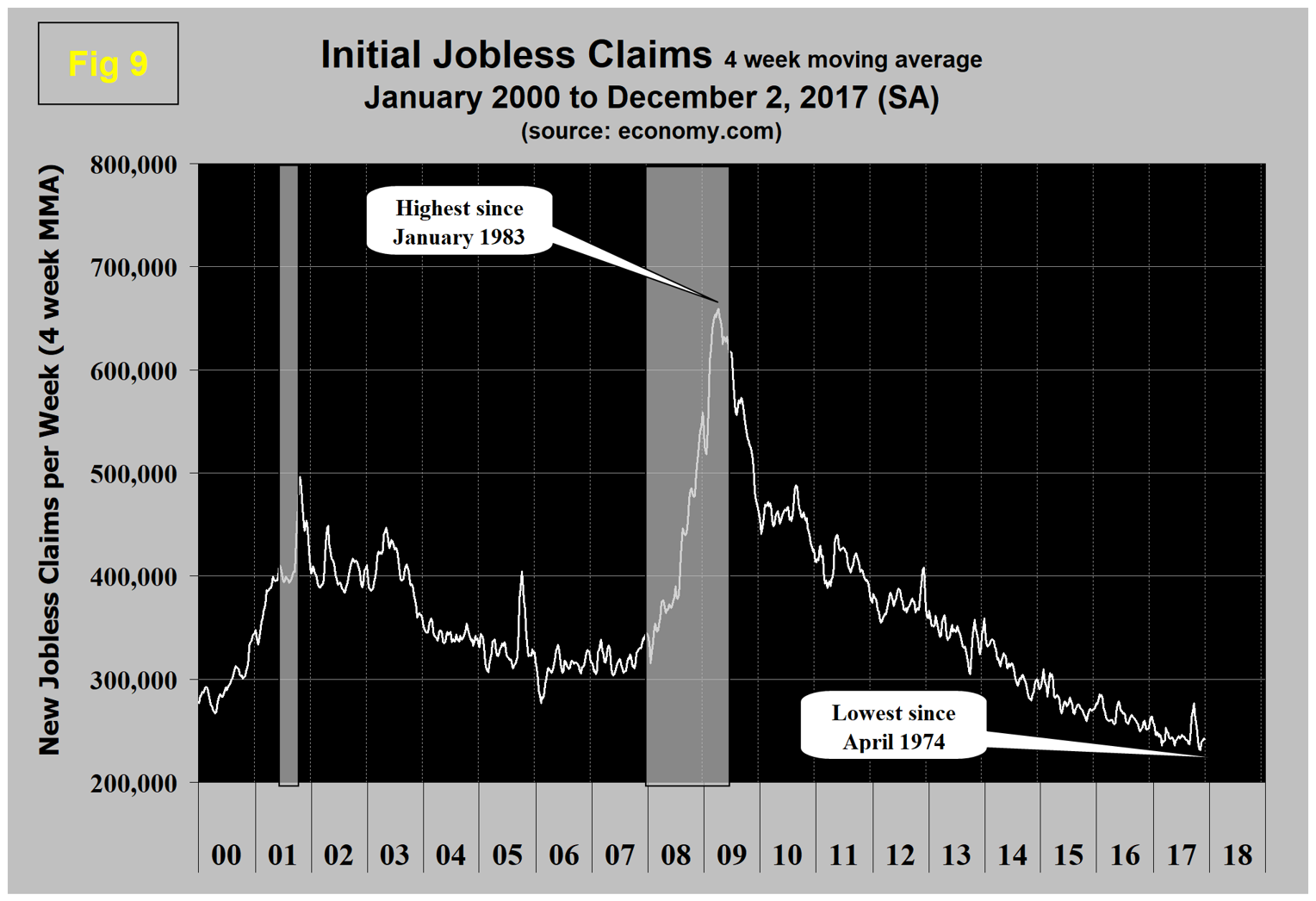

Initial claims for unemployment insurance, reported weekly by the Department of Labor, have decreased after the dramatic September surge that was driven by the Texas and Florida hurricanes. We always report a four-week moving average of this data to smooth out short-term variations, but even so the surge was quite dramatic. This is the longest streak since 1973 of initial claims below 300,000 (Figure 9).

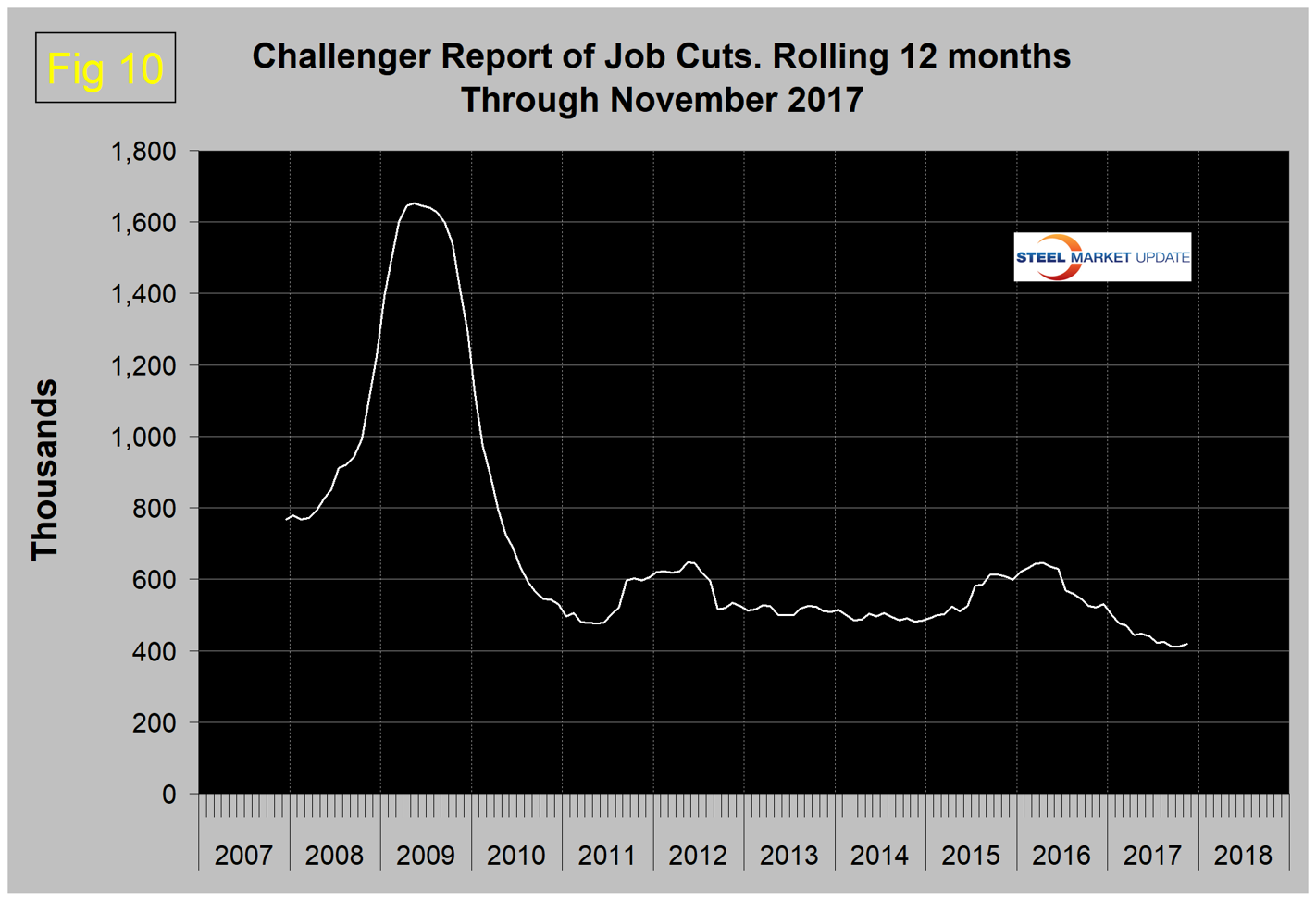

The last piece of the employment puzzle that we examine is the Challenger report, which measures job cuts monthly (Figure 10). This data also tends to be quite erratic, therefore again we examine a rolling 12 months and can see that job cuts decreased for most of 2016 and continued their downward trend in 2017.

SMU Comment: November 2017 was the 92nd consecutive month of job growth on a 3MMA basis. The mid-90s had a streak of 96 months, which was the longest sustained period of job growth since the 1940s. The November report continues to be encouraging with a high rate of job creation and good results for manufacturing and construction. Initial claims for unemployment insurance are near a 43-year low, job openings are near an all-time high and part-time jobs have morphed into full-time. These trends will result in increased earnings and spending, which will support both GDP and steel consumption.

Explanation: On the first Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS reports on the results of two surveys. The Establishment survey reports the actual number employed by industry. The Household survey reports on the unemployment rate, participation rate, earnings, average workweek, the breakout into full-time and part-time workers and lots more details describing the age breakdown of the unemployed, reasons for and duration of unemployment. At SMU, we track the job creation numbers by many different categories. The BLS database is a reality check for other economic data streams such as manufacturing and construction, and we include the net job creation figures for those two sectors in our “Key Indicators” report. It is easy to drill down into the BLS data to obtain employment data for many subsectors of the economy. For example, among hundreds of sub-indexes are truck transportation, auto production and primary metals production. The important point about each of these hundreds of data streams is in which direction they are headed. Whenever possible, we try to track three separate data sources for a given steel-related sector of the economy. We believe this gives a reasonable picture of market direction. The BLS data is one of the most important sources of fine-grained economic data that we use in our analyses. The states also collect their own employment numbers independently of the BLS. The compiled state data compares well with the federal data. Every three months, SMU examines the state data and provides a regional report that indicates strength or weakness on a geographic basis. Reports by individual state can be produced on request.