Mexico

February 13, 2018

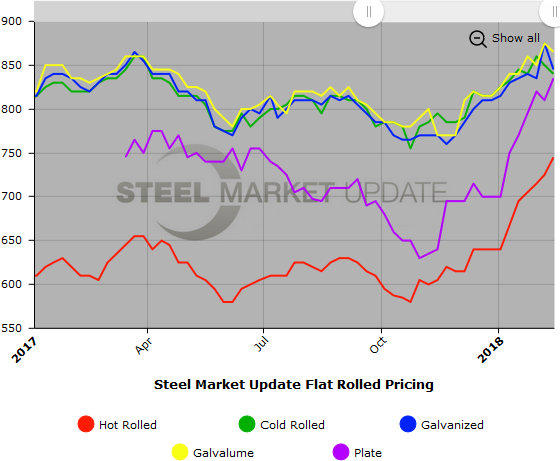

SMU Price Ranges & Indices: Market Prices are Strong

Written by John Packard

Steel prices continue their march higher, and we are seeing a very strong market on hot rolled coil right now. With the strength of HRC, we are seeing a return to more normal price spreads between hot rolled, cold rolled and coated base pricing.

Prices appear to be heading to even loftier levels with steel buyers relating discussions with their steel mill suppliers. A number of buyers have confided in Steel Market Update that mills like U.S. Steel and ArcelorMittal USA are out of the spot markets having their contract tons in hand and already booked through the month of April.

One service center general manager told SMU that the hot rolled markets are the “tightest” then comes galvanized where we are hearing tales of quotes as high as $47.50/cwt base. Cold rolled appears to be the weakest product. We were told, “While plate is extremely healthy, we’re not seeing ‘runaway’ lead-times for this product – holding about 6-8 weeks on non-heat treat.”

An end user told us, “Yes lead times are pushing way out. SDI/Nucor/Big River/Calvert all shipping late. As I have shared with you, Big River over a month late in production. I am again being asked to only order MINIMUM tons for May per my contracts from everyone except Nucor; allocation. AHMSA in Mexico is also in allocation as well.”

SMU believes this market has a bit of life left in it yet and we maintain our Price Momentum Indicator as pointing toward higher prices over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $720-$770 per ton ($36.00/cwt-$38.50/cwt) with an average of $745 per ton ($37.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to one week ago. Our overall average is up $20 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Hot Rolled Lead Times: 3-7 weeks

Cold Rolled Coil: SMU price range is $810-$870 per ton ($40.50/cwt-$43.50/cwt) with an average of $840 per ton ($42.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to last week. Our overall average is down $10 per ton compared to one week ago. Our price momentum on cold rolled steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU base price range is $41.00/cwt-$43.50/cwt ($820-$870 per ton) with an average of $42.25/cwt ($845 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to one week ago, while the upper end fell $40 per ton. Our overall average is down $30 compared to last week. Our price momentum on galvanized steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $906-$956 per net ton with an average of $931 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks

Galvalume Coil: SMU base price range is $42.00/cwt-$44.50/cwt ($840-$890 per ton) with an average of $43.25/cwt ($865 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week, while the upper end declined $20 per ton. Our overall average is down $10 per ton compared to one week ago. Our price momentum on Galvalume steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,131-$1,181 per net ton with an average of $1,156 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $810-$860 per ton ($40.50/cwt-$43.00/cwt) with an average of $835 per ton ($41.75/cwt) FOB delivered. The lower end of our range increased $50 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $25 per ton compared to last week. Our price momentum on plate steel is now pointing to Higher indicating prices are expected to increase over the next 30-60 days.

Plate Lead Times: 4-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.