Analysis

February 1, 2018

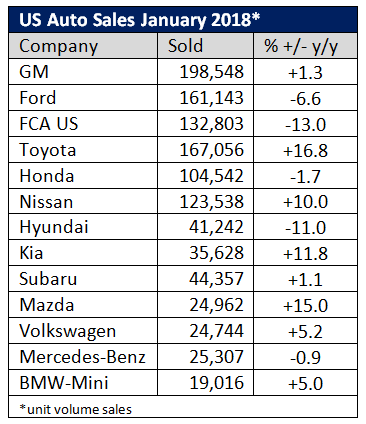

Auto Sales Mixed in January

Written by Sandy Williams

U.S. automotive sales were a mixed bag in January. General Motors’ sales climbed mildly by 1.3 percent. Ford and FCA saw sales drop, while Toyota gained 16.8 percent year over year.

“As we expected, the SUV focused-market continues into 2018 with consumer demand in those segments outpacing all others,” said John Angevine, director, National Sales, Hyundai Motor America.

Ford’s U.S. sales chief Mark LaNeve agreed. ”This (passenger cars) continues to be a difficult segment as we see a continued shift into SUVs,“ he said during a conference call on Thursday, adding ”we anticipate continued migration” from cars to SUVs over the next five years.

“Sales for the industry as a whole look like they’re going to come in above expectations,” said Jim Cain, General Motors U.S. sales analyst. “You can never predict a full year based on January results, but we see very strong underlying demand. People are working, people are getting raises and people are getting tax cuts. That’s bringing them into the showroom for crossovers and trucks.”

U.S. auto industry sales slipped 2 percent in 2017 to 17.23 million vehicles and are expected to continue to soften further in 2018. WardsAuto predicts sales will be around 1.16 million for January and the seasonally adjusted annual rate will be about 17.2 million.

“I think (consumer) incentives have reached the limit of their effectiveness in the marketplace,” Mike Jackson, CEO of AutoNation Inc. told Reuters. “I think the industry has accepted that (sales) volumes will fall somewhat in 2018 … and I don’t think the industry is going to go over the cliff with insane incentives.”

Judy Wheeler, head of U.S. sales for the Nissan brand, said the recent tax overhaul should be a positive for sales in 2018. “I think customers will have more disposable income … and we’ll see them come in to get into a new vehicle,” she said.