Prices

December 12, 2017

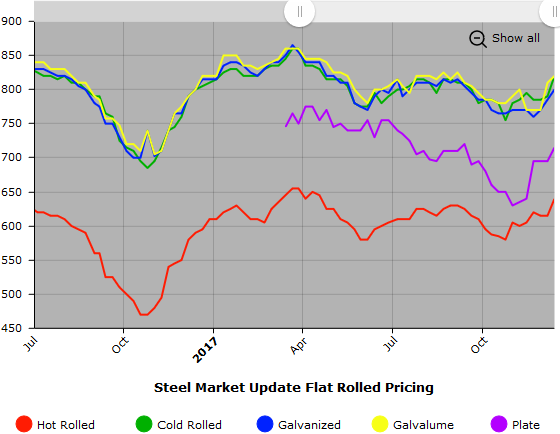

SMU Price Ranges & Indices: Prices Moving Higher

Written by John Packard

Flat rolled steel prices jumped this week as buyers and sellers of steel react to the latest round of price increase announcements. Last week, there was a $50 per ton increase announced on steel plate and then later in the week the sheet mills announced a $30 per ton price increase on hot rolled, cold rolled, galvanized and Galvalume steels. ArcelorMittal USA came out with “minimum” base prices of $680 on hot rolled ($34.00/cwt) and $860 per ton on cold rolled and coated steels ($43.00/cwt). Steel Market Update has collected where buyers are seeing new price quotes and where business is being transacted.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $620-$660 per ton ($31.00/cwt-$33.00/cwt) with an average of $640 per ton ($32.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $25 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $780-$860 per ton ($39.00/cwt-$43.00/cwt) with an average of $820 per ton ($41.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end rose $50 per ton. Our overall average is up $30 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-7 weeks

Galvanized Coil: SMU base price range is $37.00/cwt-$43.00/cwt ($740-$860 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $826-$946 per net ton with an average of $886 per ton FOB mill, east of the Rockies. Note that we have changed our G90 index extra from $78 per ton to $86 per ton, which is the NLMK USA spot number and a better indicator of the spot market than the extras being used by U.S. Steel.

Galvanized Lead Times: 3-10 weeks

Galvalume Coil: SMU base price range is $39.00/cwt-$43.00/cwt ($780-$860 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end rose $20 per ton. Our overall average is up $10 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,071-$1,151 per net ton with an average of $1,111 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $670-$760 per ton ($33.50/cwt-$38.00/cwt) with an average of $715 per ton ($35.75/cwt) FOB delivered. The lower end of our range increased $10 per ton compared to one week ago, while the upper end increased $30 per ton. Our overall average is up $20 per ton compared to last week. Our price momentum on plate steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: 4-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.